Region:Africa

Author(s):Geetanshi

Product Code:KRAB6307

Pages:83

Published On:October 2025

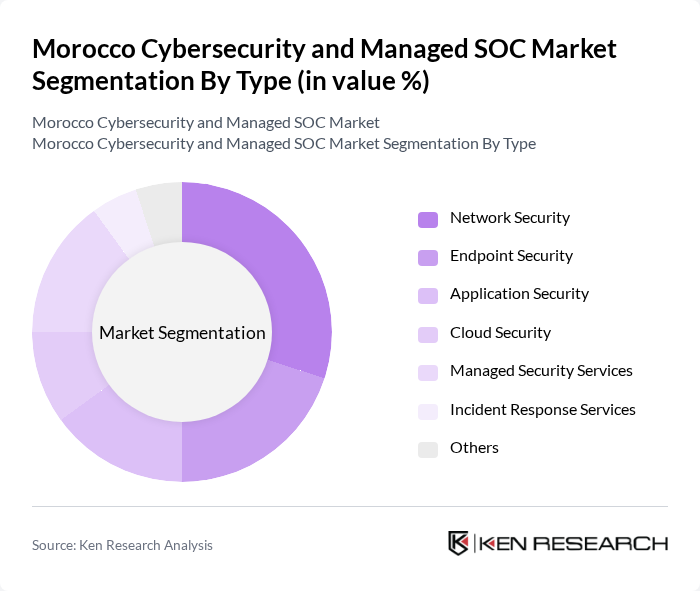

By Type:The market is segmented into various types, including Network Security, Endpoint Security, Application Security, Cloud Security, Managed Security Services, Incident Response Services, and Others. Each of these segments plays a crucial role in addressing specific cybersecurity needs, with Network Security and Managed Security Services being particularly prominent due to the increasing complexity of cyber threats and the need for comprehensive security solutions.

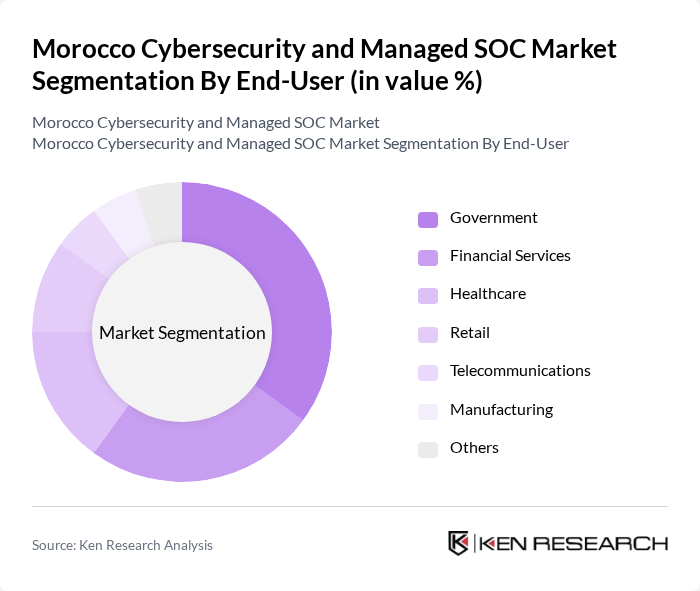

By End-User:The end-user segmentation includes Government, Financial Services, Healthcare, Retail, Telecommunications, Manufacturing, and Others. The Government and Financial Services sectors are leading the demand for cybersecurity solutions due to stringent regulatory requirements and the critical nature of their operations, which necessitate robust security measures to protect sensitive data.

The Morocco Cybersecurity and Managed SOC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Orange CyberDefense, Atos, IBM Security, Cisco Systems, Fortinet, Check Point Software Technologies, Trend Micro, Kaspersky Lab, CyberArk Software, Palo Alto Networks, McAfee, FireEye, RSA Security, Secureworks, Sumo Logic contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Moroccan cybersecurity and managed SOC market appears promising, driven by increasing government support and a growing awareness of cyber threats. As organizations continue to digitize their operations, the demand for advanced cybersecurity solutions will likely rise. Furthermore, the integration of AI and machine learning technologies into cybersecurity practices is expected to enhance threat detection and response capabilities, positioning Morocco as a regional leader in cybersecurity innovation and resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Managed Security Services Incident Response Services Others |

| By End-User | Government Financial Services Healthcare Retail Telecommunications Manufacturing Others |

| By Industry Vertical | BFSI Energy and Utilities Education Transportation Government Others |

| By Service Type | Consulting Services Implementation Services Managed Services Support and Maintenance Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Region | Casablanca-Settat Rabat-Salé-Kénitra Marrakesh-Safi Fès-Meknès Tanger-Tétouan-Al Hoceima Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cybersecurity | 100 | CIOs, IT Security Managers |

| Healthcare Sector Managed SOC | 80 | Compliance Officers, IT Directors |

| Government Cybersecurity Initiatives | 70 | Policy Makers, Cybersecurity Analysts |

| Telecommunications Security Solutions | 90 | Network Security Engineers, Operations Managers |

| Retail Sector Cyber Risk Management | 60 | Risk Managers, IT Administrators |

The Morocco Cybersecurity and Managed SOC Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing cyber threats, digital transformation initiatives, and heightened awareness of data protection regulations among businesses.