Region:Middle East

Author(s):Rebecca

Product Code:KRAA6537

Pages:92

Published On:January 2026

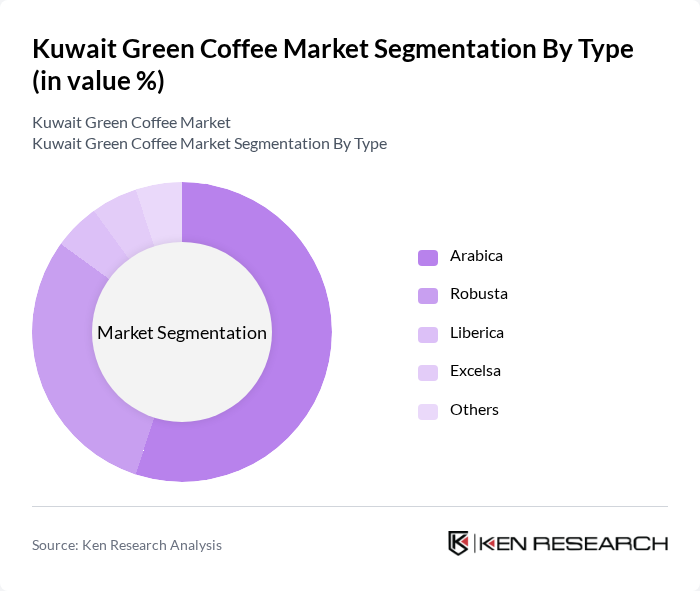

By Type:The market is segmented into various types of green coffee, including Arabica, Robusta, Liberica, Excelsa, and others. Arabica coffee is the most popular type due to its smooth flavor and aromatic qualities, making it a preferred choice among consumers. Robusta, known for its strong and bitter taste, is also gaining traction, especially among those who prefer a more robust coffee experience. The other types, while less common, cater to niche markets and specialty coffee enthusiasts.

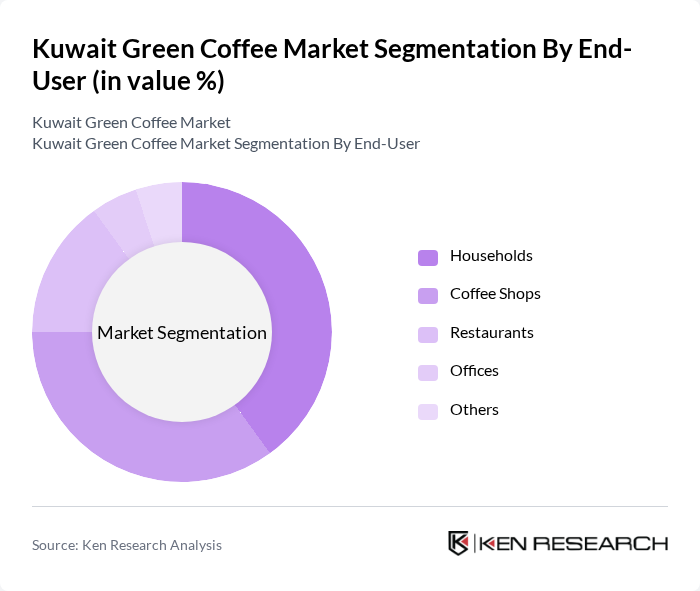

By End-User:The end-user segmentation includes households, coffee shops, restaurants, offices, and others. Households represent a significant portion of the market as more consumers are brewing coffee at home, especially during the pandemic. Coffee shops and restaurants are also major contributors, driven by the growing café culture in Kuwait. Offices are increasingly offering coffee options to employees, further expanding the market.

The Kuwait Green Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alshaya Group, Kuwait Coffee Company, Barista Coffee Company, Starbucks Kuwait, Costa Coffee Kuwait, Café Najjar, Dunkin' Donuts Kuwait, Tim Hortons Kuwait, The Coffee Bean & Tea Leaf, Caribou Coffee, Caffè Nero, Paul Bakery & Restaurant, Gloria Jean's Coffees, Second Cup Coffee Company, Arabica Coffee contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait green coffee market appears promising, driven by evolving consumer preferences and a burgeoning coffee culture. As health consciousness continues to rise, more consumers are likely to seek out green coffee for its perceived health benefits. Additionally, the expansion of specialty coffee offerings and local roasting facilities will enhance product availability, catering to the growing demand for unique coffee experiences. E-commerce platforms are also expected to play a crucial role in reaching a wider audience, facilitating market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Arabica Robusta Liberica Excelsa Others |

| By End-User | Households Coffee Shops Restaurants Offices Others |

| By Packaging Type | Bags Cans Pods Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Convenience Stores Others |

| By Origin | Domestic Imported Others |

| By Quality | Specialty Coffee Commercial Coffee Others |

| By Price Range | Premium Mid-Range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Coffee Outlets | 100 | Café Owners, Baristas, Retail Managers |

| Wholesale Coffee Distributors | 80 | Distribution Managers, Sales Representatives |

| Consumer Coffee Preferences | 120 | Regular Coffee Drinkers, Occasional Consumers |

| Importers of Green Coffee | 60 | Import Managers, Procurement Officers |

| Market Analysts and Experts | 40 | Industry Analysts, Coffee Market Researchers |

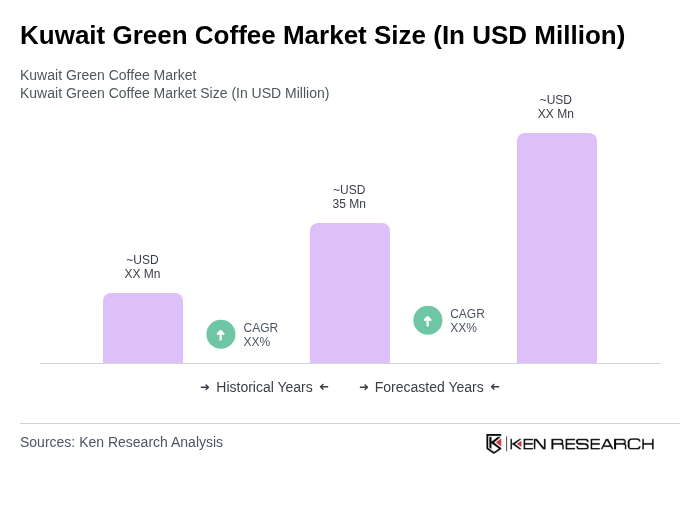

The Kuwait Green Coffee Market is valued at approximately USD 35 million, reflecting a robust growth driven by increasing coffee culture, health consciousness, and demand for specialty coffee among consumers.