Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7345

Pages:82

Published On:October 2025

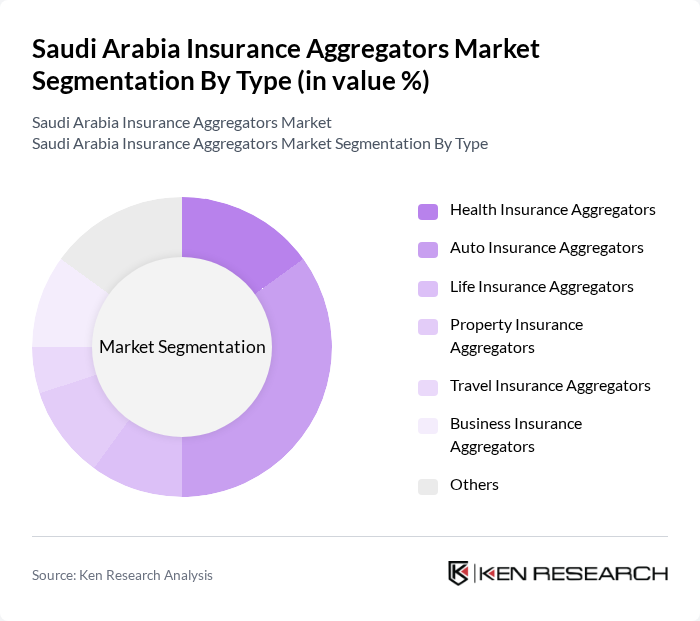

By Type:The market is segmented into various types of insurance aggregators, including Health Insurance Aggregators, Auto Insurance Aggregators, Life Insurance Aggregators, Property Insurance Aggregators, Travel Insurance Aggregators, Business Insurance Aggregators, and Others. Among these, Auto Insurance Aggregators are currently leading the market due to the high demand for vehicle insurance in a rapidly growing automotive sector. The increasing number of vehicles on the road and the need for comprehensive coverage options are driving this segment's growth.

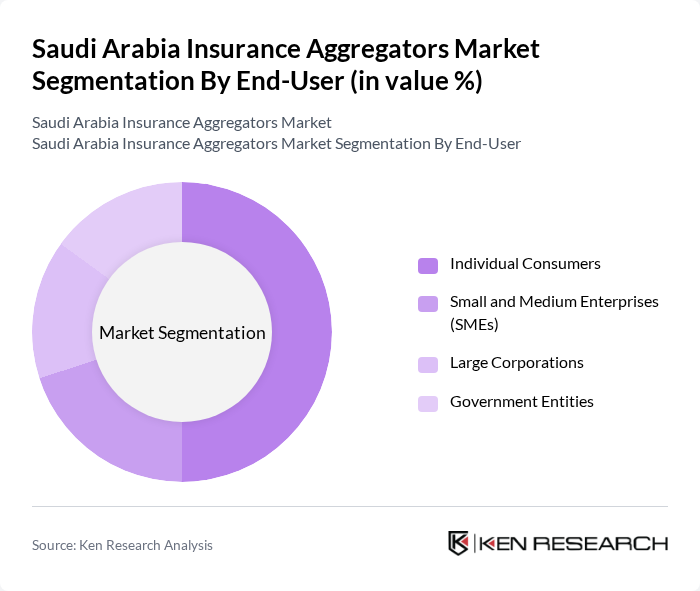

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers dominate the market as they increasingly seek personalized insurance solutions tailored to their specific needs. The rise in awareness regarding the importance of insurance and the convenience offered by online platforms have significantly contributed to this segment's growth.

The Saudi Arabia Insurance Aggregators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Souqalmal.com, Compareit4me.com, Yallacompare.com, InsuranceMarket.ae, Bima.com, Policybazaar.com, Aqarat.com, Al-Etihad Cooperative Insurance, Tawuniya, Gulf Insurance Group, Allianz Saudi Fransi, Arab National Bank Insurance, United Cooperative Assurance, Al Rajhi Takaful, MetLife AIG ANB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia insurance aggregator market appears promising, driven by technological advancements and evolving consumer preferences. As mobile platforms gain traction, the demand for seamless, user-friendly experiences will increase. Additionally, the integration of artificial intelligence and machine learning will enhance personalization in service offerings, allowing aggregators to cater to individual consumer needs more effectively. This evolution will likely foster greater consumer engagement and loyalty, positioning the market for sustained growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Health Insurance Aggregators Auto Insurance Aggregators Life Insurance Aggregators Property Insurance Aggregators Travel Insurance Aggregators Business Insurance Aggregators Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Online Platforms Mobile Applications Call Centers Direct Sales |

| By Customer Segment | Retail Customers Corporate Clients Institutional Clients |

| By Pricing Model | Fixed Pricing Dynamic Pricing Subscription-Based Pricing |

| By Service Type | Comparison Services Advisory Services Claims Assistance Services |

| By Policy Type | Comprehensive Policies Third-Party Policies Customizable Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Insurance Aggregator User Experience | 150 | End Consumers, Policyholders |

| Insurance Broker Insights | 100 | Insurance Brokers, Agency Owners |

| Market Trends in Digital Insurance | 80 | Digital Marketing Managers, Product Managers |

| Regulatory Impact Assessment | 60 | Compliance Officers, Legal Advisors |

| Consumer Preferences in Insurance Products | 120 | General Public, Focus Group Participants |

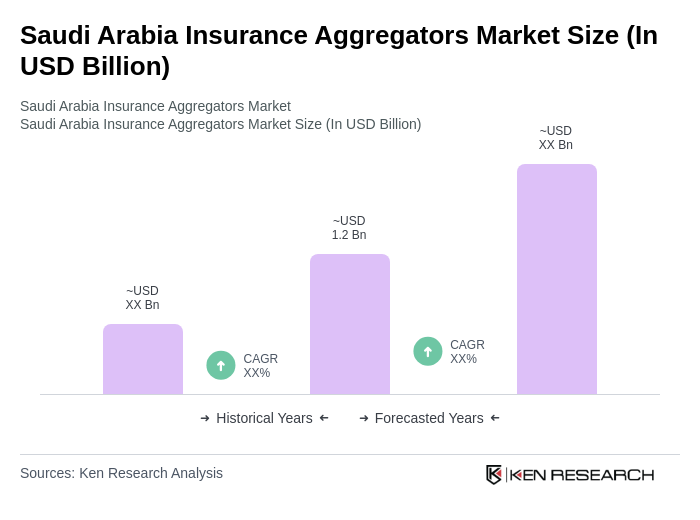

The Saudi Arabia Insurance Aggregators Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by digitalization, consumer demand for price transparency, and the rise of online insurance comparison platforms.