Region:Middle East

Author(s):Dev

Product Code:KRAB7249

Pages:89

Published On:October 2025

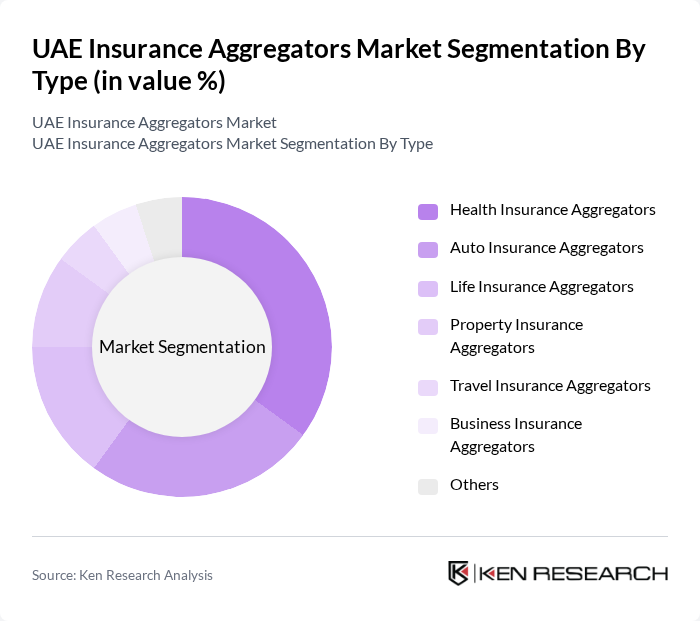

By Type:The market is segmented into various types of insurance aggregators, including Health Insurance Aggregators, Auto Insurance Aggregators, Life Insurance Aggregators, Property Insurance Aggregators, Travel Insurance Aggregators, Business Insurance Aggregators, and Others. Among these, Health Insurance Aggregators are currently leading the market due to the rising healthcare costs and increased consumer focus on health and wellness. The demand for comprehensive health coverage has driven consumers to seek out platforms that provide easy comparisons and access to various health insurance plans.

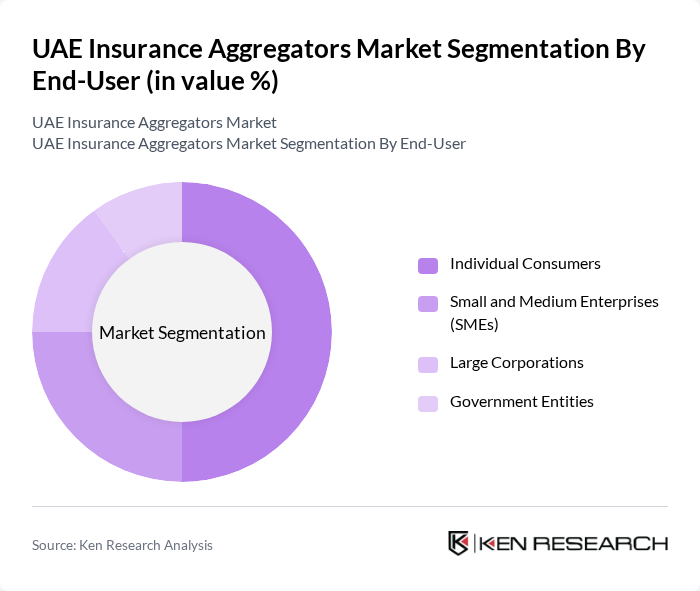

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers dominate this segment, driven by the increasing need for personal insurance solutions and the growing trend of online insurance purchases. The convenience of comparing various policies and prices has made insurance aggregators particularly appealing to individual users seeking tailored coverage options.

The UAE Insurance Aggregators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Souqalmal.com, Policybazaar UAE, Yallacompare, Compareit4me, InsuranceMarket.ae, AXA Insurance, Allianz Insurance, Dubai Insurance Company, Abu Dhabi National Insurance Company, Emirates Insurance Company, Orient Insurance, National General Insurance, Al Fujairah National Insurance Company, Al Ain Ahlia Insurance Company, Oman Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE insurance aggregator market appears promising, driven by technological advancements and evolving consumer preferences. As mobile applications gain traction, insurers are likely to invest in user-friendly platforms that enhance customer experience. Additionally, the integration of artificial intelligence and machine learning will enable personalized insurance offerings, catering to individual needs. This trend, combined with regulatory support, is expected to foster innovation and create a more competitive landscape, ultimately benefiting consumers and driving market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Health Insurance Aggregators Auto Insurance Aggregators Life Insurance Aggregators Property Insurance Aggregators Travel Insurance Aggregators Business Insurance Aggregators Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Online Platforms Mobile Applications Call Centers Insurance Brokers |

| By Customer Segment | Retail Customers Corporate Clients High Net-Worth Individuals |

| By Geographic Coverage | Urban Areas Rural Areas Free Zones |

| By Policy Type | Comprehensive Policies Basic Policies Add-On Policies |

| By Price Range | Low-Cost Insurance Mid-Range Insurance Premium Insurance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insurance Preferences | 150 | Insurance Buyers, Policyholders |

| Insurance Broker Insights | 100 | Insurance Brokers, Sales Agents |

| Aggregator Service Evaluation | 80 | Product Managers, Marketing Executives |

| Regulatory Impact Assessment | 60 | Compliance Officers, Legal Advisors |

| Technological Adoption in Insurance | 70 | IT Managers, Digital Transformation Leads |

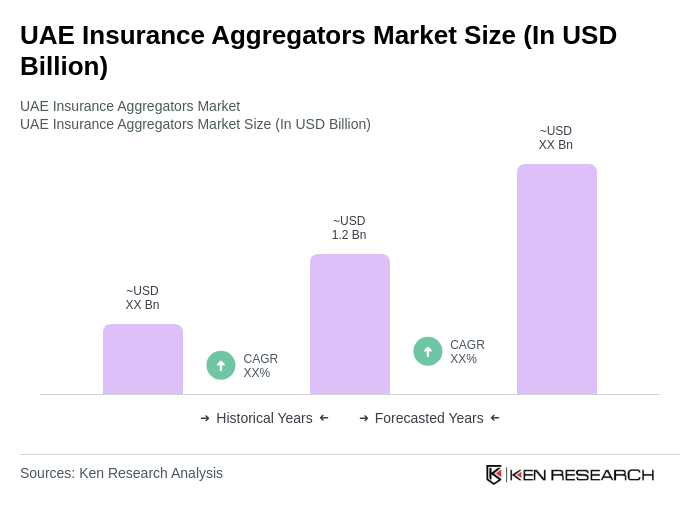

The UAE Insurance Aggregators Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digital adoption and consumer awareness regarding insurance benefits.