Region:Middle East

Author(s):Rebecca

Product Code:KRAE3006

Pages:100

Published On:February 2026

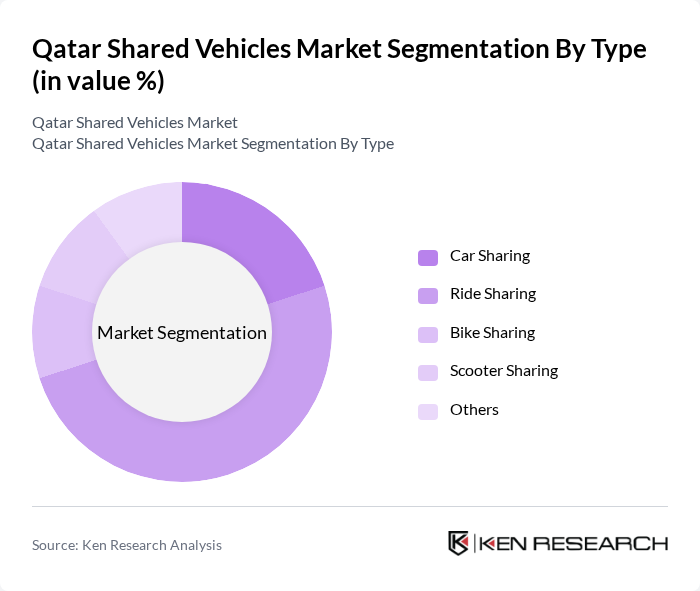

By Type:The segmentation of the market by type includes various modes of shared vehicles, such as car sharing, ride sharing, bike sharing, scooter sharing, and others. Among these, ride sharing has emerged as the leading sub-segment due to its convenience and flexibility, appealing to a wide range of users from daily commuters to tourists. The increasing penetration of smartphone applications has further facilitated the growth of ride-sharing services, making them a preferred choice for many.

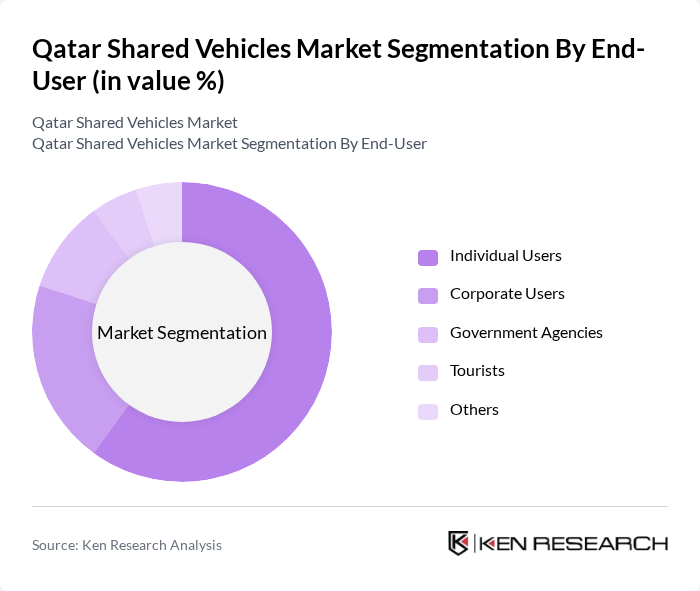

By End-User:The end-user segmentation includes individual users, corporate users, government agencies, tourists, and others. Individual users dominate this segment, driven by the growing trend of urban mobility solutions that cater to personal transportation needs. The convenience and cost-effectiveness of shared vehicles appeal to a broad demographic, including students and working professionals, making individual users the largest group in the market.

The Qatar Shared Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Careem, Uber, QCar, Qatar Mobility Innovations Center (QMIC), Ooredoo, Qatar National Bank (QNB), Doha Bus, Qatari Diar, Mowasalat, Qatari Car Rentals, Al-Futtaim Group, Al-Mana Group, Qatar Rail, Qatar Airways, Qatar Tourism Authority contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar shared vehicles market appears promising, driven by increasing urbanization and a strong push for sustainable transportation solutions. As the government invests in infrastructure and regulatory frameworks evolve, shared mobility services are likely to gain traction. The integration of technology, such as mobile applications and smart mobility solutions, will enhance user experience and accessibility, fostering greater acceptance among consumers. Overall, the market is poised for significant growth as it adapts to changing consumer preferences and environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Car Sharing Ride Sharing Bike Sharing Scooter Sharing Others |

| By End-User | Individual Users Corporate Users Government Agencies Tourists Others |

| By Vehicle Type | Electric Vehicles Hybrid Vehicles Conventional Vehicles Luxury Vehicles Others |

| By Service Model | Peer-to-Peer Sharing Fleet Operators Corporate Car Sharing Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Duration of Use | Short-Term Rentals Long-Term Rentals Subscription Services Others |

| By Payment Model | Pay-Per-Use Subscription-Based Membership Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ride-sharing User Insights | 150 | Frequent Users, Occasional Users |

| Car-sharing Service Feedback | 100 | Car-sharing Subscribers, Casual Users |

| Fleet Operator Perspectives | 80 | Fleet Managers, Business Development Executives |

| Urban Mobility Expert Opinions | 60 | Urban Planners, Transportation Policy Makers |

| Technology Provider Insights | 70 | Product Managers, Technical Leads |

The Qatar Shared Vehicles Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and a preference for shared mobility solutions among consumers, particularly in urban areas like Doha.