Region:Central and South America

Author(s):Geetanshi

Product Code:KRVN3162

Pages:100

Published On:December 2025

By Type:The market is segmented into various types of additives, including Acrylic Additives, Polyurethane Additives, Epoxy Additives, Polyester Additives, and Others. Acrylic Additives are gaining traction due to their versatility, strong adhesion, weatherability, and suitability for water-borne and low-VOC formulations used in architectural and industrial coatings. The demand for Polyurethane Additives is also significant, driven by their use in high-performance protective, automotive, and industrial coatings that require durability, chemical resistance, and flexibility in Indonesia’s tropical environment. The market is witnessing a trend towards eco-friendly and water-borne formulations, with increased use of dispersing agents, rheology modifiers, and defoamers tailored for sustainable systems, which is influencing the growth of these segments.

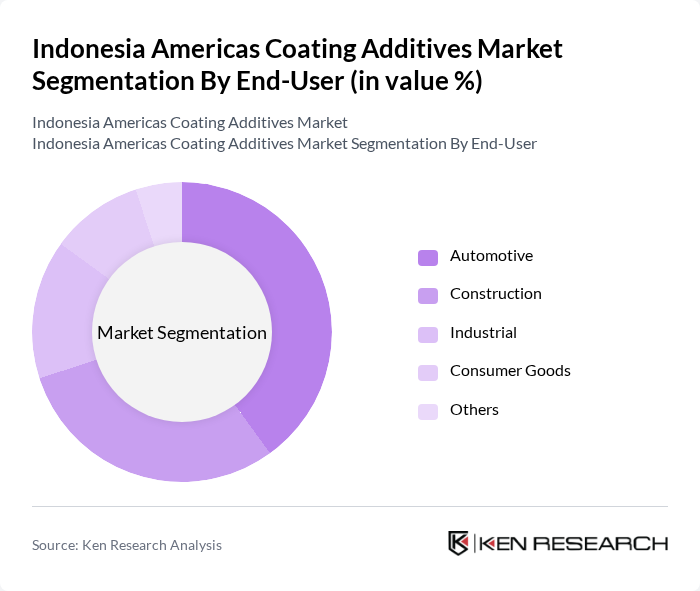

By End-User:The end-user segments include Automotive, Construction, Industrial, Consumer Goods, and Others. The Automotive sector is one of the leading consumers of coating additives in Indonesia, supported by regional automotive production, refinish demand, and the need for high-quality finishes, corrosion protection, and weather resistance on vehicles and components. The Construction industry follows closely, with growing demand for decorative and protective coatings for residential, commercial, and infrastructure projects, underpinned by Indonesia’s expanding architectural coatings and paints and coatings markets. The trend towards sustainable construction practices, such as low-odor, low-VOC, and weather-durable coatings, is also influencing the choice and formulation of additives in this sector, while industrial, marine, and consumer goods applications further diversify demand.

The Indonesia Americas Coating Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Evonik Industries AG, Dow Inc., Arkema S.A., Huntsman Corporation, Clariant AG, Eastman Chemical Company, Solvay S.A., AkzoNobel N.V., PPG Industries, Inc., Sherwin-Williams Company, RPM International Inc., KCC Corporation, Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia Americas Coating Additives Market appears promising, driven by a combination of technological advancements and increasing consumer demand for sustainable products. As urbanization accelerates, the need for innovative and high-performance coatings will rise, particularly in the construction and automotive sectors. Additionally, the integration of digital technologies in manufacturing processes is expected to enhance efficiency and reduce costs, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Acrylic Additives Polyurethane Additives Epoxy Additives Polyester Additives Others |

| By End-User | Automotive Construction Industrial Consumer Goods Others |

| By Application | Architectural Coatings Industrial Coatings Automotive Coatings Protective Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Retail Stores Others |

| By Region | Java Sumatra Kalimantan Sulawesi Others |

| By Product Formulation | Water-Based Coatings Solvent-Based Coatings Powder Coatings Others |

| By Performance Characteristics | High Durability Low VOC Fast Drying Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coating Additives | 100 | Product Managers, R&D Directors |

| Construction Coating Additives | 80 | Procurement Managers, Project Engineers |

| Industrial Coating Additives | 70 | Operations Managers, Quality Control Specialists |

| Specialty Coating Additives | 60 | Marketing Managers, Technical Sales Representatives |

| Eco-friendly Coating Additives | 50 | Sustainability Officers, Product Development Managers |

The Indonesia Americas Coating Additives Market is valued at approximately USD 1.0 billion, reflecting its significant role within the Asia Pacific coating additives sector and its connection to Indonesia's broader paints and coatings industry.