Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8221

Pages:81

Published On:December 2025

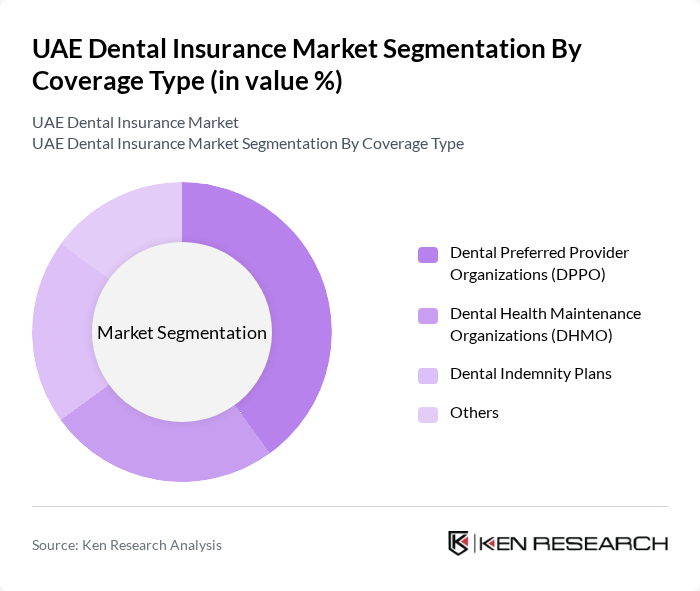

By Coverage Type:This segmentation includes various types of coverage options available in the market, which are essential for consumers to choose based on their needs.

The Dental Preferred Provider Organizations (DPPO) segment is currently leading the market due to its flexibility and extensive network of dental providers. Consumers prefer DPPOs as they offer a balance between cost and choice, allowing them to select from a wide range of dental services while keeping out-of-pocket expenses manageable. The growing trend of preventive dental care and the increasing number of dental clinics participating in these networks further enhance the appeal of DPPOs, making them the preferred choice among consumers.

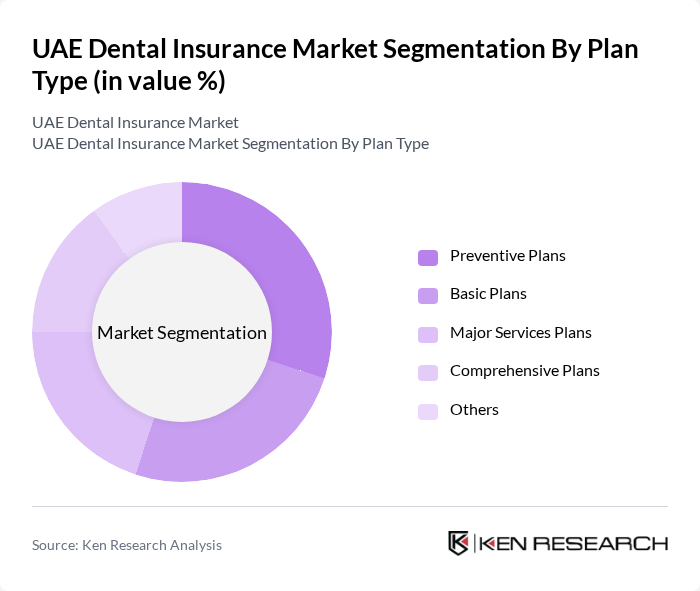

By Plan Type:This segmentation categorizes the market based on the types of dental insurance plans available to consumers.

Preventive Plans dominate the market as they focus on routine dental check-ups and cleanings, which are essential for maintaining oral health. The increasing awareness of the importance of preventive care among consumers has led to a higher uptake of these plans. Additionally, many employers are opting for preventive plans as part of their employee benefits packages, further driving their popularity. The emphasis on early detection and prevention of dental issues aligns with the broader healthcare trend of promoting wellness and preventive care.

The UAE Dental Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daman Health Insurance Company, Abu Dhabi National Insurance Company (ADNIC), AXA Gulf, MetLife UAE, Noor Takaful, Dubai Insurance Company, Al Ain Ahlia Insurance Company, Emirates Insurance Company, National General Insurance Company, Union Insurance Company, Al Fujairah National Insurance Company, Al Hilal Takaful, Al Sagr National Insurance Company, Orient Insurance Company, Allianz UAE contribute to innovation, geographic expansion, and service delivery in this space.

The UAE dental insurance market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital platforms gain traction, insurers are expected to enhance their service delivery through mobile applications and online claims processing. Additionally, the growing emphasis on preventive care will likely lead to the development of tailored insurance products that cater to specific consumer needs, fostering a more competitive landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Coverage Type | Dental Preferred Provider Organizations (DPPO) Dental Health Maintenance Organizations (DHMO) Dental Indemnity Plans Others |

| By Plan Type | Preventive Plans Basic Plans Major Services Plans Comprehensive Plans Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Employer-Sponsored Programs Others |

| By Customer Segment | Individual Plans Family Plans Employer-Sponsored Plans Government Employee Plans Others |

| By Demographics | Children Adults Seniors Others |

| By Geographic Region | Abu Dhabi Dubai Sharjah Ajman Other Emirates |

| By Insurance Coverage Status | Insured Patients Uninsured Patients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Dental Insurance Holders | 120 | Policyholders, Dental Patients |

| Corporate Dental Insurance Plans | 85 | HR Managers, Employee Benefits Coordinators |

| Dental Practitioners' Insights | 65 | Dentists, Clinic Managers |

| Insurance Provider Perspectives | 55 | Insurance Executives, Product Managers |

| Consumer Awareness and Attitudes | 95 | General Public, Dental Patients |

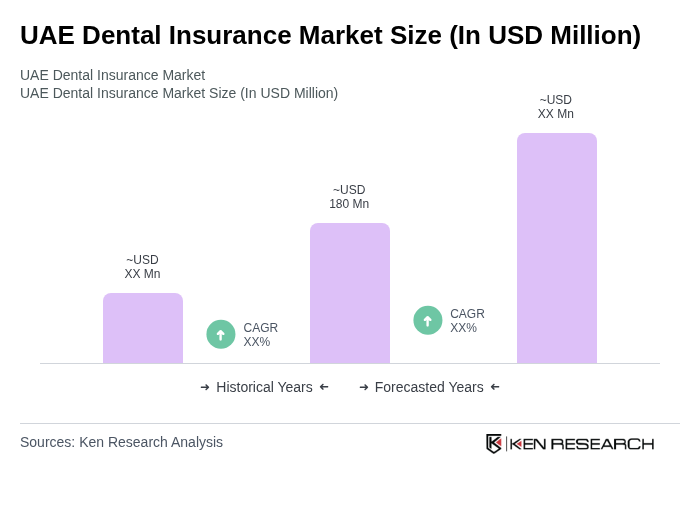

The UAE Dental Insurance Market is valued at approximately USD 180 million, reflecting a significant growth driven by increased awareness of dental health, rising disposable incomes, and the expansion of dental care services across the region.