Region:Asia

Author(s):Rebecca

Product Code:KRAB2155

Pages:85

Published On:January 2026

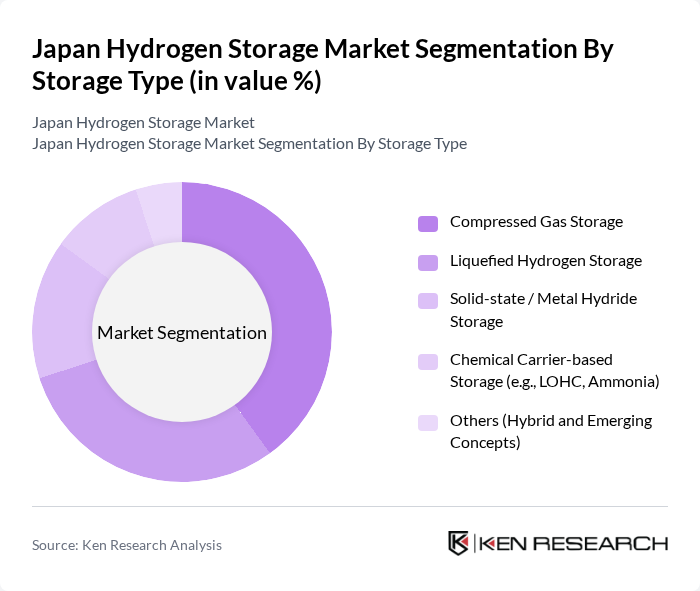

By Storage Type:The hydrogen storage market can be segmented into various types, including Compressed Gas Storage, Liquefied Hydrogen Storage, Solid-state / Metal Hydride Storage, Chemical Carrier-based Storage (e.g., LOHC, Ammonia), and Others (Hybrid and Emerging Concepts). Each of these storage types has unique characteristics and applications, catering to different needs within the hydrogen ecosystem. Compressed gas storage is widely used due to its technological maturity and suitability for fuel cell vehicle refueling and distributed storage installations, while liquefied hydrogen storage is favored for large-scale, long-distance transport and import terminals. Solid-state storage is gaining traction in Japan for its safety profile and potential for high volumetric energy density in niche and stationary applications, and chemical carrier-based storage (including ammonia and liquid organic hydrogen carriers) is emerging as a versatile solution for bulk transport, marine fuel supply, and long-duration energy storage.

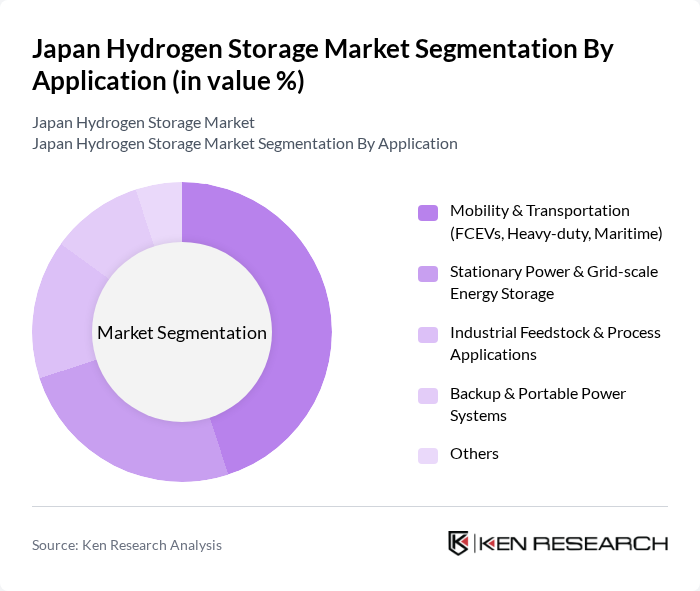

By Application:The applications of hydrogen storage are diverse, encompassing Mobility & Transportation (FCEVs, Heavy-duty, Maritime), Stationary Power & Grid-scale Energy Storage, Industrial Feedstock & Process Applications, Backup & Portable Power Systems, and Others. The mobility sector is a significant driver, with fuel cell electric vehicles (FCEVs), buses, trucks, and emerging maritime applications leveraging compressed and liquefied hydrogen storage systems to deliver zero tailpipe emissions and fast refueling. Stationary power applications are also expanding, as hydrogen storage solutions are increasingly integrated into renewable energy systems, microgrids, and backup power assets to provide grid stability, peak shaving, and long-duration energy security.

