Region:Asia

Author(s):Rebecca

Product Code:KRAA6542

Pages:86

Published On:January 2026

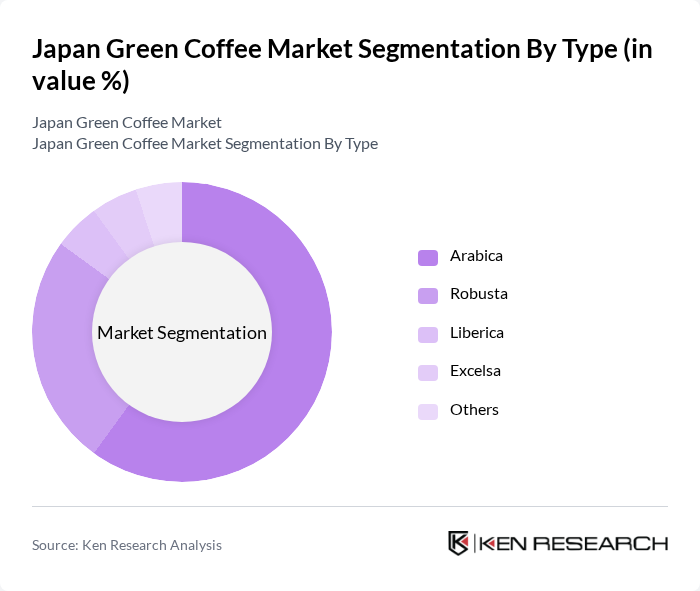

By Type:The market is segmented into various types of green coffee, including Arabica, Robusta, Liberica, Excelsa, and others. Among these, Arabica coffee dominates the market due to its superior flavor profile and higher demand among consumers who prefer specialty coffee. The trend towards premium coffee consumption has led to an increased focus on Arabica, which is often perceived as a higher-quality option compared to Robusta. The growing number of specialty coffee shops and cafes has further fueled the demand for Arabica beans, making it the leading subsegment in the market.

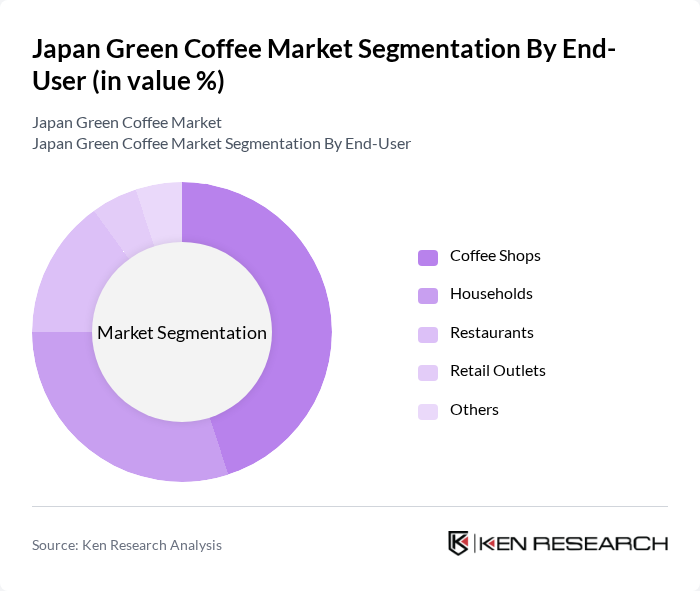

By End-User:The end-user segmentation includes households, coffee shops, restaurants, retail outlets, and others. Coffee shops are the leading end-user segment, driven by the growing coffee culture and the increasing number of specialty cafes across Japan. The rise in consumer spending on premium coffee experiences has led to a surge in coffee shop establishments, making them a significant contributor to the overall market. Households also represent a substantial segment, as more consumers are investing in high-quality coffee for home brewing.

The Japan Green Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as UCC Ueshima Coffee Co., Ltd., Key Coffee Inc., Maruyama Coffee Co., Ltd., Doutor Coffee Co., Ltd., Starbucks Coffee Japan, Ltd., Tully's Coffee Japan, Ltd., Kiyokawa Coffee Co., Ltd., Aoyama Coffee Co., Ltd., Coffee House Co., Ltd., Sazae Coffee Co., Ltd., Blue Bottle Coffee Japan, Inc., Hoshino Coffee Co., Ltd., Kurasu Kyoto, Onyx Coffee Lab Japan, Little Nap Coffee Stand contribute to innovation, geographic expansion, and service delivery in this space.

The Japan green coffee market is poised for significant growth, driven by evolving consumer preferences and a robust coffee culture. As health consciousness continues to rise, the demand for organic and specialty green coffee is expected to increase. Additionally, advancements in brewing technology and sustainable sourcing practices will likely shape the market landscape. Companies that adapt to these trends and focus on quality will be well-positioned to capitalize on emerging opportunities in this dynamic sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Arabica Robusta Liberica Excelsa Others |

| By End-User | Households Coffee Shops Restaurants Retail Outlets Others |

| By Packaging Type | Bags Cans Bottles Others |

| By Distribution Channel | Online Retail Supermarkets Specialty Stores Convenience Stores Others |

| By Origin | Domestic Imported Others |

| By Quality Grade | Specialty Grade Commercial Grade Others |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Green Coffee Importers | 45 | Import Managers, Supply Chain Coordinators |

| Specialty Coffee Roasters | 35 | Roasting Facility Owners, Quality Control Managers |

| Coffee Retailers | 50 | Store Managers, Purchasing Agents |

| Consumer Preferences | 120 | Coffee Enthusiasts, Regular Consumers |

| Industry Experts | 25 | Market Analysts, Coffee Industry Consultants |

The Japan Green Coffee Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by consumer preferences for specialty coffee and health benefits associated with green coffee consumption.