Region:Middle East

Author(s):Rebecca

Product Code:KRAC9742

Pages:100

Published On:November 2025

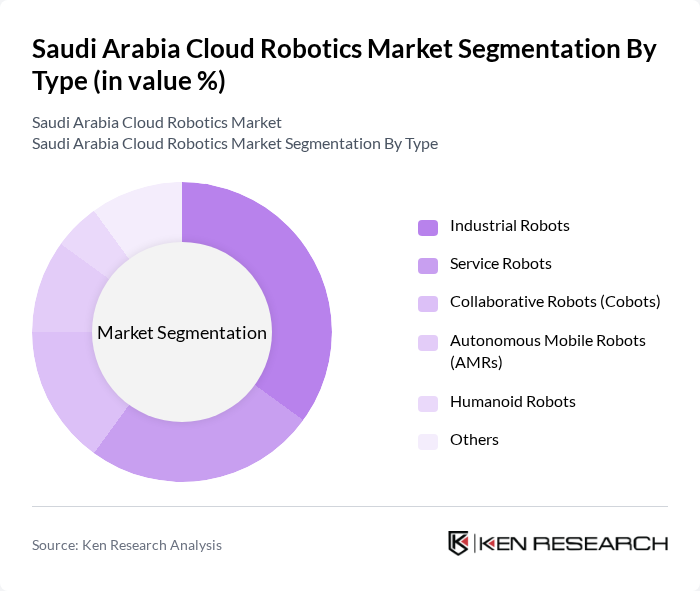

By Type:The market is segmented into Industrial Robots, Service Robots, Collaborative Robots (Cobots), Autonomous Mobile Robots (AMRs), Humanoid Robots, and Others. Industrial robots are primarily deployed in manufacturing and logistics for automation and precision tasks. Service robots are increasingly used in healthcare, hospitality, and facility management. Cobots support human workers in assembly and packaging. AMRs are adopted for warehouse automation and material handling, while humanoid robots are emerging in education and customer service.

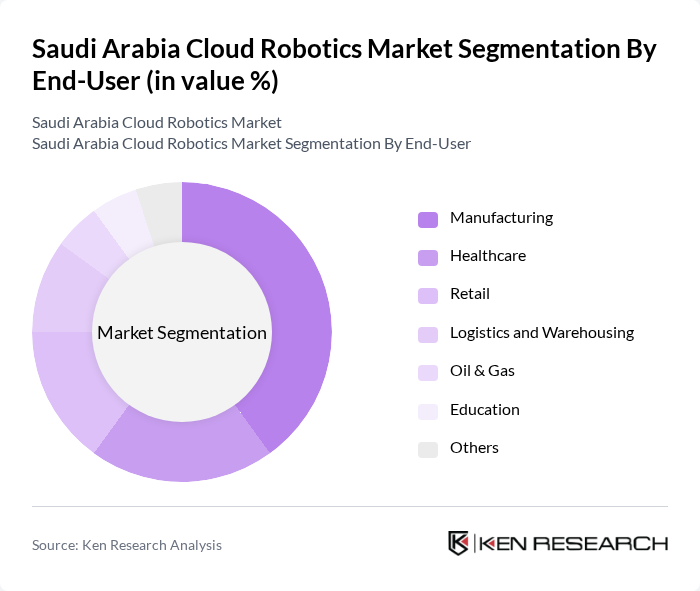

By End-User:The end-user segmentation includes Manufacturing, Healthcare, Retail, Logistics and Warehousing, Oil & Gas, Education, and Others. Manufacturing leads adoption due to automation initiatives in automotive, electronics, and metals sectors. Healthcare utilizes cloud robotics for surgical assistance, patient care, and logistics. Retail and logistics sectors deploy robotics for inventory management and last-mile delivery. Oil & Gas and Education are emerging adopters, focusing on safety, training, and operational efficiency.

The Saudi Arabia Cloud Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Robotics, KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Universal Robots, Boston Dynamics, Intuitive Surgical, SoftBank Robotics, Clearpath Robotics, Cyberdyne Inc., Omron Adept Technologies, Denso Robotics, Rethink Robotics, AUBO Robotics, PAL Robotics, Siemens AG, SABB Tech (Saudi Advanced Robotics Company), GMT Robotics, Huawei Technologies Co., Ltd., Microsoft Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud robotics market in Saudi Arabia appears promising, driven by technological advancements and increasing government support. As industries continue to embrace automation, the integration of IoT with robotics is expected to enhance operational efficiencies significantly. Furthermore, the shift towards subscription-based models will likely democratize access to cloud robotics, enabling more businesses to leverage these technologies. The focus on sustainability will also drive innovation, as companies seek energy-efficient solutions to meet regulatory requirements and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Robots Service Robots Collaborative Robots (Cobots) Autonomous Mobile Robots (AMRs) Humanoid Robots Others |

| By End-User | Manufacturing Healthcare Retail Logistics and Warehousing Oil & Gas Education Others |

| By Industry Vertical | Automotive Electronics Food and Beverage Aerospace & Defense Chemicals & Pharmaceuticals Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Community Cloud Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Application | Manufacturing Automation Supply Chain & Inventory Management Healthcare Services & Surgery Assistance Customer Service & Hospitality Security & Surveillance Education & Training Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships Foreign Direct Investment (FDI) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Automation | 100 | Plant Managers, Automation Engineers |

| Logistics and Supply Chain | 80 | Logistics Coordinators, Supply Chain Analysts |

| Healthcare Robotics | 70 | Healthcare Administrators, IT Managers |

| Retail Automation Solutions | 50 | Retail Operations Managers, Technology Managers |

| Research and Development in Robotics | 40 | R&D Directors, Robotics Researchers |

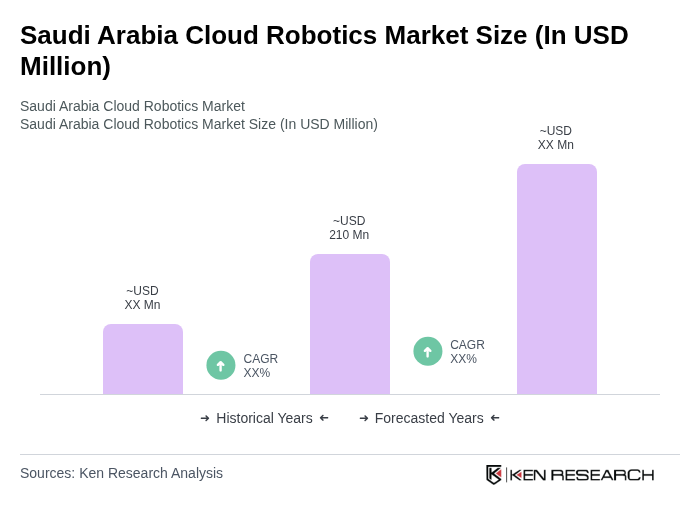

The Saudi Arabia Cloud Robotics Market is valued at approximately USD 210 million, driven by advancements in artificial intelligence and increased automation across various sectors, including manufacturing, logistics, and healthcare.