Region:Middle East

Author(s):Rebecca

Product Code:KRAB2150

Pages:94

Published On:January 2026

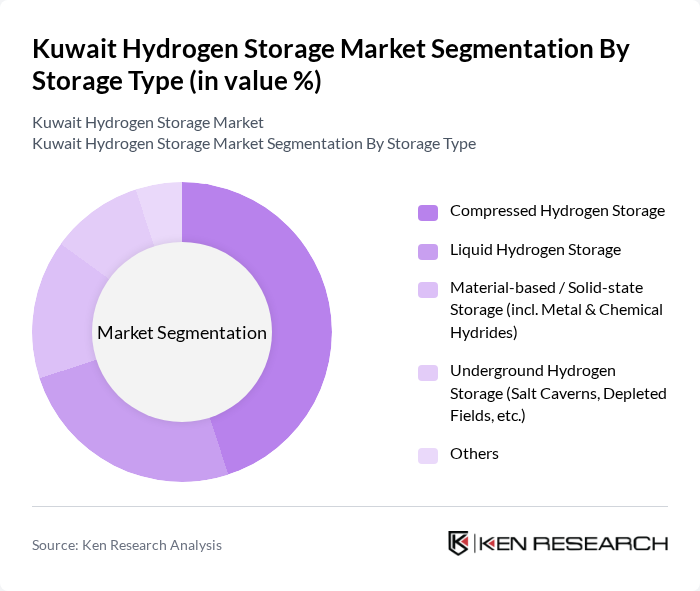

By Storage Type:The storage type segment includes various methods of hydrogen storage, each with distinct technical characteristics and use cases, consistent with global hydrogen storage practice. The subsegments are Compressed Hydrogen Storage, Liquid Hydrogen Storage, Material-based / Solid-state Storage (including Metal & Chemical Hydrides), Underground Hydrogen Storage (Salt Caverns, Depleted Fields, etc.), and Others. Compressed Hydrogen Storage and other physical storage solutions (tanks and cylinders) currently account for the largest share of hydrogen storage globally, driven by their technological maturity, compatibility with existing infrastructure, and extensive deployment in industrial and mobility applications. In Kuwait, compressed hydrogen storage is expected to maintain a leading position where hydrogen is used in refining, petrochemicals, and pilot mobility or backup power projects, due to its relative ease of implementation, established safety standards, and suitability for both on-site and distributed applications.

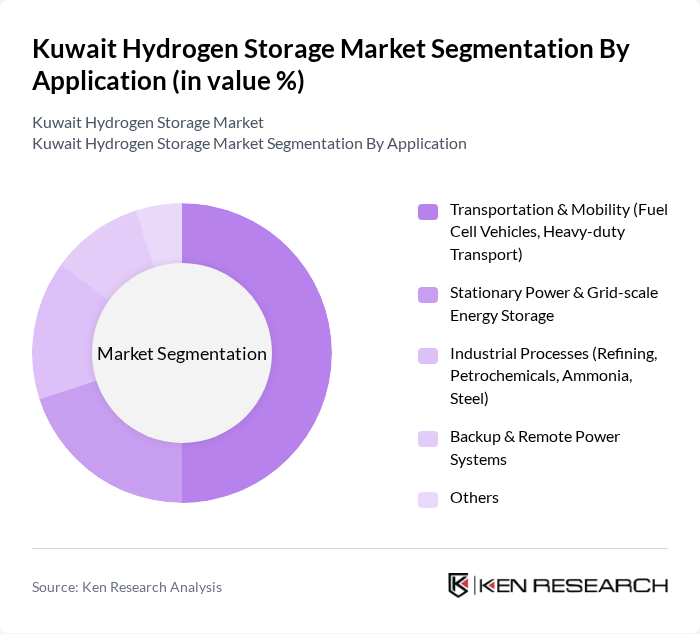

By Application:The application segment covers key use cases for hydrogen storage, including Transportation & Mobility (Fuel Cell Vehicles, Heavy-duty Transport), Stationary Power & Grid-scale Energy Storage, Industrial Processes (Refining, Petrochemicals, Ammonia, Steel), Backup & Remote Power Systems, and Others, which is consistent with regional and global hydrogen usage patterns. In Kuwait and the wider GCC, hydrogen demand is currently dominated by industrial processes, particularly refining and petrochemicals, where hydrogen is used as a feedstock and for desulfurization and upgrading operations. As pilot projects for green and blue hydrogen expand, stationary power and grid-support applications, alongside backup and remote power systems, are emerging as important storage-linked segments, while transportation and mobility are at an early stage but expected to grow as regional clean mobility and hydrogen refuelling initiatives progress.

The Kuwait Hydrogen Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Linde plc, Air Liquide S.A., Nel ASA, ITM Power plc, Ballard Power Systems Inc., Plug Power Inc., FuelCell Energy, Inc., McPhy Energy S.A., Toshiba Energy Systems & Solutions Corporation, Siemens Energy AG, H2 Energy AG, Kuwait National Petroleum Company (KNPC), Petrochemical Industries Company (PIC) – Kuwait, Kuwait Oil Company (KOC) contribute to innovation, geographic expansion, and service delivery in this space, consistent with their broader roles in global hydrogen production, storage solutions, and fuel cell or electrolyzer technologies.

The future of the Kuwait hydrogen storage market appears promising, driven by increasing investments in renewable energy and government support for hydrogen initiatives. As the nation aims for carbon neutrality by 2035, the integration of hydrogen into various sectors, including transportation and industrial applications, is expected to rise. Furthermore, advancements in storage technologies will enhance efficiency and safety, making hydrogen a more viable energy solution. The collaboration between local and international stakeholders will also play a pivotal role in shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Storage Type | Compressed Hydrogen Storage Liquid Hydrogen Storage Material-based / Solid-state Storage (incl. Metal & Chemical Hydrides) Underground Hydrogen Storage (Salt Caverns, Depleted Fields, etc.) Others |

| By Application | Transportation & Mobility (Fuel Cell Vehicles, Heavy-duty Transport) Stationary Power & Grid-scale Energy Storage Industrial Processes (Refining, Petrochemicals, Ammonia, Steel) Backup & Remote Power Systems Others |

| By End-User | Energy & Utilities Oil, Gas & Petrochemicals Industrial & Manufacturing Transportation & Logistics Operators Government & Public Sector |

| By Hydrogen Color / Source | Grey Hydrogen–based Storage Blue Hydrogen–based Storage Green Hydrogen–based Storage Other Low-carbon Hydrogen |

| By Project Scale | Pilot & Demonstration Projects Commercial-scale Projects Utility-scale / National Projects |

| By Ownership Model | State-owned Enterprises Private Sector Players Joint Ventures & PPPs Others |

| By Geography (Within Kuwait) | Kuwait City & Surrounding Industrial Zones Northern Kuwait (Oil & Gas Fields) Southern Kuwait (Industrial & Port Areas) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hydrogen Storage Technology Providers | 60 | Product Managers, R&D Directors |

| Energy Sector Policymakers | 50 | Government Officials, Regulatory Analysts |

| Industrial Users of Hydrogen | 40 | Operations Managers, Energy Procurement Officers |

| Research Institutions Focused on Hydrogen | 40 | Lead Researchers, Academic Professors |

| Investors in Renewable Energy Projects | 40 | Investment Analysts, Venture Capitalists |

The Kuwait Hydrogen Storage Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by the demand for clean energy solutions and government initiatives aimed at diversifying the energy mix and reducing carbon emissions.