Region:Middle East

Author(s):Rebecca

Product Code:KRAB2151

Pages:92

Published On:January 2026

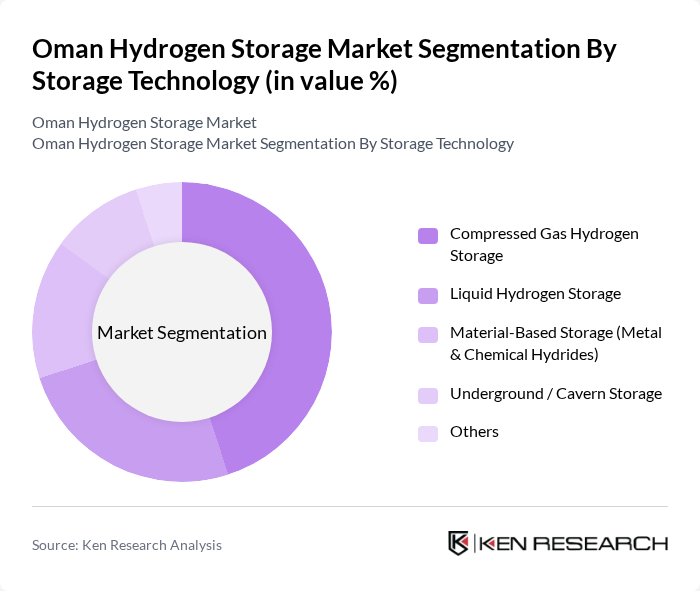

By Storage Technology:The storage technology segment includes various methods for storing hydrogen, which are crucial for its effective utilization in energy systems. The subsegments are Compressed Gas Hydrogen Storage, Liquid Hydrogen Storage, Material-Based Storage (Metal & Chemical Hydrides), Underground / Cavern Storage, and Others. Among these, Compressed Gas Hydrogen Storage is currently dominating the market due to its established technology, use in trailers and cylinders for industrial and mobility applications, and easier alignment with existing gas-handling infrastructure.

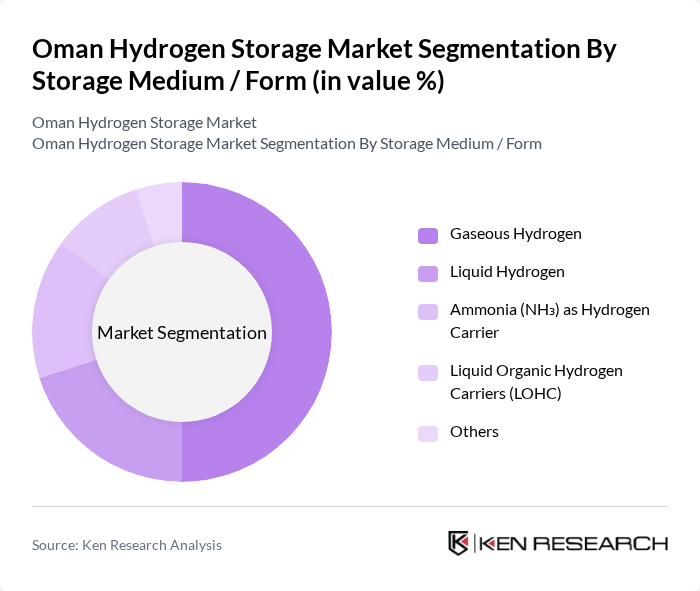

By Storage Medium / Form:This segment categorizes hydrogen storage based on its physical state and form. The subsegments include Gaseous Hydrogen, Liquid Hydrogen, Ammonia (NH?) as Hydrogen Carrier, Liquid Organic Hydrogen Carriers (LOHC), and Others. Gaseous Hydrogen is leading this segment due to its versatility, widespread use in high?pressure tanks and tube trailers, and relative ease of integration into existing industrial gas and pipeline infrastructure, while ammonia is gaining prominence in Oman as an export-oriented hydrogen carrier linked to large green ammonia projects.

The Oman Hydrogen Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Linde plc, Air Liquide S.A., Shell plc (Shell Hydrogen), TotalEnergies SE, Siemens Energy AG, Cummins Inc. (including Hydrogenics legacy business), Plug Power Inc., Ballard Power Systems Inc., Nel ASA, ITM Power plc, McPhy Energy S.A., Toshiba Energy Systems & Solutions Corporation, OQ / Hydrom-Led Hydrogen & Ammonia Project Consortia, and other regional EPCs contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman hydrogen storage market appears promising, driven by increasing investments in renewable energy and government support for hydrogen initiatives. As the country aims to diversify its energy sources, the integration of hydrogen into various sectors is expected to grow. Additionally, advancements in storage technologies will likely enhance efficiency and safety, making hydrogen a more attractive option for energy storage and distribution in Oman’s evolving energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Storage Technology | Compressed Gas Hydrogen Storage Liquid Hydrogen Storage Material-Based Storage (Metal & Chemical Hydrides) Underground / Cavern Storage Others |

| By Storage Medium / Form | Gaseous Hydrogen Liquid Hydrogen Ammonia (NH?) as Hydrogen Carrier Liquid Organic Hydrogen Carriers (LOHC) Others |

| By Application | Grid & Renewable Energy Storage Export-Oriented Hydrogen / Ammonia Supply Mobility & Fueling Infrastructure Industrial Feedstock & Process Uses Backup & Remote Power Systems |

| By Storage Scale / Capacity | Small-Scale / Distributed Storage (<1 tonne H?) Medium-Scale Storage (1–100 tonnes H?) Large-Scale / Bulk >100 tonnes H? Others |

| By End-User Sector | Energy & Utilities Industrial (Chemicals, Refining, Metals) Transport & Logistics Residential & Commercial Government & Public Sector |

| By Ownership / Investment Source | Domestic Private Sector Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Funding & Sovereign Vehicles Multilateral & International Climate Finance |

| By Distribution & Logistics Mode | Pipeline-Based Hydrogen Transport Trucked / Trailer Hydrogen Delivery Shipborne Hydrogen / Ammonia Export On-Site Production & Storage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hydrogen Storage Technology Providers | 100 | Product Managers, R&D Directors |

| Government Energy Policy Makers | 50 | Senior Energy Policy Advisors, Regulatory Officials |

| Renewable Energy Project Developers | 70 | Project Managers, Business Development Leads |

| Academic Researchers in Hydrogen Energy | 40 | Professors, Research Scientists |

| End-users of Hydrogen Storage Solutions | 90 | Operations Managers, Sustainability Officers |

The Oman Hydrogen Storage Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the country's expanding green hydrogen project pipeline and increasing demand for clean energy solutions.