Philippines Online Pharmacy and Health Delivery Market Overview

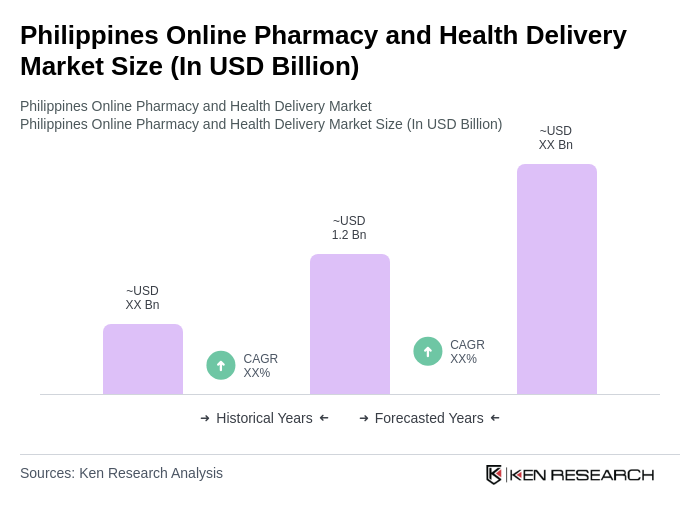

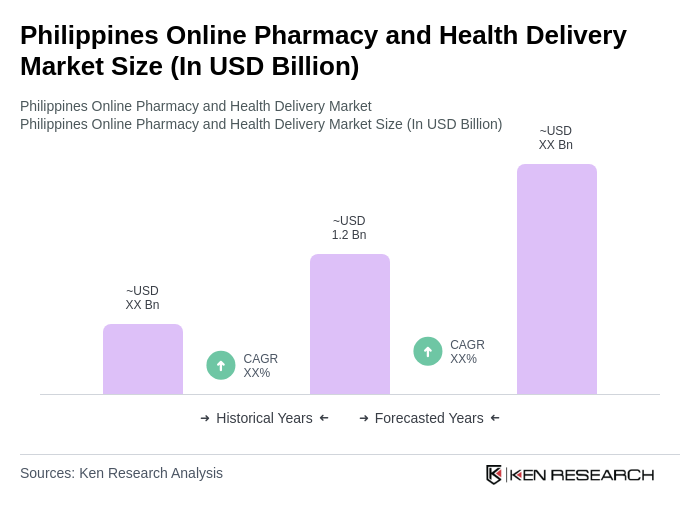

- The Philippines Online Pharmacy and Health Delivery Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital health solutions, rising consumer demand for convenience, and the expansion of e-commerce platforms. The market has seen a significant uptick in online transactions, particularly during the pandemic, as consumers sought safer alternatives for purchasing medications and health products.

- Metro Manila, Cebu, and Davao are the dominant regions in the Philippines Online Pharmacy and Health Delivery Market. Metro Manila leads due to its high population density, advanced infrastructure, and greater access to technology. Cebu and Davao follow closely, benefiting from growing urbanization and increasing internet penetration, which facilitate the adoption of online health services.

- In 2023, the Philippines government implemented the "E-Pharmacy Law," which regulates online pharmacies to ensure the safety and efficacy of medications sold online. This law mandates that all online pharmacies must be licensed and comply with strict guidelines regarding the sale of prescription and over-the-counter medications, aiming to protect consumers and enhance the integrity of the online health delivery system.

