Region:Asia

Author(s):Shubham

Product Code:KRAD3064

Pages:95

Published On:January 2026

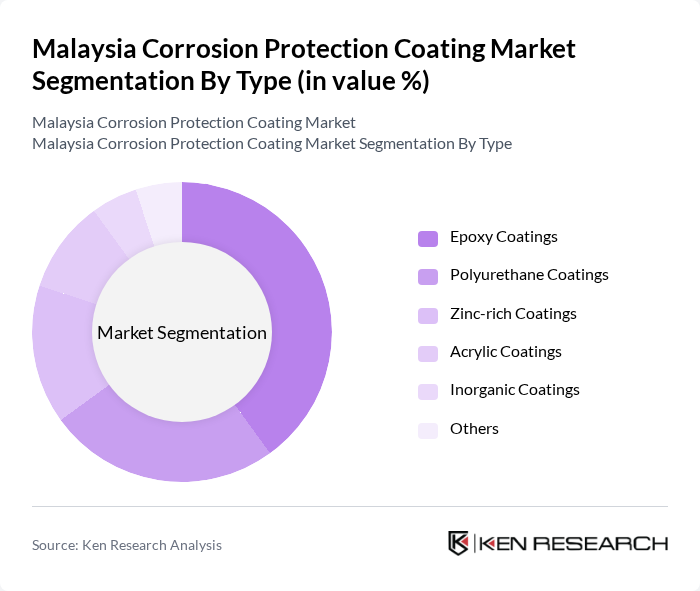

By Type:The market is segmented into various types of coatings, including Epoxy Coatings, Polyurethane Coatings, Zinc-rich Coatings, Acrylic Coatings, Inorganic Coatings, and Others. Among these, epoxy coatings are the most widely used due to their excellent adhesion, chemical resistance, and durability, making them suitable for a variety of applications in harsh environments, while zinc-rich coatings provide superior sacrificial protection and ceramic-reinforced variants offer extreme wear resistance.

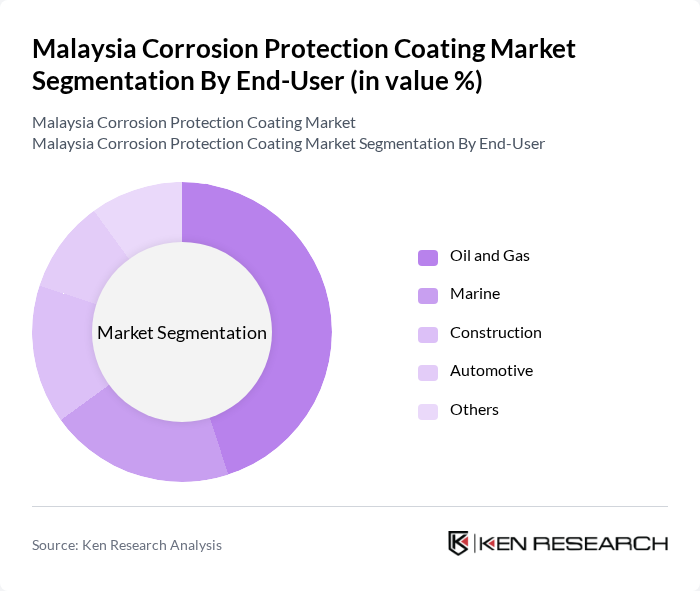

By End-User:The corrosion protection coating market is segmented by end-user industries, including Oil and Gas, Marine, Construction, Automotive, and Others. The oil and gas sector is the leading end-user, driven by the need for protective coatings to withstand harsh environmental conditions and prevent corrosion in pipelines and storage tanks, with strong demand also from marine shipping, offshore platforms, and infrastructure projects.

The Malaysia Corrosion Protection Coating Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jotun Malaysia, PPG Industries, AkzoNobel, BASF Coatings, Sherwin-Williams, Hempel, Nippon Paint, Tikkurila, RPM International, Sika AG, Carboline, Rust-Oleum, Valspar, DuPont, and 3M contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia corrosion protection coating market appears promising, driven by ongoing industrialization and a shift towards sustainable practices. As the government continues to invest in infrastructure, the demand for high-performance coatings is expected to rise in future. Additionally, advancements in coating technologies, such as smart coatings and eco-friendly formulations, will likely enhance product offerings. Companies that adapt to these trends and invest in innovation will be well-positioned to capture market share in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Coatings Polyurethane Coatings Zinc-rich Coatings Acrylic Coatings Inorganic Coatings Others |

| By End-User | Oil and Gas Marine Construction Automotive Others |

| By Application | Protective Coatings Decorative Coatings Industrial Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | Central Region Northern Region Southern Region Eastern Region |

| By Product Formulation | Water-based Coatings Solvent-based Coatings Powder Coatings Others |

| By Market Segment | Commercial Residential Industrial Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Coating Applications | 100 | Project Managers, Maintenance Engineers |

| Marine Industry Protective Coatings | 80 | Marine Engineers, Fleet Managers |

| Construction Sector Coating Solutions | 90 | Architects, Site Managers |

| Automotive Coating Applications | 70 | Production Managers, Quality Control Inspectors |

| Infrastructure Development Coatings | 60 | Urban Planners, Civil Engineers |

The Malaysia Corrosion Protection Coating Market is valued at approximately USD 15 million, driven by increasing demand across various industries such as oil and gas, construction, automotive, and marine, alongside rising awareness of corrosion prevention.