Region:Asia

Author(s):Rebecca

Product Code:KRAB2149

Pages:91

Published On:January 2026

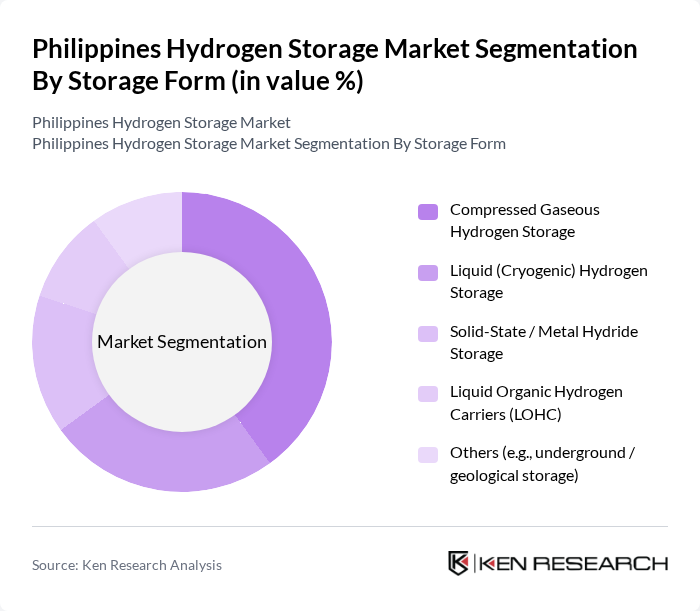

By Storage Form:The storage form segment includes various methods of storing hydrogen, which are crucial for its effective utilization in different applications. The subsegments are Compressed Gaseous Hydrogen Storage, Liquid (Cryogenic) Hydrogen Storage, Solid-State / Metal Hydride Storage, Liquid Organic Hydrogen Carriers (LOHC), and Others (e.g., underground / geological storage). Each method has its advantages and is chosen based on specific application requirements.

The leading subsegment in the storage form category is Compressed Gaseous Hydrogen Storage, which is favored for its established technology, relatively lower upfront costs compared with cryogenic and advanced solid-state systems, and compatibility with existing industrial gas infrastructure. This method is widely used in various applications, including hydrogen refueling stations, fuel cell vehicles, industrial gas supply, and backup power, due to its scalability, modularity, and ease of handling at pressures typically in the 350–700 bar range. The growing demand for hydrogen in transportation, power generation, and industrial sectors across Asia-Pacific is contributing to the continued predominance of compressed gaseous storage solutions in early-stage markets such as the Philippines.

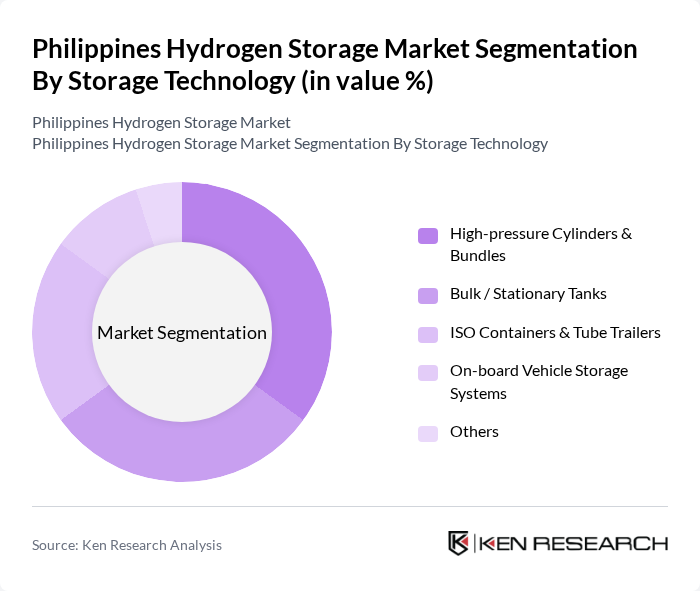

By Storage Technology:The storage technology segment encompasses various technologies used to store hydrogen, including High-pressure Cylinders & Bundles, Bulk / Stationary Tanks, ISO Containers & Tube Trailers, On-board Vehicle Storage Systems, and Others. Each technology serves different market needs and application scenarios, influencing the overall market dynamics, with selection driven by factors such as required capacity, mobility, safety standards, and integration with production and end-use facilities.