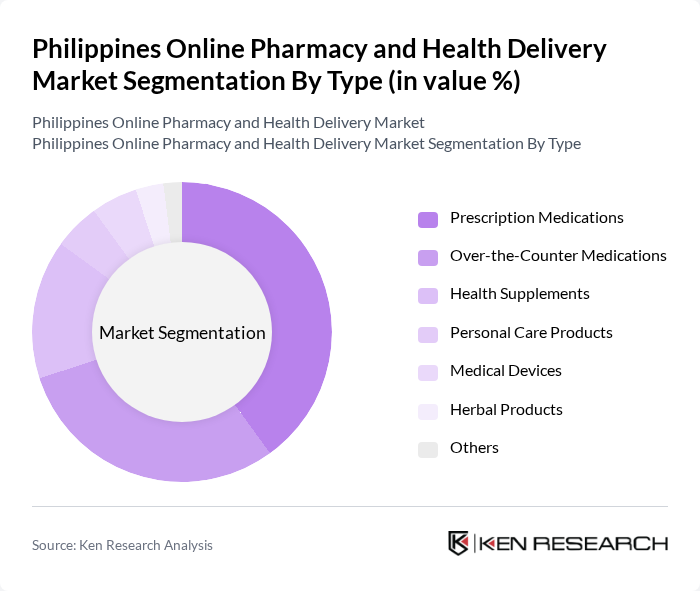

Philippines Online Pharmacy and Health Delivery Market Segmentation

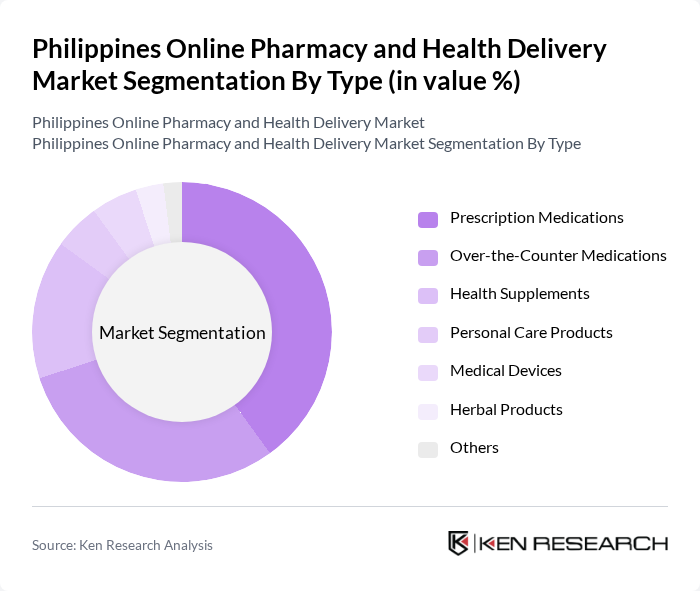

By Type:The market is segmented into various types, including Prescription Medications, Over-the-Counter Medications, Health Supplements, Personal Care Products, Medical Devices, Herbal Products, and Others. Among these, Prescription Medications and Over-the-Counter Medications are the most significant segments, driven by the increasing prevalence of chronic diseases and the growing awareness of health and wellness among consumers. The demand for Health Supplements and Personal Care Products is also rising, reflecting a shift towards preventive healthcare and self-care.

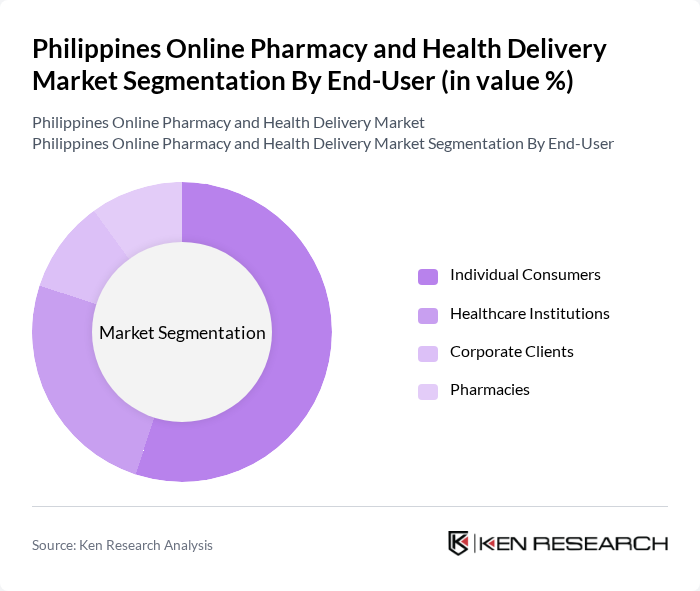

By End-User:The market is segmented by end-users into Individual Consumers, Healthcare Institutions, Corporate Clients, and Pharmacies. Individual Consumers dominate the market, driven by the increasing trend of self-medication and the convenience of online shopping. Healthcare Institutions and Pharmacies also play a significant role, as they increasingly rely on online platforms for procurement and supply chain efficiency. Corporate Clients are emerging as a growing segment, particularly in providing health benefits to employees.

