Region:Middle East

Author(s):Shubham

Product Code:KRAD6805

Pages:96

Published On:December 2025

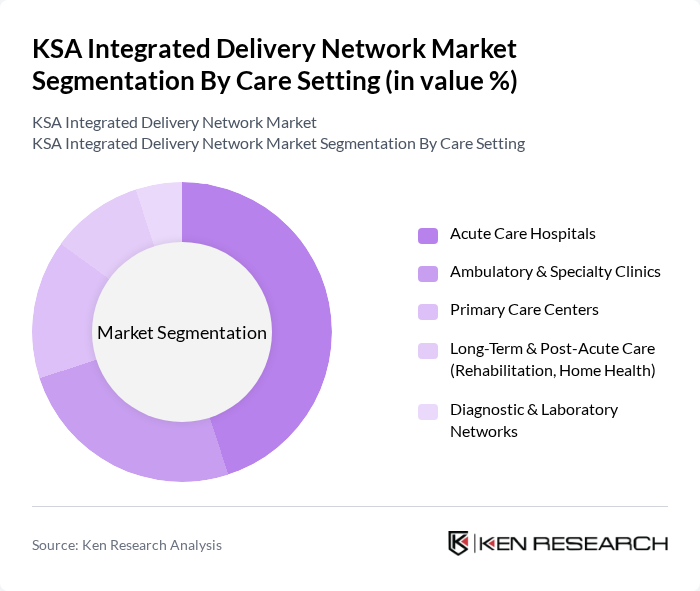

By Care Setting:The KSA Integrated Delivery Network Market is segmented into various care settings, including Acute Care Hospitals, Ambulatory & Specialty Clinics, Primary Care Centers, Long-Term & Post-Acute Care (Rehabilitation, Home Health), and Diagnostic & Laboratory Networks. Among these, Acute Care Hospitals are the most dominant segment due to the high demand for emergency, surgical, and specialized medical services, and because most tertiary capacity, including intensive care and advanced diagnostics, is concentrated in hospital settings. The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and obesity-related conditions, combined with trauma and accident cases, and the growing use of advanced procedures and technologies, have led to a surge in patient volumes and higher acuity levels in these facilities.

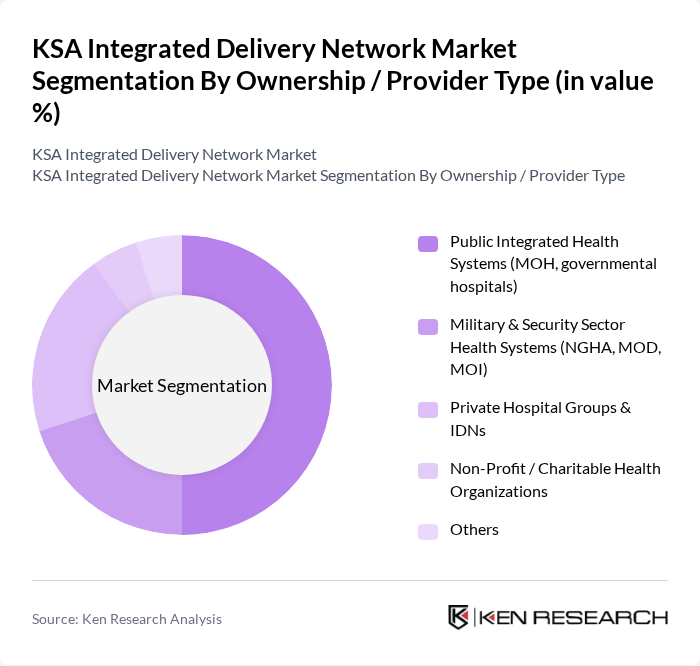

By Ownership / Provider Type:The market is also segmented by ownership and provider type, which includes Public Integrated Health Systems (MOH, governmental hospitals), Military & Security Sector Health Systems (NGHA, MOD, MOI), Private Hospital Groups & IDNs, Non-Profit / Charitable Health Organizations, and Others. Public Integrated Health Systems dominate the market due to their extensive network of primary, secondary, and tertiary facilities operated by the Ministry of Health and other government entities, supported by strong public funding that ensures broad accessibility and affordability of healthcare services for the population. Military and security sector systems, along with large private groups, also play a growing role in specialized, high-complexity, and insured care, often acting as key nodes in emerging integrated delivery networks.

