Region:Asia

Author(s):Geetanshi

Product Code:KRVN3163

Pages:84

Published On:December 2025

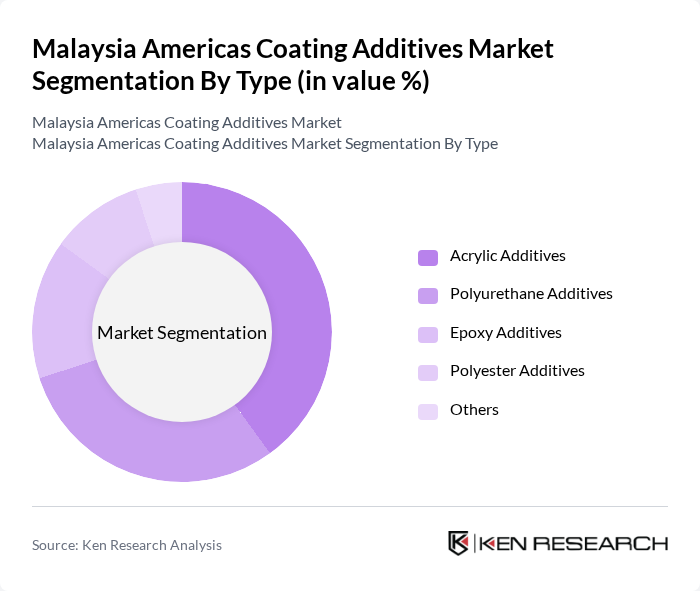

By Type:The market is segmented into various types of additives, including Acrylic Additives, Polyurethane Additives, Epoxy Additives, Polyester Additives, and Others. Among these, Acrylic Additives are currently leading the market due to their versatility and superior performance in various applications, consistent with the dominance of acrylic chemistries in paints and coatings in Malaysia and across Asia Pacific. They are widely used in architectural and industrial coatings, driven by their excellent weather resistance, adhesion properties, and suitability for water?borne, low?VOC formulations. Polyurethane Additives also hold a significant share, particularly in automotive and protective applications, owing to their durability, flexibility, chemical resistance, and contribution to scratch and abrasion resistance in high?performance topcoats. The demand for these additives is further fueled by the growing trend towards high-performance coatings that meet stringent environmental and performance regulations, including improved durability, UV resistance, and lower emissions across architectural, industrial, and transportation segments.

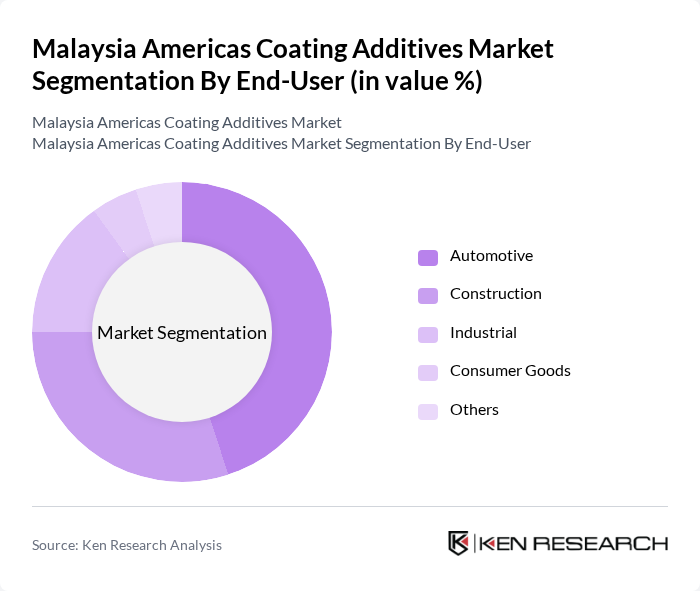

By End-User:The market is categorized into Automotive, Construction, Industrial, Consumer Goods, and Others. The Automotive sector is the dominant end-user, driven by the increasing production of vehicles and components in Malaysia and the wider Asia Pacific region, and by the demand for high-quality coatings that enhance durability, corrosion resistance, and aesthetics for OEM and refinish applications. The Construction industry follows closely, as the need for protective and decorative coatings in residential, commercial, and infrastructure projects continues to rise with ongoing urbanization and government?supported infrastructure programs. Additionally, the Industrial sector is witnessing growth due to the need for specialized coatings that can withstand harsh environments in areas such as marine, oil and gas, and general industrial equipment, which require advanced rheology modifiers, dispersants, and anti?corrosion additives.

The Malaysia Americas Coating Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Evonik Industries AG, Dow Inc., Arkema S.A., Huntsman Corporation, Clariant AG, Eastman Chemical Company, Solvay S.A., AkzoNobel N.V., PPG Industries, Inc., Sherwin-Williams Company, RPM International Inc., KCC Corporation, Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space, supported by their global portfolios of dispersants, rheology modifiers, defoamers, flow and leveling additives, and specialty performance boosters tailored for automotive, architectural, and industrial coatings.

The future of the Malaysian Americas coating additives market appears promising, driven by a strong emphasis on sustainability and innovation. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in developing advanced formulations that meet these demands. Additionally, the ongoing digital transformation in manufacturing processes is expected to enhance operational efficiency. With strategic partnerships and increased R&D investments, the market is poised for significant growth, aligning with global trends towards sustainability and high-performance solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Acrylic Additives Polyurethane Additives Epoxy Additives Polyester Additives Others |

| By End-User | Automotive Construction Industrial Consumer Goods Others |

| By Application | Architectural Coatings Industrial Coatings Automotive Coatings Protective Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | Central Malaysia Northern Malaysia Southern Malaysia Eastern Malaysia |

| By Product Formulation | Water-Based Coatings Solvent-Based Coatings Powder Coatings Others |

| By Customer Type | OEMs End Users Retail Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coating Additives | 100 | Product Managers, R&D Directors |

| Construction Coating Solutions | 80 | Project Managers, Procurement Specialists |

| Industrial Coatings Applications | 70 | Operations Managers, Quality Control Supervisors |

| Consumer Goods Coatings | 60 | Brand Managers, Product Development Leads |

| Regulatory Compliance in Coatings | 50 | Compliance Officers, Environmental Managers |

The Malaysia Americas Coating Additives Market is valued at approximately USD 1.0 billion, reflecting a robust growth trajectory driven by increasing demand for high-performance coatings across various industries, including automotive and construction.