Region:Asia

Author(s):Rebecca

Product Code:KRAA7074

Pages:80

Published On:January 2026

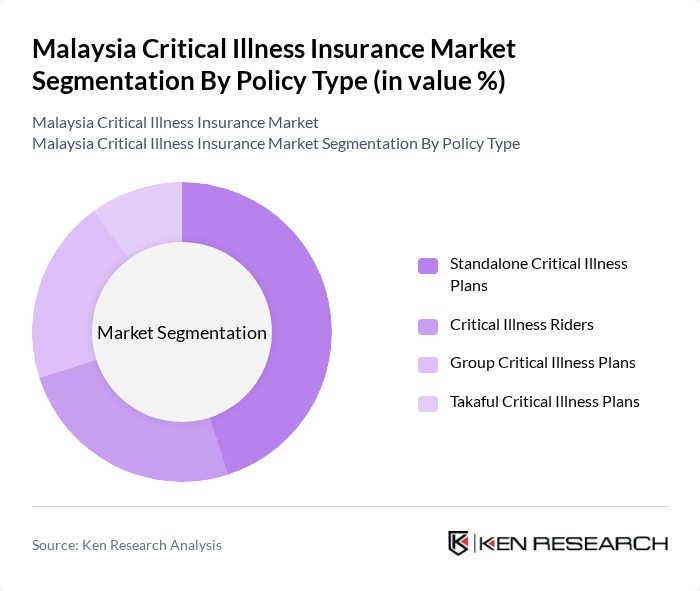

By Policy Type:

The policy type segmentation includes Standalone Critical Illness Plans, Critical Illness Riders, Group Critical Illness Plans, and Takaful Critical Illness Plans. Among these, Standalone Critical Illness Plans are currently dominating the market due to their comprehensive coverage and flexibility, allowing policyholders to tailor their insurance according to specific health risks. The increasing prevalence of critical illnesses such as cancer and heart diseases has led consumers to prefer standalone plans that offer higher coverage amounts and benefits. This trend is further supported by rising health awareness and the need for financial security in the face of serious health challenges. Additionally, employers across Malaysia are increasingly including critical illness coverage in corporate benefit programs to attract and retain employees, with group insurance plans offering lower premiums and broader coverage options.

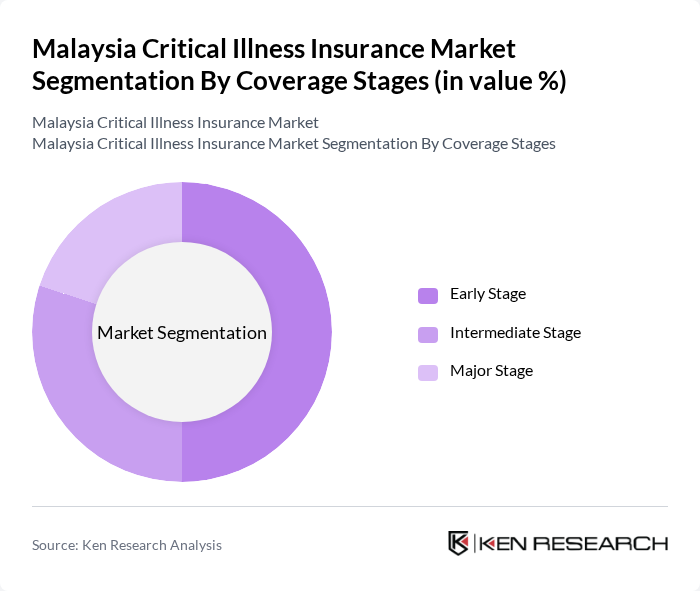

By Coverage Stages:

The coverage stages segmentation includes Early Stage, Intermediate Stage, and Major Stage. The Early Stage coverage is currently leading the market, as it provides policyholders with essential financial support during the initial diagnosis of critical illnesses. This segment appeals to consumers who prefer to manage their healthcare costs proactively. The increasing awareness of early detection and treatment options has further fueled the demand for early-stage coverage, making it a preferred choice among policyholders seeking to mitigate financial risks associated with critical health conditions.

The Malaysia Critical Illness Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as AIA Malaysia, Prudential Assurance Malaysia, Great Eastern Life Assurance, Allianz Malaysia, Tokio Marine Life Insurance Malaysia, Zurich Insurance Malaysia, Hong Leong Assurance, AmMetLife Insurance, Etiqa Insurance, MSIG Insurance, Takaful Malaysia, RHB Insurance, Kurnia Insurans, FWD Insurance, Manulife Insurance contribute to innovation, geographic expansion, and service delivery in this space. Digital transformation is accelerating across the sector, with insurers integrating AI-based underwriting, data analytics, and mobile banking platforms to improve claim processing, risk assessment accuracy, and premium payment convenience.

The future of the critical illness insurance market in Malaysia appears promising, driven by technological advancements and evolving consumer preferences. The integration of digital platforms for insurance purchasing and claims processing is expected to enhance customer experience significantly in future. Additionally, as the population ages and healthcare needs increase, insurers will likely focus on developing tailored products that address specific health concerns, ensuring that coverage remains relevant and accessible to a diverse demographic.

| Segment | Sub-Segments |

|---|---|

| By Policy Type | Standalone Critical Illness Plans Critical Illness Riders Group Critical Illness Plans Takaful Critical Illness Plans |

| By Coverage Stages | Early Stage Intermediate Stage Major Stage |

| By Illness Category | Cancer Heart-related Stroke Organ Failure Others |

| By Distribution Channel | Agents/Brokers Bancassurance Digital/Online Platforms Direct Sales |

| By Gender | Male-specific Plans Female-specific Plans Unisex Plans |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Policyholders | 120 | Current policyholders, potential buyers aged 30-50 |

| Insurance Agents | 100 | Insurance agents and financial advisors |

| Healthcare Professionals | 80 | Doctors, hospital administrators, and health consultants |

| Corporate Clients | 70 | HR managers and benefits coordinators from large firms |

| Regulatory Bodies | 40 | Officials from insurance regulatory authorities and health ministries |

The Malaysia Critical Illness Insurance Market is valued at approximately USD 6.5 billion. This growth is driven by increasing healthcare costs, rising awareness of critical illnesses, and a growing middle-class population seeking financial protection against health-related risks.