Middle East Critical Illness Insurance Market Overview

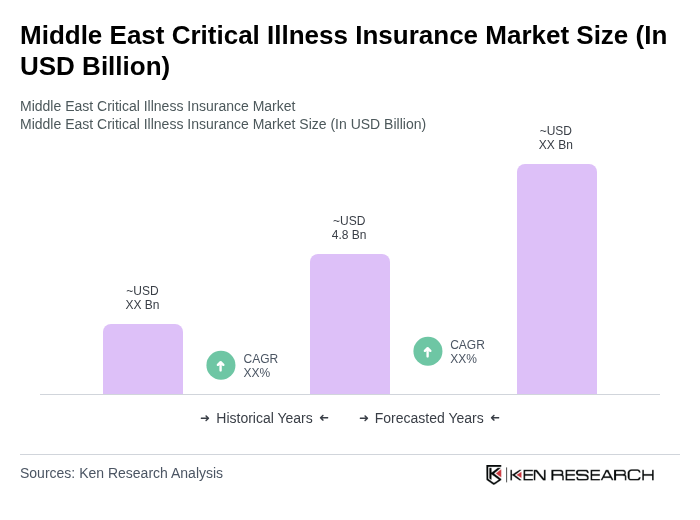

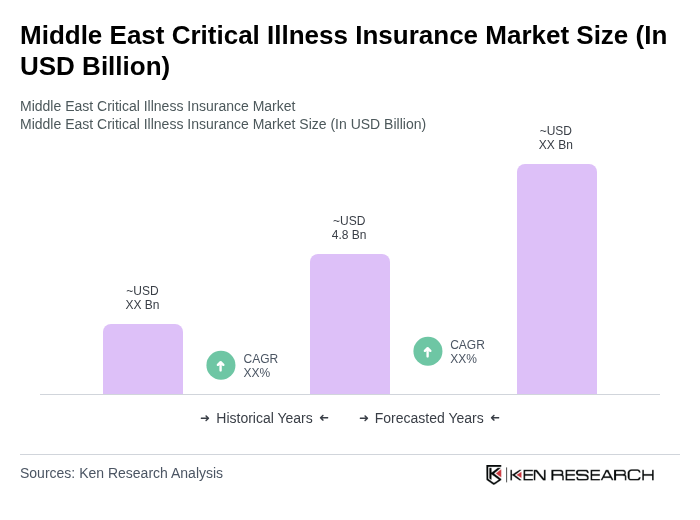

- The Middle East Critical Illness Insurance Market is valued at USD 4.8 billion, based on a five-year historical analysis. This growth is primarily driven by increasing healthcare costs, rising awareness of critical illnesses, a growing middle-class population seeking financial protection against health-related risks, and surging prevalence of chronic conditions like diabetes and cancer.

- Countries such as the United Arab Emirates, Saudi Arabia, and Qatar dominate the market due to their robust healthcare infrastructure, high disposable incomes, and government initiatives promoting health insurance coverage. These nations have also seen a surge in lifestyle-related diseases, further driving the demand for critical illness insurance.

- The UAE Cabinet Resolution No. 41 of 2013, issued by the UAE Cabinet of Ministers, mandates health insurance coverage for all residents in Dubai and Abu Dhabi emirates, extending to private sector employees nationwide, with compliance requiring employers to provide policies meeting minimum benefit thresholds for inpatient and outpatient care including critical conditions. This regulation aims to enhance public health and ensure that individuals are financially protected against severe health conditions, thereby increasing the uptake of critical illness insurance products.

Middle East Critical Illness Insurance Market Segmentation

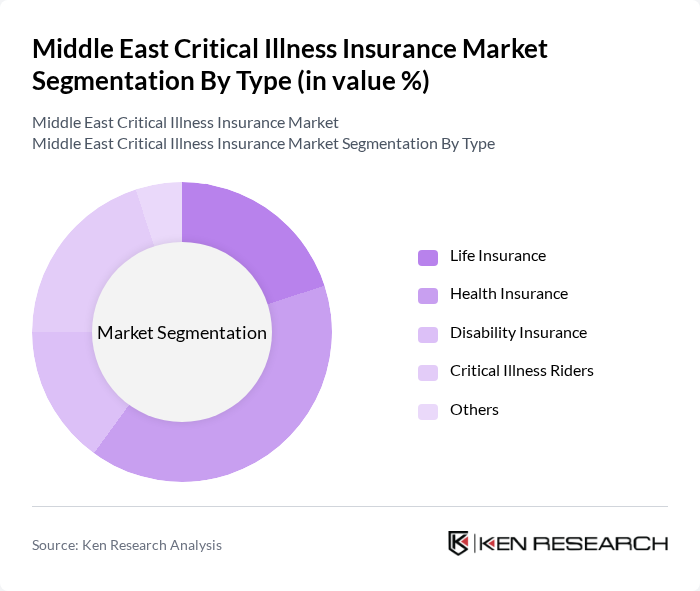

By Type:

The critical illness insurance market is segmented into various types, including Life Insurance, Health Insurance, Disability Insurance, Critical Illness Riders, and Others. Among these, Health Insurance is the leading sub-segment, driven by the increasing prevalence of chronic diseases and the rising costs of medical treatments. Consumers are increasingly opting for comprehensive health insurance plans that cover critical illnesses, reflecting a shift towards proactive health management. The demand for Critical Illness Riders is also growing, as policyholders seek additional coverage for specific health risks, enhancing the overall market dynamics.

