Region:Asia

Author(s):Dev

Product Code:KRAA6560

Pages:93

Published On:January 2026

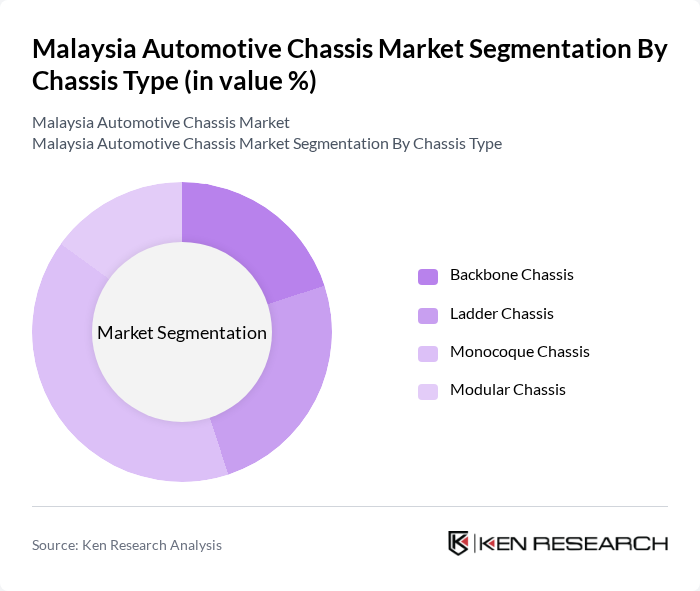

By Chassis Type:The chassis type segmentation includes Backbone Chassis, Ladder Chassis, Monocoque Chassis, and Modular Chassis. Among these, the Monocoque Chassis is currently dominating the market due to its lightweight design and enhanced structural integrity, making it a preferred choice for modern passenger vehicles. The increasing focus on fuel efficiency and safety features has led manufacturers to adopt this design, which integrates the body and chassis into a single unit, thereby reducing weight and improving performance.

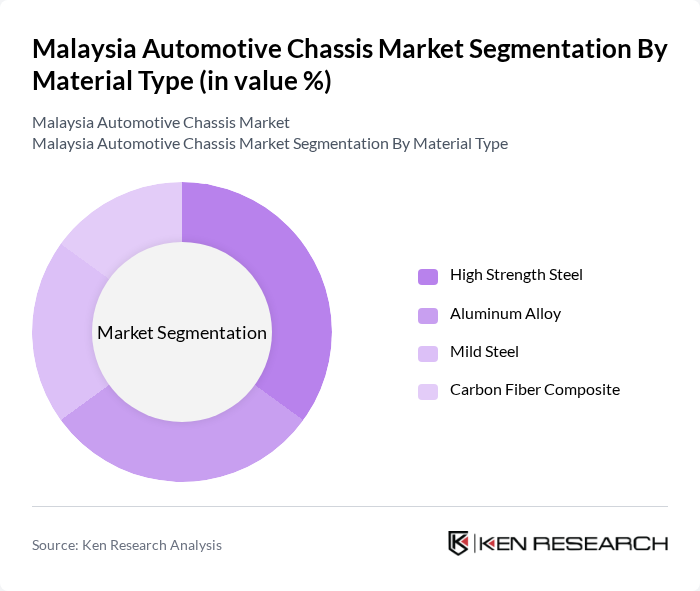

By Material Type:The material type segmentation includes High Strength Steel, Aluminum Alloy, Mild Steel, and Carbon Fiber Composite. High Strength Steel is leading the market due to its excellent strength-to-weight ratio and cost-effectiveness, making it a popular choice among manufacturers. The automotive industry is increasingly adopting this material to enhance vehicle safety and performance while keeping production costs manageable. Additionally, the growing trend towards lightweight vehicles is further driving the demand for High Strength Steel.

The Malaysia Automotive Chassis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Denso, Robert Bosch, Perodua, Proton, Delphi, Champion, Toyota, Mitsubishi, Valeo, Honda Malaysia, Nissan Malaysia, and Isuzu Malaysia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysian automotive chassis market appears promising, driven by technological advancements and a growing focus on sustainability. As manufacturers increasingly adopt smart chassis technologies and modular designs, the industry is expected to evolve rapidly. Additionally, the government's commitment to enhancing local production capabilities and supporting electric vehicle initiatives will likely create a more robust automotive ecosystem. This environment will foster innovation, enabling local firms to compete effectively on a global scale while addressing consumer demands for customization and performance.

| Segment | Sub-Segments |

|---|---|

| By Chassis Type | Backbone Chassis Ladder Chassis Monocoque Chassis Modular Chassis |

| By Material Type | High Strength Steel Aluminum Alloy Mild Steel Carbon Fiber Composite |

| By Vehicle Type | Passenger Car Light Commercial Vehicle Heavy Commercial Vehicle |

| By Electric Vehicle Type | Battery Electric Vehicle Hybrid Electric Vehicle Plug-In Hybrid Electric Vehicle |

| By Region | Central Region Northern Region Southern Region Eastern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Chassis Manufacturers | 45 | Production Managers, Quality Assurance Engineers |

| Commercial Vehicle Chassis Suppliers | 38 | Supply Chain Managers, Operations Directors |

| Automotive Component Distributors | 32 | Sales Managers, Product Line Managers |

| Research & Development in Automotive Engineering | 28 | R&D Engineers, Technical Directors |

| Regulatory Bodies and Industry Associations | 22 | Policy Makers, Industry Analysts |

The Malaysia Automotive Chassis Market is valued at approximately USD 1.6 billion, driven by increasing vehicle demand, advancements in automotive technology, and a shift towards lightweight materials for improved fuel efficiency.