Region:Middle East

Author(s):Shubham

Product Code:KRAB7300

Pages:98

Published On:October 2025

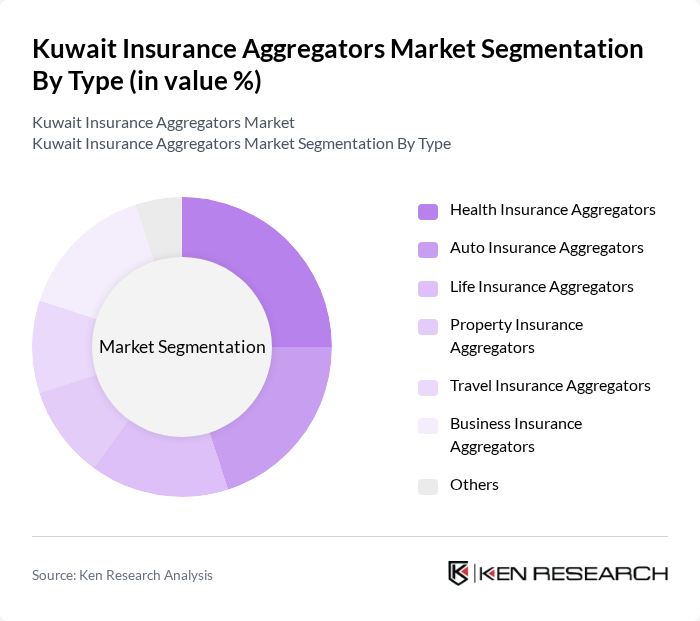

By Type:The market is segmented into various types of insurance aggregators, including Health Insurance Aggregators, Auto Insurance Aggregators, Life Insurance Aggregators, Property Insurance Aggregators, Travel Insurance Aggregators, Business Insurance Aggregators, and Others. Each sub-segment caters to specific consumer needs and preferences, reflecting the diverse landscape of insurance products available in Kuwait.

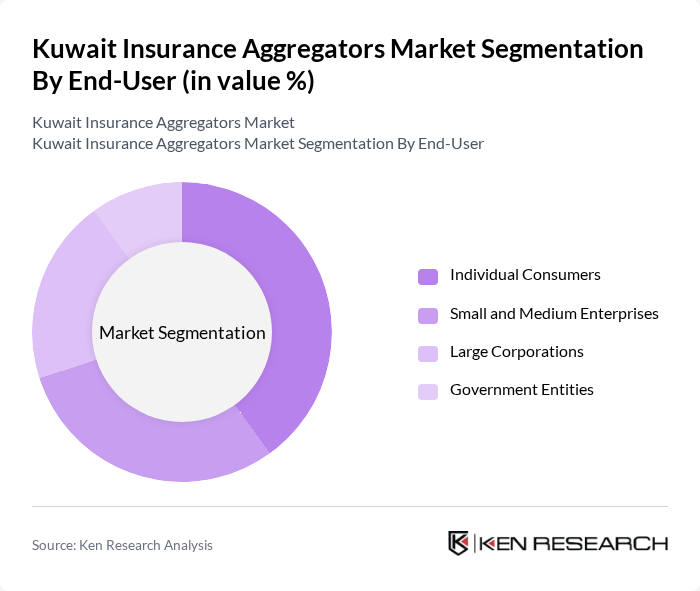

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises, Large Corporations, and Government Entities. Each segment has unique requirements and purchasing behaviors, influencing the types of insurance products they seek through aggregators.

The Kuwait Insurance Aggregators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Wathba National Insurance Company, Gulf Insurance Group, Kuwait Insurance Company, Warba Insurance Company, Al Ahli United Bank, National Life & General Insurance Company, Al Sagr Cooperative Insurance Company, Takaful International Company, Al-Masraf Insurance Company, Al-Ahlia Insurance Company, Al-Mawashi Insurance Company, Al-Hilal Insurance Company, Al-Jazeera Insurance Company, Al-Madina Insurance Company, Al-Qurain Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait insurance aggregators market appears promising, driven by technological advancements and evolving consumer preferences. As mobile platforms gain traction, aggregators are likely to enhance their offerings through personalized services and AI-driven insights. Additionally, the integration of big data analytics will enable more accurate risk assessments and tailored insurance products, fostering greater consumer engagement. The focus on transparency and user experience will be pivotal in shaping the competitive landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Health Insurance Aggregators Auto Insurance Aggregators Life Insurance Aggregators Property Insurance Aggregators Travel Insurance Aggregators Business Insurance Aggregators Others |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations Government Entities |

| By Sales Channel | Online Platforms Mobile Applications Direct Sales Affiliate Marketing |

| By Customer Segment | Retail Customers Corporate Clients High Net-Worth Individuals |

| By Service Type | Comparison Services Advisory Services Claims Assistance |

| By Geographic Coverage | Urban Areas Rural Areas Expatriate Communities |

| By Policy Type | Comprehensive Policies Basic Policies Customizable Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Aggregation | 100 | Insurance Brokers, Health Policyholders |

| Auto Insurance Aggregation | 80 | Car Owners, Insurance Agents |

| Life Insurance Aggregation | 70 | Financial Advisors, Life Insurance Customers |

| Consumer Preferences in Insurance | 90 | General Public, Insurance Buyers |

| Market Trends and Insights | 60 | Industry Analysts, Market Researchers |

The Kuwait Insurance Aggregators Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digital adoption and consumer awareness regarding insurance products.