Region:Middle East

Author(s):Rebecca

Product Code:KRAB2152

Pages:88

Published On:January 2026

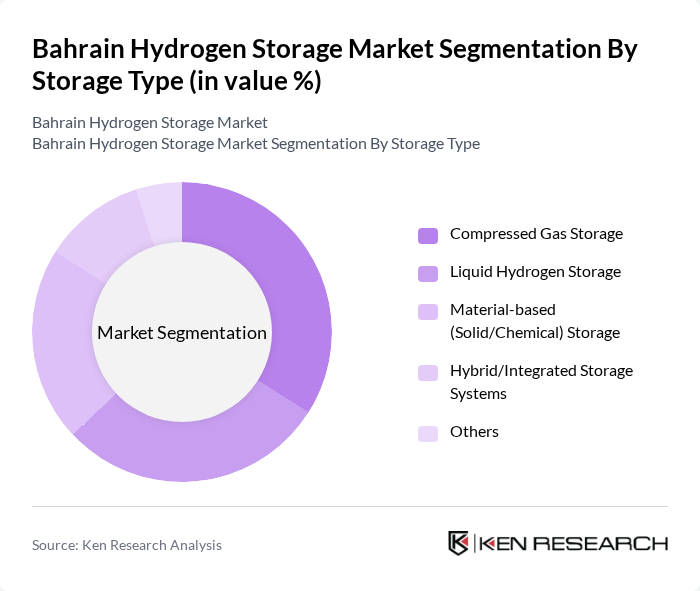

By Storage Type:The storage type segmentation includes various methods of hydrogen storage, which are crucial for the effective management and utilization of hydrogen as an energy source. The subsegments include Compressed Gas Storage, Liquid Hydrogen Storage, Material-based (Solid/Chemical) Storage, Hybrid/Integrated Storage Systems, and Others. Each method has its unique advantages and applications, catering to different market needs.

The leading subsegment in the storage type category is Compressed Gas Storage, which is favored for its relatively mature technology, scalability, and compatibility with existing gas and pipeline infrastructure. This method allows hydrogen to be stored in high-pressure cylinders and tanks, enabling flexible deployment for refuelling stations, industrial users, and backup power applications. The growing demand for hydrogen in mobility, refining, and power sectors is driving the preference for compressed gas systems, reinforcing their dominant role in early hydrogen markets such as Bahrain.

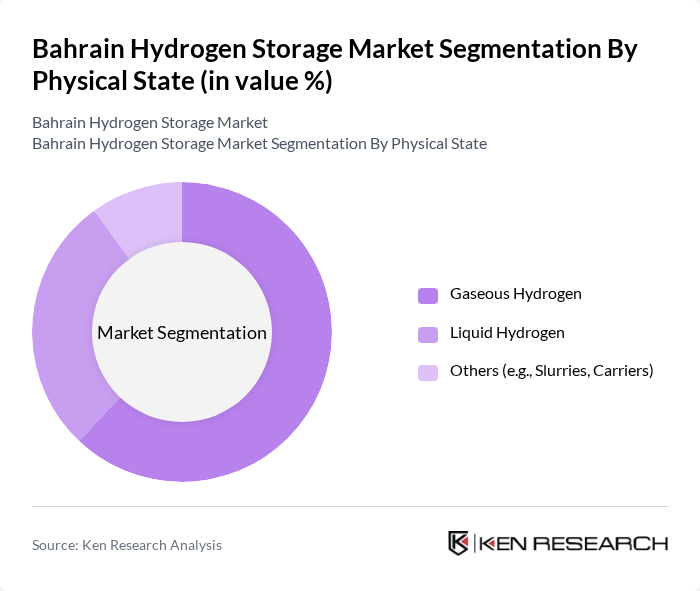

By Physical State:The physical state segmentation categorizes hydrogen based on its form, which includes Gaseous Hydrogen, Liquid Hydrogen, and Others (e.g., Slurries, Carriers). Each state has specific applications and benefits, influencing the choice of storage solutions in the market.

Gaseous Hydrogen is the leading subsegment in the physical state category, primarily due to its versatility, established handling practices, and lower infrastructure complexity compared with cryogenic liquid or advanced solid-state options. It is extensively used in applications such as industrial feedstock, mobility, and power generation, where high-pressure tanks and cylinders offer a practical and cost-effective solution. The predominance of gaseous hydrogen storage worldwide, especially in early-stage markets, underpins its role as the preferred option for Bahrain as it integrates hydrogen into its energy transition and fuel cell initiatives.

The Bahrain Hydrogen Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Linde plc, Plug Power Inc., Ballard Power Systems Inc., Hydrogenics Corporation, ITM Power plc, Nel ASA, McPhy Energy S.A., Toshiba Energy Systems & Solutions Corporation, Siemens Energy AG, Shell Hydrogen, TotalEnergies SE, Air Liquide S.A., Enel Green Power S.p.A., BP plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain hydrogen storage market appears promising, driven by increasing attention to low?carbon energy and government support for renewable energy initiatives. As the country aims for a 30% reduction in carbon emissions in future, hydrogen storage technologies are expected to play a supporting role in achieving these targets. Furthermore, advancements in storage technologies and infrastructure development are expected to enhance the efficiency and reliability of hydrogen as a clean energy source, fostering greater integration into the energy mix.

| Segment | Sub-Segments |

|---|---|

| By Storage Type | Compressed Gas Storage Liquid Hydrogen Storage Material-based (Solid/Chemical) Storage Hybrid/Integrated Storage Systems Others |

| By Physical State | Gaseous Hydrogen Liquid Hydrogen Others (e.g., Slurries, Carriers) |

| By Application | Grid and Renewable Energy Storage Industrial Processes & Refineries Mobility & Transportation (FCEVs, Fleet, Marine, Aviation Pilots) Backup Power & Distributed Energy Systems Others |

| By End-User | Utilities & Power Producers Oil & Gas / Petrochemicals Industrial & Manufacturing Mobility & Transport Operators Government, Defense & Public Sector Commercial & Institutional Users Others |

| By Project Scale | Pilot & Demonstration Projects Small-scale / Distributed Systems Utility-scale / Large Industrial Projects Export-oriented Projects Others |

| By Ownership / Business Model | Utility / State-owned Private / IPP Public-Private Partnership (PPP) BOO / BOOT / Concession Models Others |

| By Location of Storage | On-site (Co-located with Production/Use) Centralized / Hub Storage Port & Export Terminal Storage Underground / Geological Storage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hydrogen Production Facilities | 45 | Plant Managers, Operations Directors |

| Energy Storage Solutions Providers | 40 | Business Development Managers, Technical Leads |

| Government Energy Policy Makers | 40 | Regulatory Affairs Specialists, Energy Policy Analysts |

| Research Institutions Focused on Hydrogen | 40 | Lead Researchers, Academic Professors |

| End-users in Transportation Sector | 45 | Fleet Managers, Sustainability Officers |

The Bahrain Hydrogen Storage Market is valued at approximately USD 1.1 billion, reflecting a significant growth trajectory driven by the demand for clean energy solutions and government initiatives aimed at diversifying the energy mix away from conventional hydrocarbons.