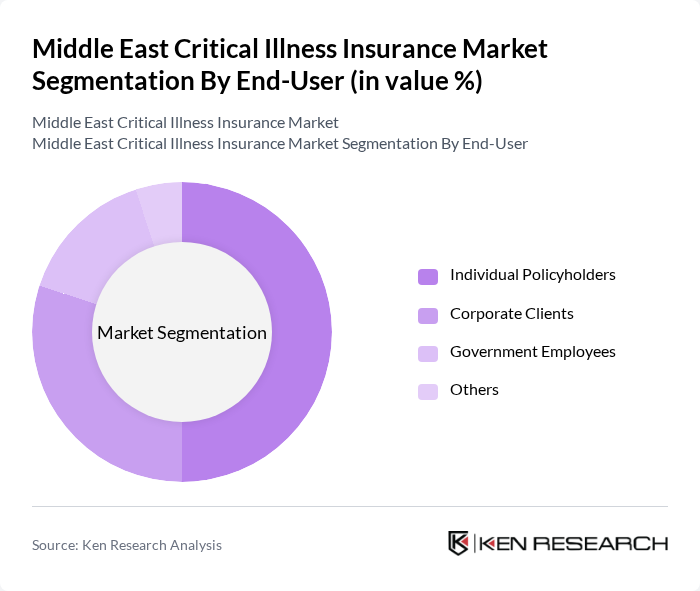

By End-User:

The market is segmented by end-users, including Individual Policyholders, Corporate Clients, Government Employees, and Others. Individual Policyholders dominate the market, as there is a growing trend among individuals to secure their health and financial future through personal insurance plans. Corporate Clients are also significant contributors, as companies increasingly offer health benefits to employees, including critical illness coverage. The rising awareness of health risks and the need for financial security are driving the demand across all end-user segments.

Middle East Critical Illness Insurance Market Competitive Landscape

The Middle East Critical Illness Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz, AXA, MetLife, Prudential, AIG, Zurich Insurance Group, Aviva, Dubai Insurance Company, Qatar Insurance Company, Abu Dhabi National Insurance Company, Oman Insurance Company, Saudi Arabian Insurance Company, Bahrain National Holding, Emirates Insurance Company, National General Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Critical Illness Insurance Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The Middle East is witnessing a significant rise in chronic diseases, with the World Health Organization reporting that non-communicable diseases account for 73% of total deaths in the region. In future, an estimated 24 million people in the Middle East will be living with diabetes, a key driver for critical illness insurance. This growing health burden is prompting individuals to seek financial protection against high medical costs associated with chronic conditions.

- Rising Healthcare Costs:Healthcare expenditure in the Middle East is projected to reach $250 billion in future, driven by advancements in medical technology and increased demand for healthcare services. As treatment costs escalate, individuals are increasingly recognizing the importance of critical illness insurance to mitigate financial risks. The average cost of treating a critical illness can exceed $60,000, making insurance a vital financial tool for many families facing potential health crises.

- Growing Awareness of Critical Illness Insurance:Awareness campaigns and educational initiatives have significantly increased consumer knowledge about critical illness insurance in the Middle East. In future, it is estimated that 70% of the population will be aware of such insurance products, up from 40% in 2020. This heightened awareness is leading to increased policy uptake, as individuals seek to secure their financial futures against unforeseen health challenges, thereby driving market growth.

Market Challenges

- Limited Consumer Understanding of Policies:Despite growing awareness, many consumers in the Middle East still struggle to understand the complexities of critical illness insurance policies. A survey by the Insurance Authority found that 70% of respondents could not accurately explain their policy terms. This lack of understanding can lead to mistrust and reluctance to purchase insurance, hindering market growth and limiting the potential customer base.

- Regulatory Hurdles:The insurance sector in the Middle East faces significant regulatory challenges, with varying regulations across countries. In future, the region will see over 20 different regulatory frameworks governing insurance products. These inconsistencies can create barriers for insurers looking to expand their offerings, complicating compliance and increasing operational costs, which may deter new entrants and stifle market growth.

Middle East Critical Illness Insurance Market Future Outlook

The future of the Middle East critical illness insurance market appears promising, driven by increasing healthcare costs and a growing prevalence of chronic diseases. As consumers become more health-conscious, the demand for tailored insurance products is expected to rise. Additionally, advancements in technology, such as telemedicine and AI, will enhance service delivery and customer engagement, making insurance more accessible and appealing. Insurers that adapt to these trends will likely capture a larger market share in future.

Market Opportunities

- Development of Innovative Insurance Products:There is a significant opportunity for insurers to develop innovative products that cater to the unique needs of the Middle Eastern population. For instance, products that combine critical illness coverage with wellness programs can attract health-conscious consumers, potentially increasing policy sales by 35% in future.

- Partnerships with Healthcare Providers:Collaborating with healthcare providers can enhance the value proposition of critical illness insurance. By offering integrated services, insurers can improve customer experience and retention. Such partnerships could lead to a 30% increase in policy renewals in future, as customers appreciate the added benefits of seamless healthcare access alongside their insurance coverage.