Region:Middle East

Author(s):Dev

Product Code:KRAC3399

Pages:97

Published On:October 2025

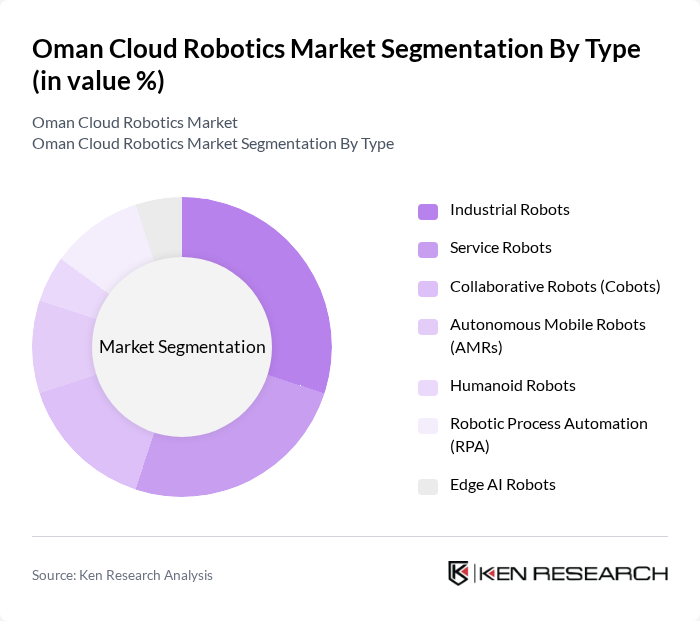

By Type:The market is segmented into Industrial Robots, Service Robots, Collaborative Robots (Cobots), Autonomous Mobile Robots (AMRs), Humanoid Robots, Robotic Process Automation (RPA), and Edge AI Robots. These categories address diverse industry needs: industrial robots are widely used in manufacturing and logistics for repetitive tasks; service robots support healthcare, hospitality, and retail; cobots enable safe human-robot collaboration in flexible production environments; AMRs automate material handling in warehouses; humanoid robots are emerging in education and customer service; RPA automates digital workflows in business processes; and Edge AI Robots provide real-time, decentralized decision-making for critical applications .

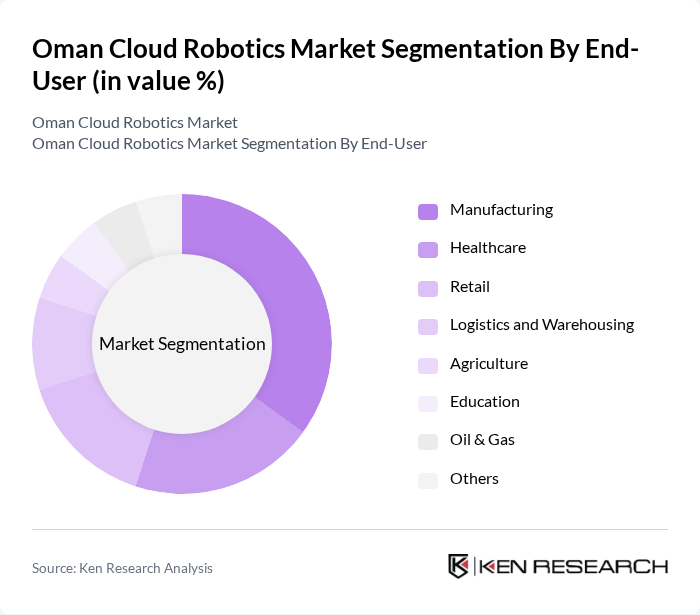

By End-User:The end-user segmentation includes Manufacturing, Healthcare, Retail, Logistics and Warehousing, Agriculture, Education, Oil & Gas, and Others. Manufacturing leads due to strong demand for automation in production and assembly lines. Healthcare is a major adopter, leveraging robotics for surgery, diagnostics, and patient care. Retail uses robots for inventory management and customer service, while logistics and warehousing deploy robotics for order fulfillment and material handling. Agriculture, education, and oil & gas are emerging segments, increasingly utilizing robotics for precision tasks, training, and remote operations .

The Oman Cloud Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Universal Robots A/S, SoftBank Robotics Group Corp., Boston Dynamics, Inc., iRobot Corporation, DJI Technology Co., Ltd., Clearpath Robotics Inc., Omron Corporation, Siemens AG, Amazon Web Services (AWS), Microsoft Corporation, Google LLC, IBM Corporation, NVIDIA Corporation, Ooredoo Oman, Oman Data Park, and Gulf Business Machines (GBM Oman) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cloud robotics market in Oman appears promising, driven by technological advancements and increasing government support. As the nation continues to invest in digital transformation, the integration of cloud robotics into various sectors is expected to accelerate. Moreover, the focus on developing smart cities will further enhance the demand for innovative robotic solutions, creating a conducive environment for growth. Collaborative efforts between public and private sectors will also play a crucial role in overcoming existing challenges and fostering a robust ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Robots Service Robots Collaborative Robots (Cobots) Autonomous Mobile Robots (AMRs) Humanoid Robots Robotic Process Automation (RPA) Edge AI Robots |

| By End-User | Manufacturing Healthcare Retail Logistics and Warehousing Agriculture Education Oil & Gas Others |

| By Application | Assembly and Packaging Inspection and Quality Control Material Handling Cleaning and Maintenance Delivery and Transportation Remote Monitoring & Teleoperation Others |

| By Component | Hardware (Sensors, Actuators, Controllers) Software (Cloud Platforms, AI/ML Algorithms) Services (Integration, Maintenance, Robotics-as-a-Service) |

| By Sales Channel | Direct Sales Distributors Online Sales System Integrators Others |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Automation | 100 | Production Managers, Automation Engineers |

| Healthcare Robotics Applications | 60 | Healthcare IT Managers, Robotics Specialists |

| Logistics and Supply Chain Robotics | 50 | Logistics Coordinators, Supply Chain Analysts |

| Retail Sector Cloud Robotics | 40 | Retail Operations Managers, IT Managers |

| Research and Development in Robotics | 45 | R&D Managers, Innovation Officers |

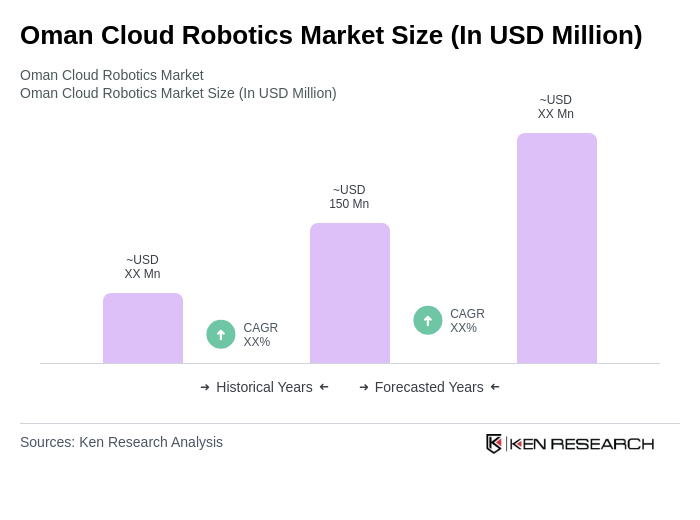

The Oman Cloud Robotics Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This growth is driven by the increasing adoption of automation technologies across various sectors, including manufacturing, logistics, and healthcare.