Region:Asia

Author(s):Harsh Saxena

Product Code:KR1540

Pages:90

Published On:October 2014

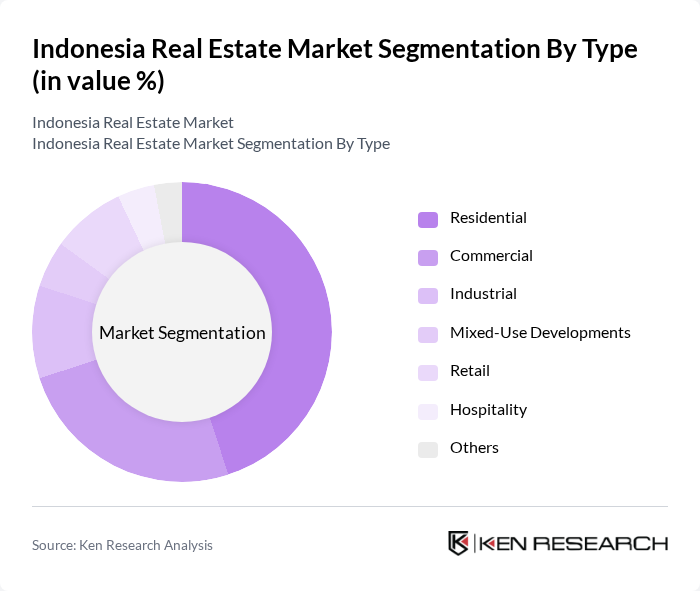

By Type:The real estate market in Indonesia can be segmented into various types, including Residential, Commercial, Industrial, Mixed-Use Developments, Retail, Hospitality, and Others. Among these, the Residential segment is the most dominant, driven by the increasing urban population and the demand for affordable housing. The Commercial segment is also significant, fueled by the growth of businesses and the need for office spaces.

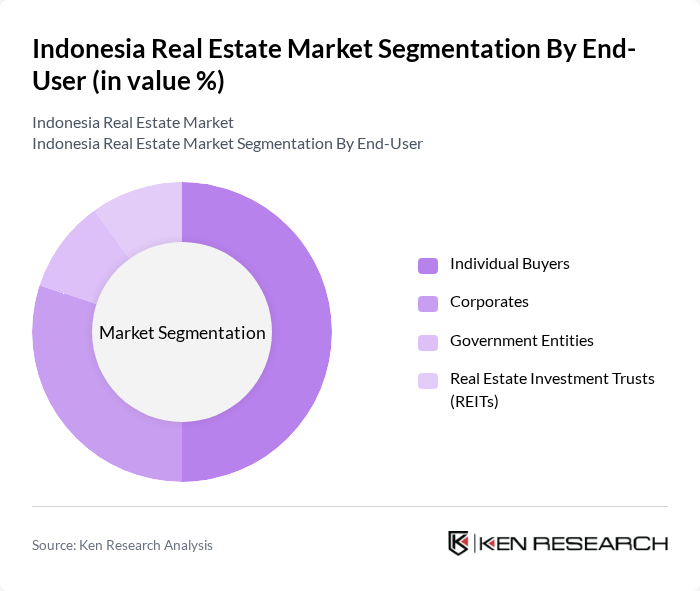

By End-User:The end-user segmentation includes Individual Buyers, Corporates, Government Entities, and Real Estate Investment Trusts (REITs). Individual Buyers dominate the market, driven by the growing middle class and increasing access to financing options. Corporates and REITs also play a significant role, particularly in the commercial and industrial segments, as businesses seek to expand their operations.

The Indonesia Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agung Podomoro Land, Ciputra Development, Summarecon Agung, Bumi Serpong Damai, Pakuwon Jati contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesian real estate market is poised for significant transformation driven by urbanization, rising middle-class affluence, and government infrastructure initiatives. As cities expand and infrastructure improves, demand for residential and commercial properties will likely increase. Additionally, the market is expected to embrace innovative technologies and sustainable practices, aligning with global trends. However, addressing regulatory challenges and economic volatility will be crucial for maintaining investor confidence and ensuring long-term growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Commercial Industrial Mixed-Use Developments Retail Hospitality Others |

| By End-User | Individual Buyers Corporates Government Entities Real Estate Investment Trusts (REITs) |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Residential Development Commercial Leasing Property Management Real Estate Brokerage |

| By Price Range | Low-End Properties Mid-Range Properties Luxury Properties |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time Homebuyers, Investors |

| Commercial Real Estate Investors | 100 | Real Estate Fund Managers, Corporate Buyers |

| Property Management Firms | 80 | Property Managers, Asset Managers |

| Real Estate Agents and Brokers | 120 | Real Estate Agents, Sales Directors |

| Urban Development Planners | 70 | Urban Planners, Government Officials |

The Indonesia Real Estate Market is valued at approximately USD 60 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and government initiatives aimed at enhancing housing development and infrastructure projects.