Region:Middle East

Author(s):Rebecca

Product Code:KRAC1074

Pages:85

Published On:October 2025

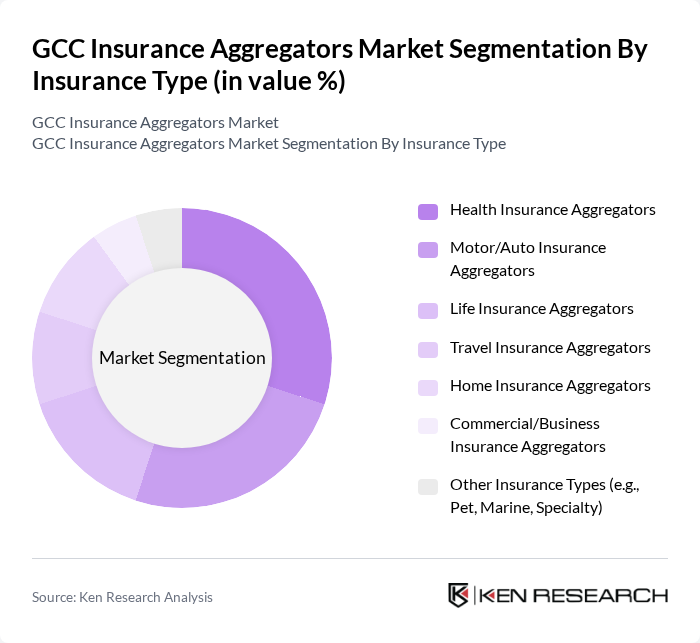

By Insurance Type:The insurance type segmentation includes various categories such as Health Insurance Aggregators, Motor/Auto Insurance Aggregators, Life Insurance Aggregators, Travel Insurance Aggregators, Home Insurance Aggregators, Commercial/Business Insurance Aggregators, and Other Insurance Types (e.g., Pet, Marine, Specialty). Among these, Health Insurance Aggregators are currently leading the market due to the rising healthcare costs and increased awareness of health insurance products among consumers. The demand for comprehensive health coverage has surged, prompting more individuals to seek out comparison platforms to find the best policies. The market is also witnessing growth in motor/auto and travel insurance aggregation, driven by regulatory requirements and increased travel activity .

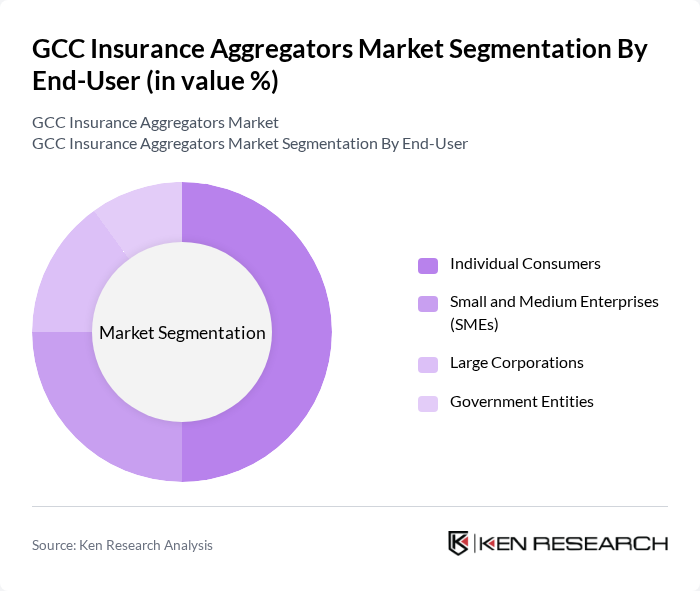

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers dominate this segment as they increasingly turn to online platforms for personal insurance needs. The convenience of comparing various policies and prices has made it easier for individuals to select the best options tailored to their specific requirements, thus driving the growth of this segment. SMEs are also rapidly adopting aggregator platforms to optimize insurance procurement and cost management .

The GCC Insurance Aggregators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Souqalmal.com, Yallacompare.com, Policybazaar.ae, InsuranceMarket.ae, Bayzat, Aqeed.com, RAKINSURANCE Aggregator, Compareit4me.com, Shory.com, Bima Middle East, Tameeni.com (Saudi Arabia), UCompare (Qatar), MyCompare (Oman), Beema (UAE), InsuranceMarket Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC insurance aggregator market appears promising, driven by technological advancements and evolving consumer preferences. As digital adoption continues to rise, aggregators are expected to enhance their platforms with AI and machine learning capabilities, improving customer experience and operational efficiency. Additionally, the shift towards customer-centric models will likely lead to more personalized insurance offerings, catering to the diverse needs of consumers in the region, thereby fostering market growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Insurance Type | Health Insurance Aggregators Motor/Auto Insurance Aggregators Life Insurance Aggregators Travel Insurance Aggregators Home Insurance Aggregators Commercial/Business Insurance Aggregators Other Insurance Types (e.g., Pet, Marine, Specialty) |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Online Web Platforms Mobile Applications Call Centers Insurance Brokers/Partners |

| By Geographic Coverage | United Arab Emirates Saudi Arabia Qatar Kuwait Bahrain Oman |

| By Customer Segment | Retail Customers Corporate Clients Institutional Clients |

| By Service Type | Comparison Services Advisory Services Claims Assistance |

| By Policy Type | Comprehensive Policies Basic/Third-Party Policies Custom Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insurance Preferences | 120 | Insurance Buyers, Policyholders |

| Insurance Aggregator Performance | 80 | Business Development Managers, Marketing Directors |

| Regulatory Impact on Insurance Aggregation | 60 | Compliance Officers, Legal Advisors |

| Technological Adoption in Insurance | 50 | IT Managers, Digital Transformation Leads |

| Market Trends and Consumer Behavior | 70 | Market Analysts, Consumer Insights Managers |

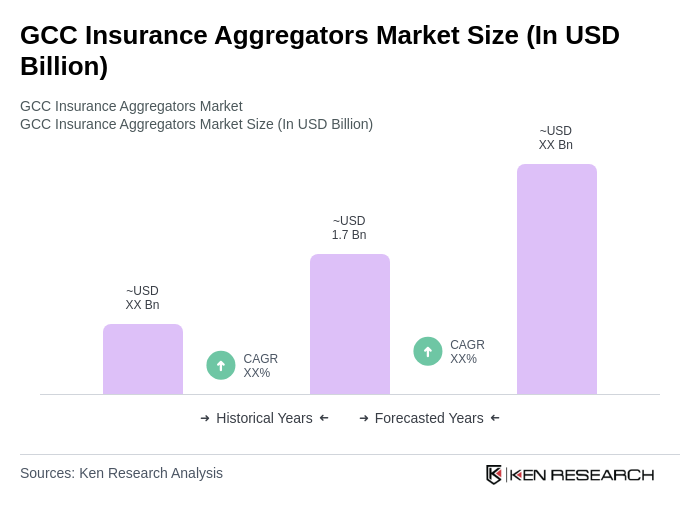

The GCC Insurance Aggregators Market is valued at approximately USD 1.7 billion, reflecting significant growth driven by digital platform adoption, consumer awareness, and demand for personalized insurance solutions.