Region:Asia

Author(s):Rebecca

Product Code:KRAA6543

Pages:95

Published On:January 2026

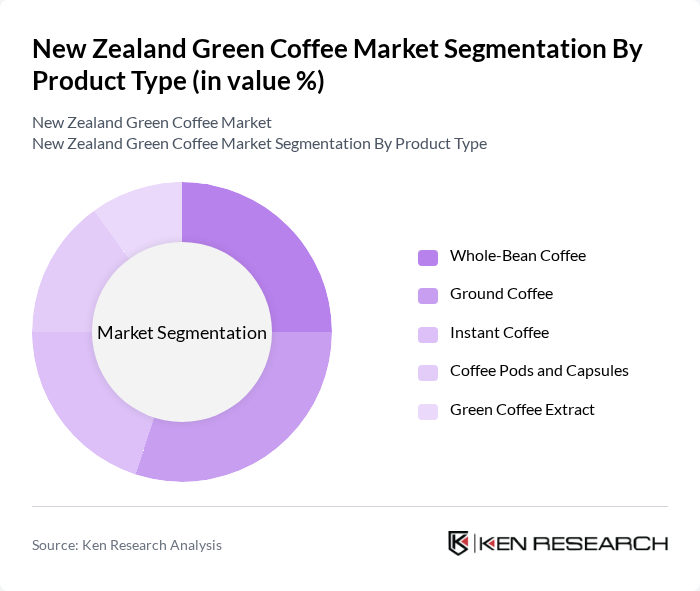

By Product Type:The product type segmentation includes various forms of green coffee available in the market. Whole-bean coffee is popular among consumers who prefer freshly ground coffee, while ground coffee appeals to those seeking convenience. Instant coffee has gained traction due to its ease of preparation, and coffee pods and capsules cater to the growing demand for single-serve options. Green coffee extract is increasingly used in dietary supplements and functional foods.

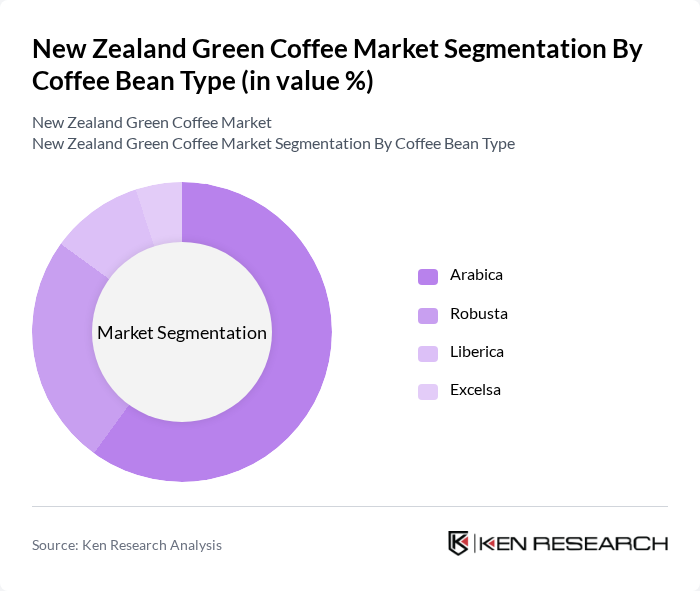

By Coffee Bean Type:The coffee bean type segmentation includes various species of coffee beans. Arabica beans dominate the market due to their superior flavor profile and lower caffeine content, appealing to health-conscious consumers. Robusta beans are favored for their strong flavor and higher caffeine content, making them popular in espresso blends. Liberica and Excelsa beans, while less common, are gaining interest for their unique flavors and characteristics.

The New Zealand Green Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coffee Supreme, Allpress Espresso, Ozone Coffee Roasters, L'Affare, Mojo Coffee, Havana Coffee Works, The Coffee Collective, Caffe L'Affare, Coffee Culture, Robert Harris Coffee, The Coffee Emporium, Black & White Coffee Cartel, The Coffee Company, Caffeinated Coffee, The Coffee House contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand green coffee market is poised for continued growth, driven by evolving consumer preferences towards health-conscious products and specialty coffee experiences. As e-commerce platforms expand, accessibility to diverse green coffee options will increase, fostering innovation in product offerings. Additionally, the focus on sustainable sourcing practices will likely shape market dynamics, encouraging local roasters to collaborate with farmers and enhance the quality of their products, ultimately benefiting consumers and the environment alike.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Whole-Bean Coffee Ground Coffee Instant Coffee Coffee Pods and Capsules Green Coffee Extract |

| By Coffee Bean Type | Arabica Robusta Liberica Excelsa |

| By Distribution Channel | On-Trade (Cafés, Coffee Shops, Restaurants) Off-Trade (Supermarkets, Retail Stores, Online) Direct Sales |

| By Application | Beverages Dietary Supplements Functional Foods and Skincare Products |

| By Origin | Imported Domestic |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Green Coffee Importers | 45 | Import Managers, Supply Chain Coordinators |

| Coffee Retailers | 60 | Store Owners, Purchasing Managers |

| Café Operators | 50 | Baristas, Café Managers |

| Consumer Preferences | 120 | Coffee Enthusiasts, General Consumers |

| Agricultural Experts | 40 | Farmers, Agricultural Consultants |

The New Zealand Green Coffee Market is valued at approximately USD 140 million, reflecting a growing consumer preference for organic and sustainably sourced coffee, as well as increased awareness of the health benefits associated with green coffee consumption.