The KSA Integrated Delivery Network Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dr. Sulaiman Al Habib Medical Services Group (HMG), Saudi German Health (SGH), Dallah Healthcare Company, Mouwasat Medical Services Company, Sultan Bin Abdulaziz Humanitarian City, King Faisal Specialist Hospital & Research Centre, Ministry of National Guard Health Affairs, King Fahad Medical City, Al-Moosa Specialist Hospital, International Medical Center (IMC), Jeddah, Saudi Aramco Johns Hopkins Aramco Healthcare (JHAH), Bupa Arabia for Cooperative Insurance, Tawuniya (The Company for Cooperative Insurance), Al Borg Diagnostics, Altakassusi Alliance / SEHA Virtual Hospital–Affiliated Network contribute to innovation, geographic expansion, and service delivery in this space through investment in new hospitals and clinics, digital platforms, and integrated care models that link primary, secondary, and tertiary services.

The KSA Integrated Delivery Network market is poised for transformative growth, driven by ongoing government reforms and technological advancements. As the population continues to urbanize, the demand for integrated healthcare services will rise, necessitating innovative solutions. The focus on patient-centric care and value-based models will reshape service delivery, while partnerships with technology providers will enhance operational efficiency. Overall, the market is expected to evolve significantly, aligning with global healthcare trends and improving patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Care Setting | Acute Care Hospitals Ambulatory & Specialty Clinics Primary Care Centers Long-Term & Post-Acute Care (Rehabilitation, Home Health) Diagnostic & Laboratory Networks |

| By Ownership / Provider Type | Public Integrated Health Systems (MOH, governmental hospitals) Military & Security Sector Health Systems (NGHA, MOD, MOI) Private Hospital Groups & IDNs Non-Profit / Charitable Health Organizations Others |

| By Service Delivery Model | Hospital-Centric Integrated Networks Physician-Led / Clinic-Centric Networks Virtual-First & Telehealth-Enabled Networks Hybrid Integrated Networks |

| By Digital & IT Integration Level | Basic Integration (EHR within facility) Cross-Facility Integrated EHR & PACS Advanced Digital Health (Telemedicine, Remote Monitoring, mHealth) Data-Driven & AI-Enabled Integrated Networks |

| By Region in KSA | Central Region (Riyadh) Western Region (Makkah, Madinah) Eastern Province Northern & Southern Regions |

| By Payment & Contracting Model | Fee-for-Service Capitation & Global Budget Contracts Bundled Payments & Episode-Based Contracts Value-Based / Outcome-Based Contracts |

| By Integration Depth | Vertical Integration (Primary to Tertiary Care) Horizontal Integration (Multi-Hospital / Multi-Clinic Systems) Clinical Integration (Shared Protocols & Care Pathways) Financial & Administrative Integration |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Administrators | 60 | CEOs, CFOs, and Operations Managers |

| Healthcare Professionals | 120 | Doctors, Nurses, and Allied Health Staff |

| Insurance Providers | 50 | Underwriters, Claims Managers, and Policy Analysts |

| Patients and Caregivers | 100 | Patients with chronic conditions, Family Caregivers |

| Healthcare Consultants | 40 | Healthcare Strategy Consultants, Market Analysts |

The KSA Integrated Delivery Network Market is valued at approximately USD 1113 billion, driven by increasing demand for comprehensive healthcare services, advancements in medical technology, and government initiatives under Vision 2030 aimed at enhancing healthcare infrastructure.