Region:Middle East

Author(s):Rebecca

Product Code:KRAA6540

Pages:91

Published On:January 2026

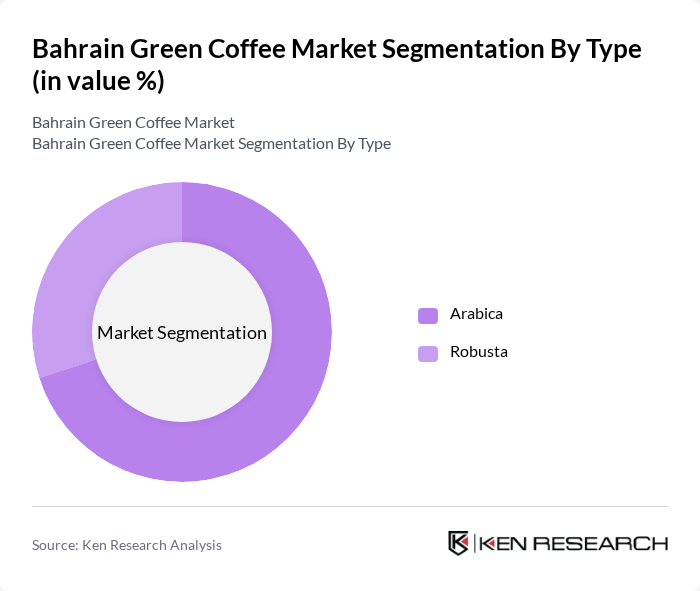

By Type:The market is segmented into two main types: Arabica and Robusta. Arabica coffee is known for its smooth, mild flavor and is preferred by a significant portion of consumers in Bahrain. Robusta, on the other hand, is often used in blends and instant coffee due to its stronger flavor and higher caffeine content. The preference for Arabica coffee is driven by its perceived quality and taste, making it the dominant type in the market.

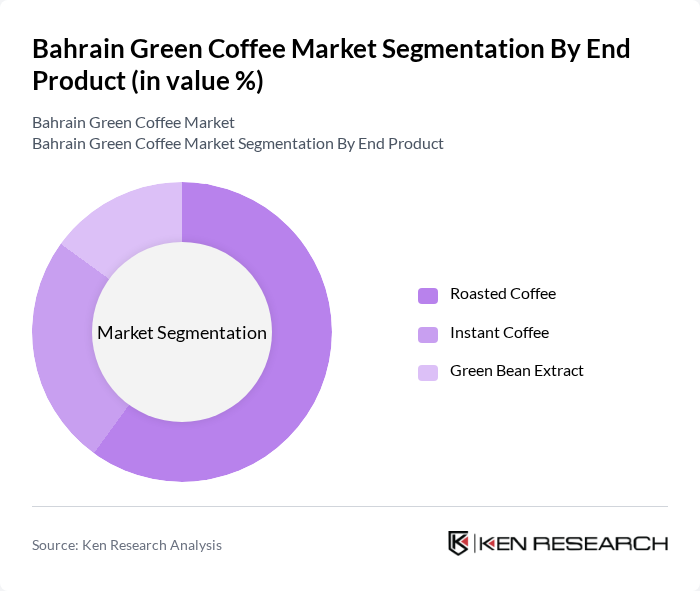

By End Product:The market is further segmented into roasted coffee, instant coffee, and green bean extract. Roasted coffee is the most popular end product, favored for its rich flavor and aroma. Instant coffee is gaining traction due to its convenience, especially among busy consumers. Green bean extract is also emerging as a health trend, appealing to health-conscious individuals looking for natural supplements.

The Bahrain Green Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Hajri Coffee, Bahrain Coffee Company, Café Mondo, Coffee Island, The Coffee Bean & Tea Leaf, Starbucks Bahrain, Costa Coffee, Dunkin' Donuts Bahrain, Caribou Coffee, Tim Hortons Bahrain, Caffè Nero, Lavazza, Illy, Nespresso, Peet's Coffee contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain green coffee market is poised for significant evolution, driven by consumer trends favoring health and sustainability. As the market adapts to increasing demand for specialty and organic products, local roasting facilities may emerge, enhancing product freshness and quality. Additionally, the rise of coffee subscription services is likely to reshape consumer purchasing habits, providing convenience and variety. These trends indicate a dynamic future for the green coffee sector, with opportunities for innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Arabica Robusta |

| By End Product | Roasted Coffee Instant Coffee Green Bean Extract |

| By End-User | Households Cafes and Restaurants Offices Hotels Retail Outlets |

| By Packaging Type | Glass Bottles PET Bottles Cans Cartons (Tetra Packs, Paperboard) |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Coffee Shops Wholesalers HoReCa (Hotels, Restaurants, Cafés) |

| By Price Segment | Premium Mid-Range Economy |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Coffee Outlets | 45 | Café Owners, Baristas, Retail Managers |

| Importers and Distributors | 35 | Supply Chain Managers, Import Specialists |

| Local Coffee Roasters | 28 | Roasting Facility Managers, Product Developers |

| Consumer Preferences | 120 | Coffee Consumers |

| Market Analysts and Experts | 22 | Industry Analysts, Market Researchers |

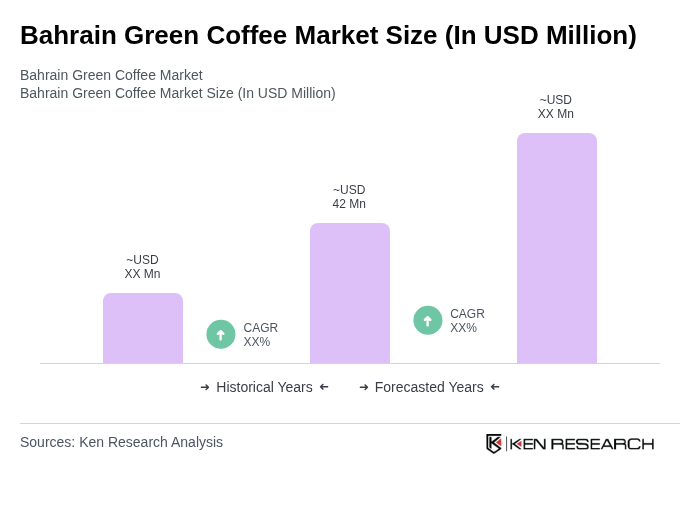

The Bahrain Green Coffee Market is valued at approximately USD 42 million, reflecting a growing trend in coffee consumption, particularly among younger demographics and the rising popularity of specialty coffee.