Region:Middle East

Author(s):Shubham

Product Code:KRAA3633

Pages:94

Published On:September 2025

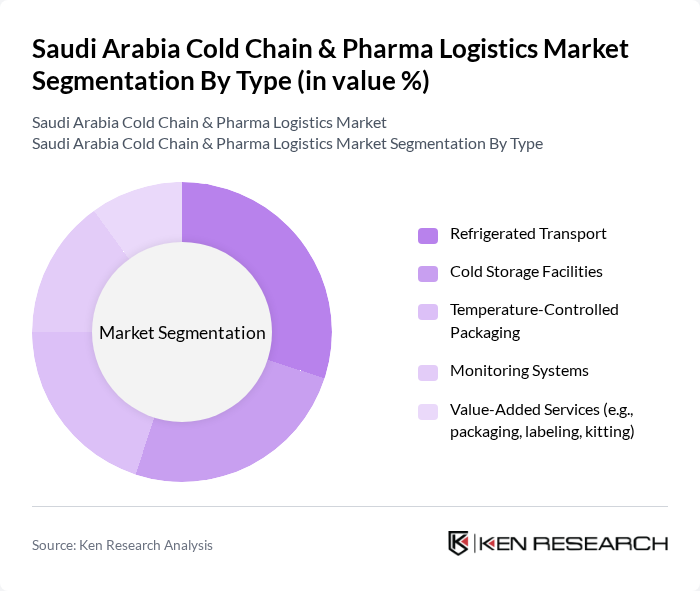

By Type:The market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring Systems, and Value-Added Services. Each of these segments plays a crucial role in maintaining the integrity of temperature-sensitive products throughout the supply chain .

The Refrigerated Transport segment is currently leading the market due to the rising demand for efficient and reliable transportation of temperature-sensitive goods. This segment benefits from advancements in logistics technology, such as real-time tracking and temperature monitoring systems, ensuring compliance with stringent temperature regulations. The increasing focus on the pharmaceutical sector, particularly for vaccines, biologics, and specialty drugs, further drives the need for specialized refrigerated transport solutions .

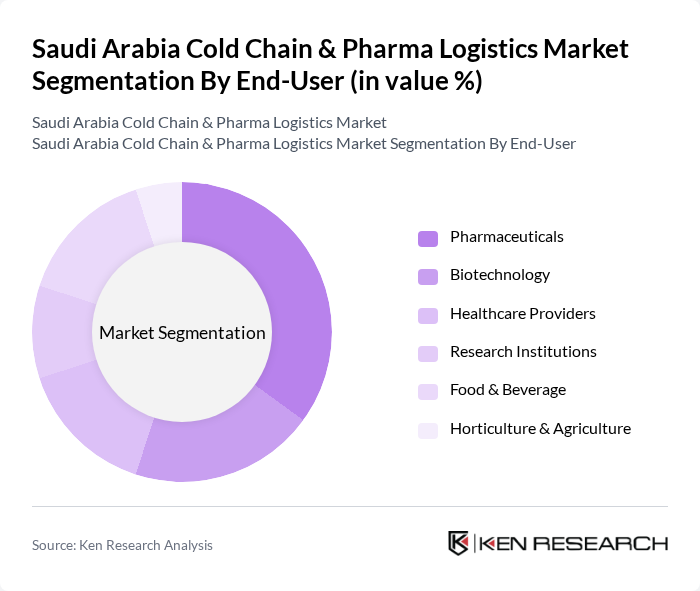

By End-User:The market is segmented by end-users, including Pharmaceuticals, Biotechnology, Healthcare Providers, Research Institutions, Food & Beverage, and Horticulture & Agriculture. Each end-user category has unique requirements for cold chain logistics, influencing the overall market dynamics .

The Pharmaceuticals segment is the dominant end-user in the market, driven by the increasing demand for temperature-sensitive medications, vaccines, and biologics. The stringent regulatory requirements for drug storage and transportation necessitate robust cold chain logistics solutions. Additionally, the growth of the biotechnology sector, which often involves sensitive biological products, contributes to the rising demand for specialized cold chain services .

The Saudi Arabia Cold Chain & Pharma Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coldstores Group of Saudi Arabia (CGS), Mosanada Logistics Services, Agility Public Warehousing Company K.S.C.P., NAQEL Express, Almajdouie Logistics, Takhzeen Logistics Company, Wared Logistics, Camels Party Logistics, United Warehouse Co Ltd., IFFCO Group, DHL Supply Chain, Kuehne + Nagel, CEVA Logistics, UPS Healthcare, FedEx Supply Chain contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain and pharma logistics market in Saudi Arabia appears promising, driven by technological advancements and increased investment in infrastructure. The integration of IoT and AI technologies is expected to enhance monitoring and efficiency, while government initiatives will likely continue to support logistics improvements. As the healthcare sector expands, the demand for reliable cold chain solutions will grow, presenting opportunities for innovation and partnerships within the industry, particularly in underserved regions.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring Systems Value-Added Services (e.g., packaging, labeling, kitting) |

| By End-User | Pharmaceuticals Biotechnology Healthcare Providers Research Institutions Food & Beverage Horticulture & Agriculture |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Wholesale/Distributor Networks |

| By Application | Vaccines Biologics Clinical Trials Blood & Plasma Products Diagnostics |

| By Sales Channel | Online Sales Offline Sales Distributors Direct to Hospitals/Pharmacies |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Public-Private Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 120 | Logistics Managers, Supply Chain Executives |

| Cold Chain Technology Providers | 80 | Product Managers, Technical Directors |

| Healthcare Facility Supply Chain | 60 | Procurement Officers, Operations Managers |

| Regulatory Compliance in Pharma Logistics | 50 | Compliance Officers, Quality Assurance Managers |

| Market Trends in Cold Chain Solutions | 70 | Market Analysts, Business Development Managers |

The Saudi Arabia Cold Chain & Pharma Logistics Market is valued at approximately USD 2.9 billion, driven by the increasing demand for temperature-sensitive products in the pharmaceutical and food sectors, as well as the expansion of e-commerce and healthcare services.