Region:Middle East

Author(s):Shubham

Product Code:KRAD3058

Pages:98

Published On:January 2026

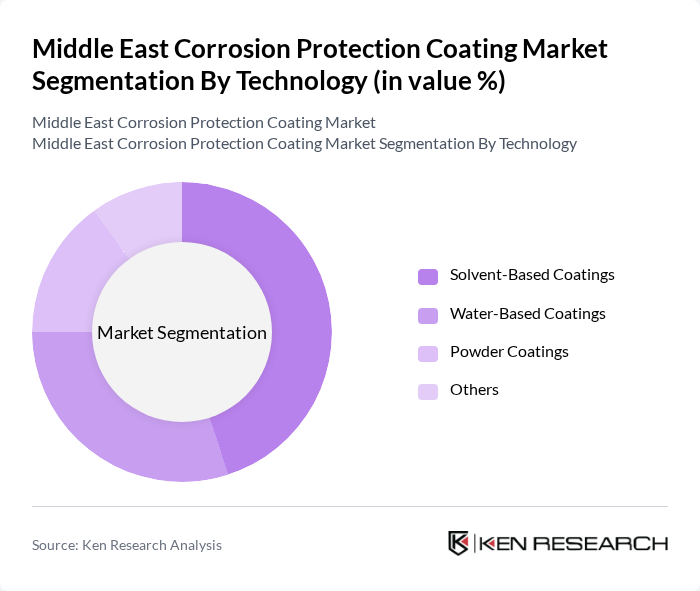

By Technology:

The technology segment includes solvent-based coatings, water-based coatings, powder coatings, and others. Among these, solvent-based coatings are currently dominating the market due to their superior performance in harsh environments and their widespread use in industrial applications. The high durability and resistance to extreme temperatures make them a preferred choice for sectors like oil and gas and marine. Water-based coatings are gaining traction due to their eco-friendliness and lower VOC emissions, appealing to industries focused on sustainability. However, solvent-based coatings remain the leading technology due to their established performance and reliability.

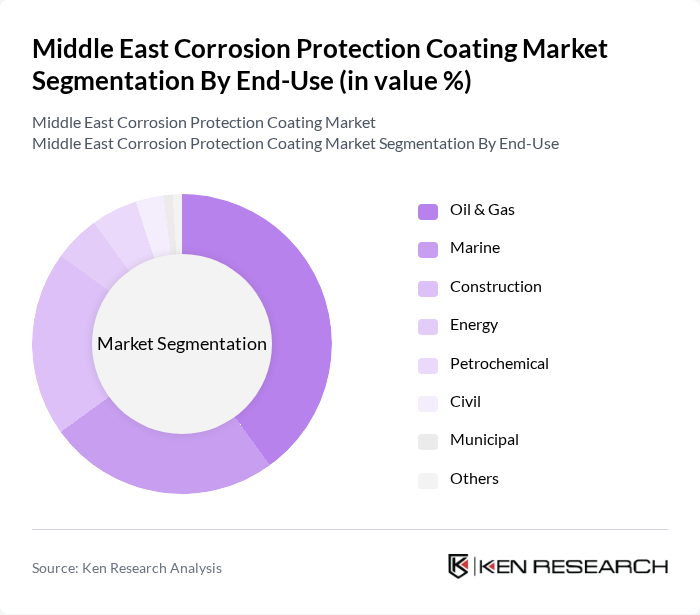

By End-Use:

The end-use segment encompasses oil and gas, marine, construction, energy, petrochemical, civil, municipal, and others. The oil and gas sector is the leading end-user of corrosion protection coatings, driven by the need for robust protection against harsh environmental conditions and corrosive substances. The marine industry also significantly contributes to market demand due to the exposure of vessels to seawater and other corrosive elements. Construction is witnessing increased adoption of protective coatings as infrastructure projects expand across the region, further bolstering the market.

The Middle East Corrosion Protection Coating Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jotun Group, PPG Industries, AkzoNobel, Sherwin-Williams, Hempel A/S, BASF SE, RPM International Inc., Carboline Company, Tnemec Company, Inc., DuPont, International Paints, Sika AG, Henkel AG & Co. KGaA, Valspar Corporation, Covestro AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East corrosion protection coating market appears promising, driven by increasing investments in infrastructure and a growing emphasis on sustainability. As industries adopt eco-friendly coatings and advanced technologies, the market is expected to evolve significantly. Additionally, the integration of smart coatings and digital technologies will enhance performance and monitoring capabilities, aligning with global trends towards innovation and efficiency in protective solutions.

| Segment | Sub-Segments |

|---|---|

| By Technology | Solvent-Based Coatings Water-Based Coatings Powder Coatings Others |

| By End-Use | Oil & Gas Marine Construction Energy Petrochemical Civil Municipal Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Kuwait, Qatar, Oman, Bahrain) Levant Region North Africa (Morocco, Nigeria, South Africa) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Coating Applications | 100 | Project Managers, Site Engineers |

| Oil & Gas Industry Corrosion Management | 80 | Maintenance Supervisors, Safety Officers |

| Marine Coating Solutions | 70 | Marine Engineers, Fleet Managers |

| Industrial Facility Maintenance | 90 | Facility Managers, Operations Directors |

| Research & Development in Coating Technologies | 60 | R&D Managers, Product Development Engineers |

The Middle East Corrosion Protection Coating Market is valued at approximately USD 3 billion, driven by increasing demand for protective coatings across various industries, particularly oil and gas, marine, and construction sectors, where corrosion resistance is essential for asset longevity and safety.