Region:Asia

Author(s):Rebecca

Product Code:KRAA6536

Pages:100

Published On:January 2026

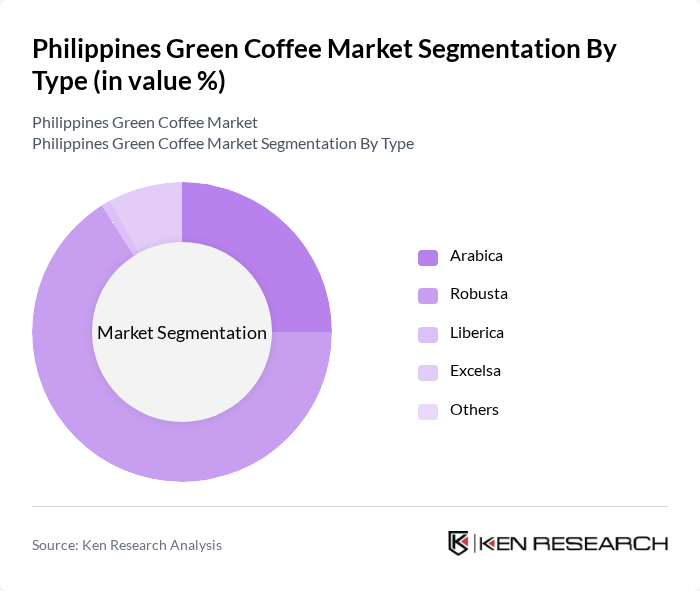

By Type:The market is segmented into various types of green coffee, including Arabica, Robusta, Liberica, Excelsa, and others. Arabica coffee is known for its smooth flavor and higher market value, making it a popular choice among consumers. Robusta, on the other hand, is favored for its strong taste and higher caffeine content, appealing to a different segment of coffee drinkers. Liberica and Excelsa are unique to the Philippines and are gaining traction due to their distinct flavors.

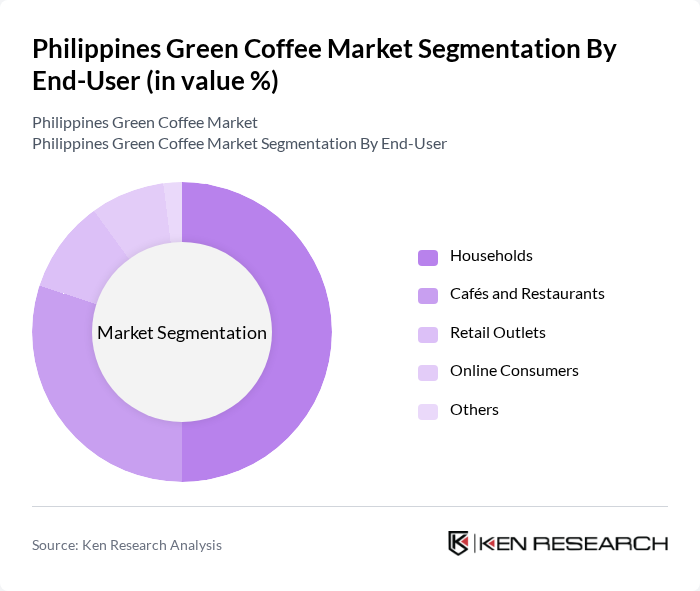

By End-User:The end-user segmentation includes households, cafés and restaurants, retail outlets, online consumers, and others. Households represent a significant portion of the market as coffee consumption is a daily ritual for many Filipinos. Cafés and restaurants are also crucial as they drive the demand for high-quality green coffee, while online consumers are increasingly purchasing coffee products through e-commerce platforms.

The Philippines Green Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philippine Coffee Board, Inc., Coffee for Peace, Kape Maria, Figaro Coffee Company, Bo's Coffee, Coffee Dream, The Coffee Bean & Tea Leaf, Starbucks Philippines, UCC Coffee, Blue Tokai Coffee Roasters, Davao Coffee, Barako Coffee, 8 Cuts Burger Blends, The Coffee Academy, Coffee Culture contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines green coffee market appears promising, driven by evolving consumer preferences and a burgeoning café culture. As urbanization continues, the demand for specialty coffee is expected to rise, with an increasing focus on sustainability and ethical sourcing. Innovations in coffee brewing technologies and the expansion of e-commerce platforms will further enhance market accessibility. The government’s support for local farmers and quality standards will also play a crucial role in shaping the industry landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Arabica Robusta Liberica Excelsa Others |

| By End-User | Households Cafés and Restaurants Retail Outlets Online Consumers Others |

| By Processing Method | Washed Natural Honey Processed Others |

| By Packaging Type | Bags Cans Pods Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Online Retail Direct Sales Others |

| By Price Range | Premium Mid-range Budget Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smallholder Coffee Farmers | 120 | Farm Owners, Agricultural Extension Workers |

| Coffee Roasters and Distributors | 80 | Business Owners, Operations Managers |

| Retail Coffee Outlets | 60 | Store Managers, Marketing Executives |

| Consumers of Specialty Coffee | 100 | Coffee Enthusiasts, Regular Consumers |

| Industry Experts and Analysts | 40 | Market Analysts, Academic Researchers |

The Philippines Green Coffee Market is valued at approximately USD 1.3 billion, driven by increasing demand for specialty coffee, health awareness, and a growing café culture, alongside expanding e-commerce platforms for coffee sales.