Region:Middle East

Author(s):Rebecca

Product Code:KRAA7059

Pages:83

Published On:January 2026

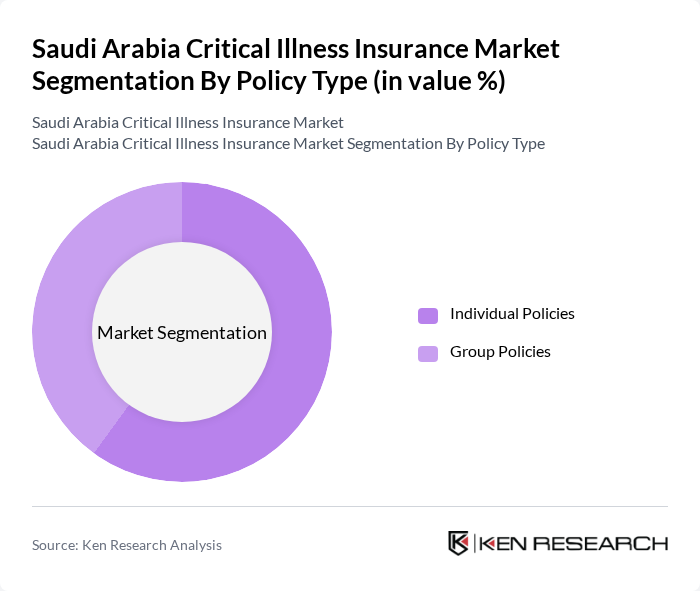

By Policy Type:

Individual policies dominate the market due to the increasing trend of personalized health coverage among consumers. Individuals are increasingly seeking tailored insurance solutions that cater to their specific health needs, particularly in urban areas where awareness of critical illnesses is rising. The flexibility and customization offered by individual policies appeal to a broad demographic, including young professionals and families. Group policies, while significant, are often seen as supplementary to individual coverage, particularly in corporate settings where employers provide basic health insurance.

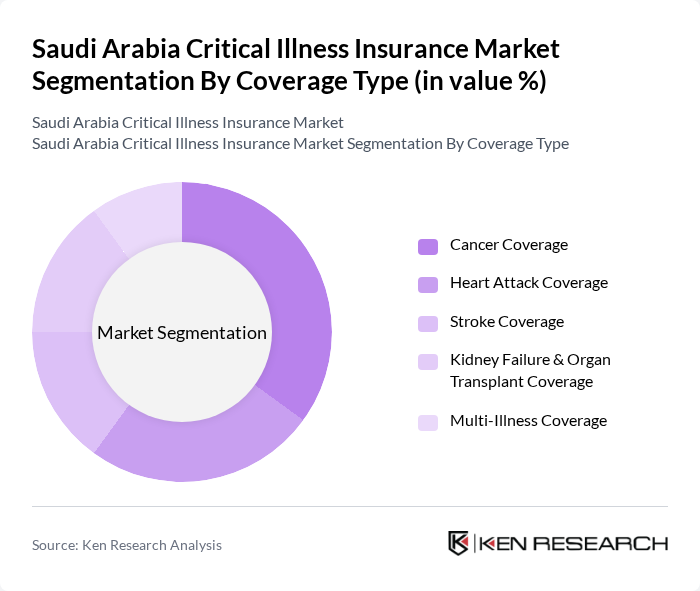

By Coverage Type:

Cancer coverage is the leading sub-segment, driven by the high prevalence of cancer in the region and increasing public awareness about the disease. The rising incidence of lifestyle-related diseases has led to a greater demand for comprehensive cancer insurance policies. Heart attack and stroke coverage also hold significant market shares, reflecting the growing concern over cardiovascular health. The multi-illness coverage segment is gaining traction as consumers seek broader protection against various health risks, although it currently represents a smaller portion of the market.

The Saudi Arabia Critical Illness Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya, Bupa Arabia, Allianz Saudi Fransi, Medgulf, Gulf Insurance Group, Al Rajhi Takaful, Alinma Tokio Marine, United Cooperative Assurance, Al-Ahlia Insurance, Al-Etihad Cooperative Insurance, Saudi Arabian Insurance Company (SAICO), Al Sagr Cooperative Insurance, Al-Bilad Insurance, Al-Jazira Takaful, Al-Mawared Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the critical illness insurance market in Saudi Arabia appears promising, driven by increasing health awareness and technological advancements. As the population ages and chronic diseases become more prevalent, demand for insurance products that offer comprehensive coverage will likely rise. Additionally, the integration of digital platforms for insurance services is expected to enhance accessibility and customer engagement, making it easier for consumers to understand and purchase critical illness insurance, thereby fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Policy Type | Individual Policies Group Policies |

| By Coverage Type | Cancer Coverage Heart Attack Coverage Stroke Coverage Kidney Failure & Organ Transplant Coverage Multi-Illness Coverage |

| By Distribution Channel | Bancassurance Insurance Brokers/Agents Direct Sales Online Platforms |

| By End-User | Individuals Corporates/Employers |

| By Care Setting (Long-Term Care Integration) | Home Healthcare/In-Home Care Assisted Living Facilities Nursing Homes/Skilled Nursing Facilities Hospice & Palliative Care |

| By Product Type | Traditional Critical Illness Insurance Hybrid Products (Life & Health with Critical Illness Riders) Short-Term Care Insurance Critical Illness & Disability Riders with LTC Benefits |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Policyholders | 120 | Current policyholders, potential buyers |

| Healthcare Professionals | 100 | Doctors, nurses, hospital administrators |

| Insurance Agents | 80 | Insurance brokers, sales agents |

| Regulatory Bodies | 40 | Policy makers, health insurance regulators |

| Corporate Clients | 70 | HR managers, corporate insurance decision-makers |

The Saudi Arabia Critical Illness Insurance Market is valued at approximately USD 6.5 billion, reflecting a significant growth driven by rising healthcare costs and increasing awareness of critical illnesses among the population.