Region:Middle East

Author(s):Dev

Product Code:KRAB7243

Pages:97

Published On:October 2025

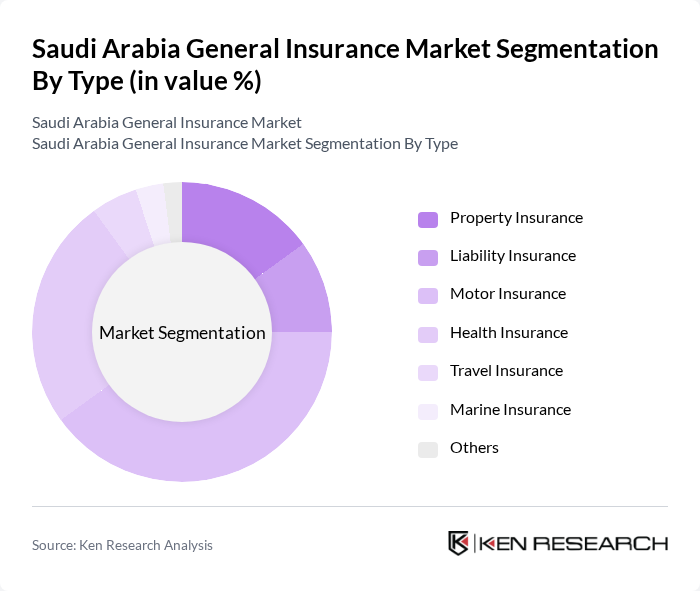

By Type:The market is segmented into various types of insurance products, including Property Insurance, Liability Insurance, Motor Insurance, Health Insurance, Travel Insurance, Marine Insurance, and Others. Each of these segments caters to different consumer needs and preferences, with specific trends influencing their growth. Motor Insurance is particularly dominant due to the high vehicle ownership rates in the country, while Health Insurance is gaining traction as healthcare costs rise.

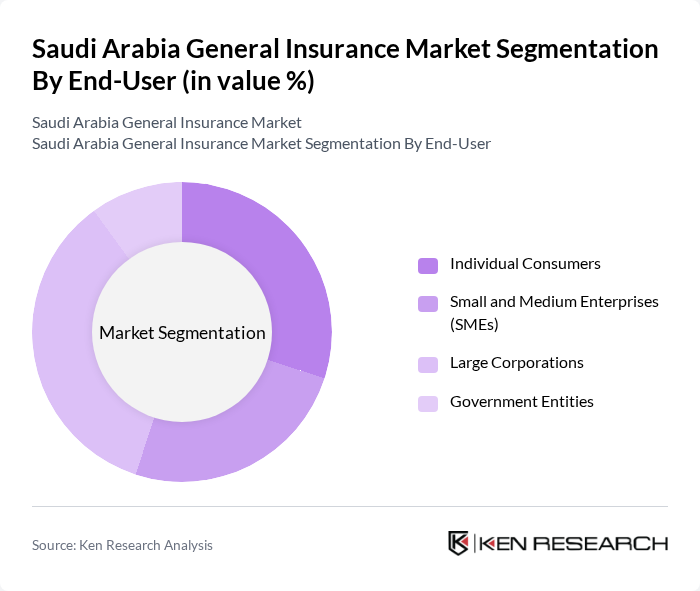

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each segment has distinct insurance needs, with individual consumers primarily seeking health and motor insurance, while SMEs and large corporations focus on liability and property insurance to protect their assets and operations. Government entities also play a significant role in the market, often requiring comprehensive coverage for public services.

The Saudi Arabia General Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya, Bupa Arabia, Al Rajhi Takaful, Gulf Insurance Group, Allianz Saudi Fransi, Medgulf, Alinma Tokio Marine, United Cooperative Assurance, Al-Ahlia Insurance Company, Saudi Arabian Insurance Company, Al Sagr Cooperative Insurance, Al-Etihad Cooperative Insurance, Al-Bilad Insurance, Al-Faisal Insurance, Al-Mawared Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian general insurance market appears promising, driven by increasing digitalization and evolving consumer expectations. Insurers are expected to leverage technology to enhance service delivery and streamline operations, which will likely improve customer engagement. Additionally, as the population continues to grow and urbanize, the demand for diverse insurance products will expand, creating new opportunities for market players. The focus on sustainability will also shape product offerings, aligning with global trends and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Property Insurance Liability Insurance Motor Insurance Health Insurance Travel Insurance Marine Insurance Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Coverage Type | Comprehensive Coverage Third-Party Coverage |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Customer Segment | Retail Customers Corporate Clients |

| By Policy Duration | Short-Term Policies Long-Term Policies Annual Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Market Insights | 100 | Insurance Product Managers, Actuaries |

| Health Insurance Consumer Preferences | 80 | Policyholders, Healthcare Administrators |

| General Insurance Claims Process | 70 | Claims Adjusters, Risk Managers |

| Insurance Brokers' Market Dynamics | 90 | Insurance Brokers, Sales Executives |

| Regulatory Impact on Insurance Products | 60 | Compliance Officers, Legal Advisors |

The Saudi Arabia General Insurance Market is valued at approximately USD 10 billion, reflecting a significant growth driven by increased consumer awareness, regulatory reforms, and a growing economy that encourages spending on insurance services.