The Japan Hydrogen Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Honda Motor Co., Ltd., Mitsubishi Heavy Industries, Ltd., Toshiba Energy Systems & Solutions Corporation, Iwatani Corporation, JGC Holdings Corporation, Sumitomo Corporation, Chiyoda Corporation, Air Liquide Japan Ltd., Nippon Steel Corporation, Osaka Gas Co., Ltd., ENEOS Corporation, Hitachi Zosen Corporation, Panasonic Holdings Corporation, Kyushu Electric Power Co., Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hydrogen storage market in Japan appears promising, driven by increasing investments in renewable energy and government support for hydrogen technologies. In future, the integration of hydrogen storage with renewable energy sources is expected to enhance energy security and sustainability. Furthermore, the growing interest in green hydrogen production will likely lead to innovative storage solutions, positioning Japan as a leader in the global hydrogen economy and fostering international collaborations for technology exchange.

| Segment | Sub-Segments |

|---|---|

| By Storage Type | Compressed Gas Storage Liquefied Hydrogen Storage Solid-state / Metal Hydride Storage Chemical Carrier-based Storage (e.g., LOHC, Ammonia) Others (Hybrid and Emerging Concepts) |

| By Application | Mobility & Transportation (FCEVs, Heavy-duty, Maritime) Stationary Power & Grid-scale Energy Storage Industrial Feedstock & Process Applications Backup & Portable Power Systems Others |

| By End-Use Sector | Power Utilities & Energy Companies Refining & Petrochemicals Steel, Chemicals & Other Heavy Industries Transport & Logistics Operators Commercial & Residential Users Others |

| By Storage Capacity | Small Scale (up to 100 kg H?) Medium Scale (100 kg to 1,000 kg H?) Large Scale (over 1,000 kg H?) Utility-scale / Bulk Storage |

| By Location | On-site / On-premise Storage Centralized / Hub-based Storage In-transit & Mobile Storage (Trailers, Tankers, Bunkering) Others |

| By Hydrogen Source | Grey & Brown Hydrogen Blue Hydrogen Green Hydrogen By-product Hydrogen Others |

| By Regional Cluster | Kanto Region Kansai / Kinki Region Chubu / Central Region Kyushu–Okinawa Region Tohoku Region Chugoku & Shikoku Regions Hokkaido Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hydrogen Storage Technology Providers | 100 | Product Managers, Technology Developers |

| Energy Policy Experts | 60 | Government Officials, Regulatory Analysts |

| End-users in Transportation Sector | 80 | Fleet Managers, Logistics Coordinators |

| Industrial Hydrogen Consumers | 60 | Operations Managers, Procurement Specialists |

| Research Institutions and Academia | 40 | Research Scientists, Professors |

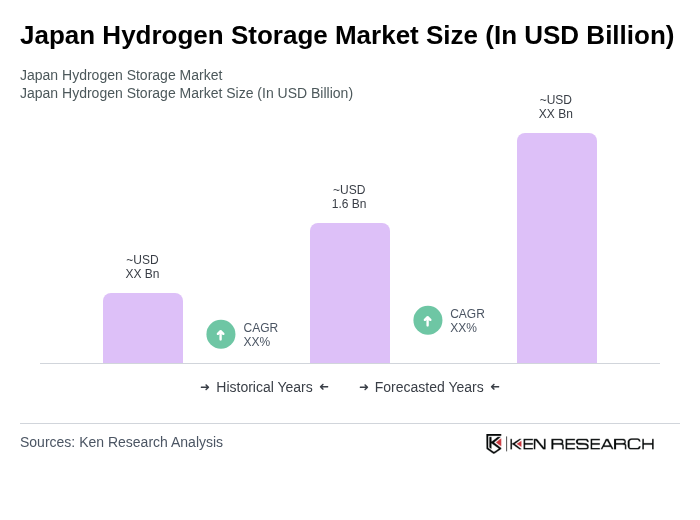

The Japan Hydrogen Storage Market is valued at approximately USD 1.6 billion, reflecting its significant role in the Asia-Pacific and global hydrogen energy storage landscape, driven by increasing demand for clean energy solutions and advancements in storage technologies.