Philippines Online Pharmacy and Health Delivery Market Competitive Landscape

The Philippines Online Pharmacy and Health Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Watsons Philippines, Mercury Drug Corporation, Generika Drugstore, Southstar Drug, Rose Pharmacy, MedGrocer, HealthNow, MyRx, Alagang Kapatid, Drugstore.ph, ePharmacy, PhilCare, AIDE, MedExpress, GrabHealth contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Online Pharmacy and Health Delivery Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:The Philippines has seen a significant rise in internet users, reaching approximately 82 million in the future, representing a penetration rate of about 75%. This growth facilitates access to online pharmacies, enabling consumers to order medications conveniently. The World Bank reports that the country's internet infrastructure is improving, with investments of over $1 billion in broadband expansion, further supporting the online health delivery market's growth.

- Rising Health Awareness:Health awareness in the Philippines has surged, with 65% of the population actively seeking health information online. The Department of Health reported a 30% increase in health-related searches from 2022 to the future. This trend is driving demand for online pharmacies, as consumers prefer platforms that provide easy access to medications and health products, reflecting a shift towards proactive health management and preventive care.

- Convenience of Home Delivery:The convenience of home delivery services is a major growth driver, with 70% of consumers preferring online shopping for health products. A survey by the Philippine E-commerce Association indicated that 60% of respondents would choose online pharmacies for their ability to deliver medications directly to homes. This trend is supported by the increasing number of logistics companies partnering with online pharmacies, enhancing delivery efficiency and customer satisfaction.

Market Challenges

- Regulatory Compliance Issues:Online pharmacies in the Philippines face stringent regulatory compliance challenges, with the Food and Drug Administration (FDA) enforcing strict licensing requirements. As of the future, only 40% of online pharmacies are fully compliant with these regulations, leading to potential legal repercussions and operational limitations. This lack of compliance can hinder market growth and consumer trust, as regulations are crucial for ensuring safety and quality in pharmaceutical services.

- Logistics and Delivery Constraints:Logistics remains a significant challenge for online pharmacies, particularly in rural areas where infrastructure is underdeveloped. The Philippine Statistics Authority reported that 30% of rural households lack reliable access to delivery services. This limitation affects the timely delivery of medications, leading to customer dissatisfaction and potential health risks. Addressing these logistical issues is essential for the sustainable growth of the online pharmacy sector.

Philippines Online Pharmacy and Health Delivery Market Future Outlook

The future of the Philippines online pharmacy and health delivery market appears promising, driven by technological advancements and changing consumer behaviors. As telemedicine continues to gain traction, more patients are likely to seek online consultations, leading to increased demand for online pharmacies. Additionally, the integration of artificial intelligence in customer service is expected to enhance user experience, making online health services more accessible and efficient, thereby fostering market growth in the coming years.

Market Opportunities

- Growth of Telemedicine:The rise of telemedicine presents a significant opportunity for online pharmacies, with an estimated 50% increase in telehealth consultations expected in the future. This trend allows pharmacies to collaborate with healthcare providers, offering integrated services that enhance patient care and medication adherence, ultimately driving sales and customer loyalty.

- Development of Mobile Applications:The development of user-friendly mobile applications can significantly enhance customer engagement. With over 70% of Filipinos using smartphones, mobile apps can streamline the ordering process, provide personalized health recommendations, and facilitate better communication between patients and pharmacists, thus expanding the market reach and improving service delivery.