Region:Middle East

Author(s):Geetanshi

Product Code:KRAB3310

Pages:100

Published On:October 2025

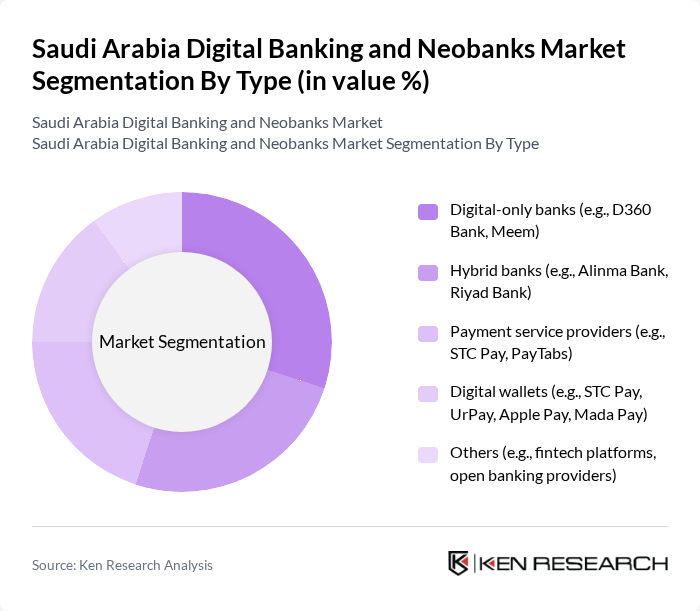

By Type:The market is segmented into various types, including digital-only banks, hybrid banks, payment service providers, digital wallets, and others. Digital-only banks have gained traction due to their low operational costs and ability to offer competitive rates. Hybrid banks combine traditional banking with digital services, appealing to a broader customer base. Payment service providers and digital wallets are increasingly popular as consumers seek seamless transaction experiences. Digital payments represent the largest share of fintech activity in Saudi Arabia, accounting for nearly half of the sector's value .

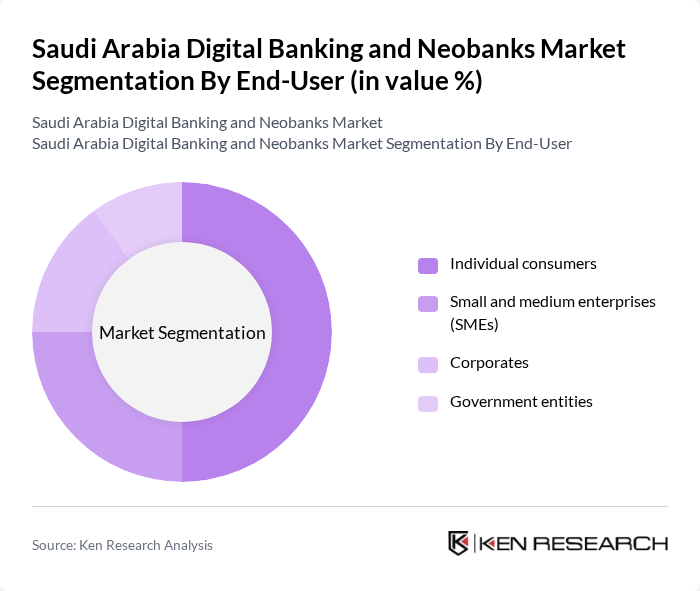

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), corporates, and government entities. Individual consumers are the largest segment, driven by the increasing use of mobile banking apps. SMEs are also adopting digital banking solutions to streamline operations and enhance financial management. Corporates and government entities are leveraging digital banking for efficiency and transparency in financial transactions. The adoption of digital banking among SMEs and corporates is further supported by regulatory initiatives and the integration of advanced technologies such as artificial intelligence and open banking APIs .

The Saudi Arabia Digital Banking and Neobanks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Rajhi Bank, SNB (Saudi National Bank, formerly NCB), STC Pay, Riyad Bank, Bank Albilad, Samba Financial Group, Arab National Bank, Alinma Bank, D360 Bank, Meem (Gulf International Bank - Saudi Arabia), UrPay, PayTabs, Lean Technologies, Fintech Saudi, Mada (Saudi Payments) contribute to innovation, geographic expansion, and service delivery in this space.

The future of digital banking and neobanks in Saudi Arabia appears promising, driven by technological advancements and a supportive regulatory environment. As the government continues to prioritize digital transformation, the integration of AI and machine learning into banking services will enhance customer experiences and operational efficiency. Furthermore, the rise of open banking initiatives is expected to foster innovation, allowing for more personalized financial products and services tailored to consumer needs, thereby increasing market competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital-only banks (e.g., D360 Bank, Meem) Hybrid banks (e.g., Alinma Bank, Riyad Bank) Payment service providers (e.g., STC Pay, PayTabs) Digital wallets (e.g., STC Pay, UrPay, Apple Pay, Mada Pay) Others (e.g., fintech platforms, open banking providers) |

| By End-User | Individual consumers Small and medium enterprises (SMEs) Corporates Government entities |

| By Service Offered | Savings accounts Loans and credit facilities Investment services Insurance products |

| By Customer Segment | Millennials Gen Z Professionals Retirees |

| By Distribution Channel | Mobile applications Web platforms Third-party aggregators |

| By Geographic Presence | Urban areas Rural areas Expatriate communities |

| By Policy Support | Government subsidies Tax incentives Regulatory support for innovation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 120 | Individual Account Holders, Retail Banking Managers |

| Small and Medium Enterprises (SMEs) | 80 | SME Owners, Financial Officers |

| Neobank Users | 100 | Digital Banking Customers, Fintech Enthusiasts |

| Regulatory Bodies | 40 | Policy Makers, Financial Regulators |

| Fintech Experts | 40 | Consultants, Industry Analysts |

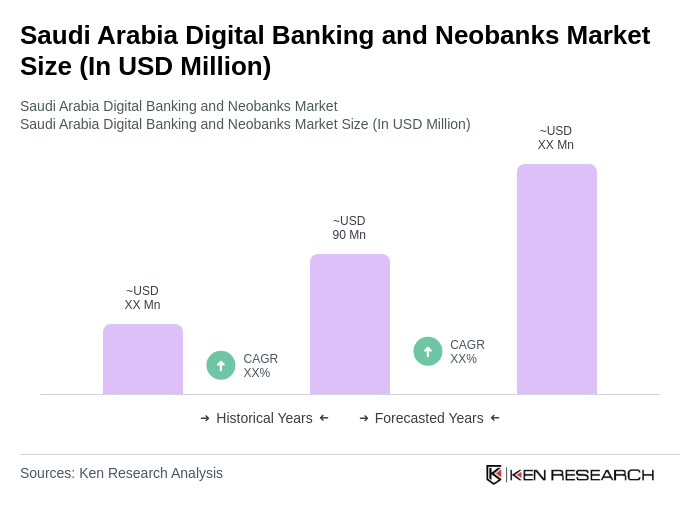

The Saudi Arabia Digital Banking and Neobanks Market is valued at approximately USD 90 million, reflecting significant growth driven by increased adoption of digital financial services and smartphone penetration among consumers.