High-pressure Cylinders & Bundles dominate the storage technology segment due to their versatility, standardization, and widespread application in industrial gas distribution, pilot hydrogen refueling, and small-scale energy storage projects. They are particularly relevant for early-stage hydrogen markets and transport applications, where modular cylinder packages can be deployed without extensive fixed infrastructure and can serve as mobile or temporary storage. The increasing focus on hydrogen as a clean energy source across Asia-Pacific, alongside growing deployment of hydrogen demonstration projects, is driving demand for high-pressure storage solutions, making them a preferred choice among industrial users, energy developers, and transport operators during the initial scale-up phase.

The Philippines Hydrogen Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Linde plc, Air Liquide S.A., Engie SA, TotalEnergies SE, Shell plc (Hydrogen & New Energies), Mitsubishi Power, Ltd., Toshiba Energy Systems & Solutions Corporation, Siemens Energy AG, Nel ASA, ITM Power plc, Plug Power Inc., Ballard Power Systems, FuelCell Energy, Inc., and selected local and regional players (e.g., ACEN Corporation, AboitizPower, Meralco PowerGen) contribute to innovation, geographic expansion, and service delivery in this space, primarily through technology partnerships, supply of industrial gases, engineering services, and participation in low?carbon and renewable energy projects that can incorporate hydrogen and storage solutions over time.

The future of the hydrogen storage market in the Philippines appears promising, driven by increasing government support and a growing emphasis on sustainable energy solutions. As the country progresses towards its renewable energy targets, advancements in hydrogen production and storage technologies are expected to enhance efficiency and reduce costs. Collaborations with international partners will likely accelerate innovation, while local manufacturing capabilities will strengthen the market's resilience and competitiveness in the region.

| Segment | Sub-Segments |

|---|---|

| By Storage Form | Compressed Gaseous Hydrogen Storage Liquid (Cryogenic) Hydrogen Storage Solid-State / Metal Hydride Storage Liquid Organic Hydrogen Carriers (LOHC) Others (e.g., underground / geological storage) |

| By Storage Technology | High-pressure Cylinders & Bundles Bulk / Stationary Tanks ISO Containers & Tube Trailers On-board Vehicle Storage Systems Others |

| By Application | Grid-scale & Renewable Energy Storage Mobility & Transportation (FCEVs, marine, off-road) Industrial & Refining Applications Backup & Remote Power Systems Others |

| By End-Use Sector | Utilities & Power Producers Industrial & Manufacturing Transportation & Logistics Operators Commercial & Institutional Users Others |

| By System Capacity | Micro & Small-scale Systems (<100 kg H?) Medium-scale Systems (100–1,000 kg H?) Large-scale Systems (>1,000 kg H?) Others |

| By Project Type | Pilot & Demonstration Projects Commercial Projects Public Sector / Government-led Projects Public-Private Partnerships Others |

| By Region | Luzon Visayas Mindanao Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hydrogen Storage Technology Providers | 100 | Product Managers, R&D Directors |

| Energy Policy Makers | 80 | Government Officials, Regulatory Analysts |

| Industrial Users of Hydrogen | 70 | Operations Managers, Energy Procurement Officers |

| Research Institutions and Academia | 60 | Research Scientists, Professors in Energy Studies |

| Investors in Renewable Energy | 40 | Venture Capitalists, Investment Analysts |

The Philippines Hydrogen Storage Market is valued at approximately USD 900 million, reflecting significant investments in hydrogen generation and storage technologies over the past five years, driven by the demand for clean energy solutions and government initiatives.