Region:Middle East

Author(s):Shubham

Product Code:KRAB7273

Pages:86

Published On:October 2025

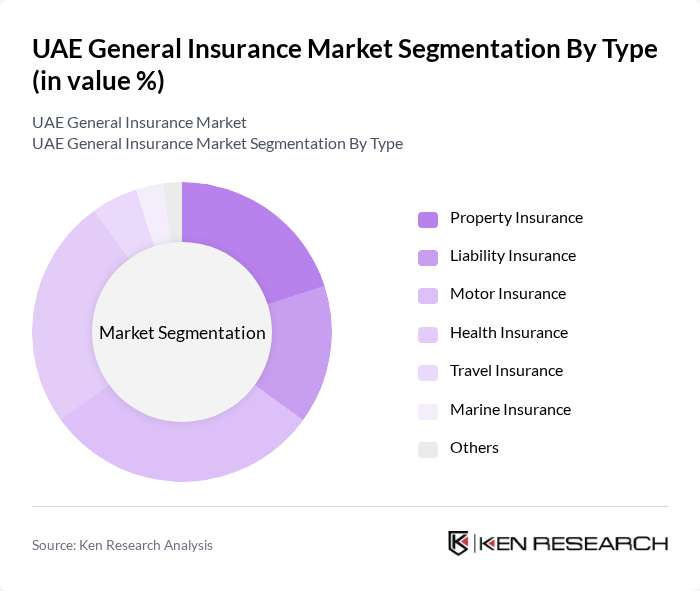

By Type:The market can be segmented into various types of insurance products, including Property Insurance, Liability Insurance, Motor Insurance, Health Insurance, Travel Insurance, Marine Insurance, and Others. Each of these segments caters to different consumer needs and preferences, with specific products designed to mitigate various risks.

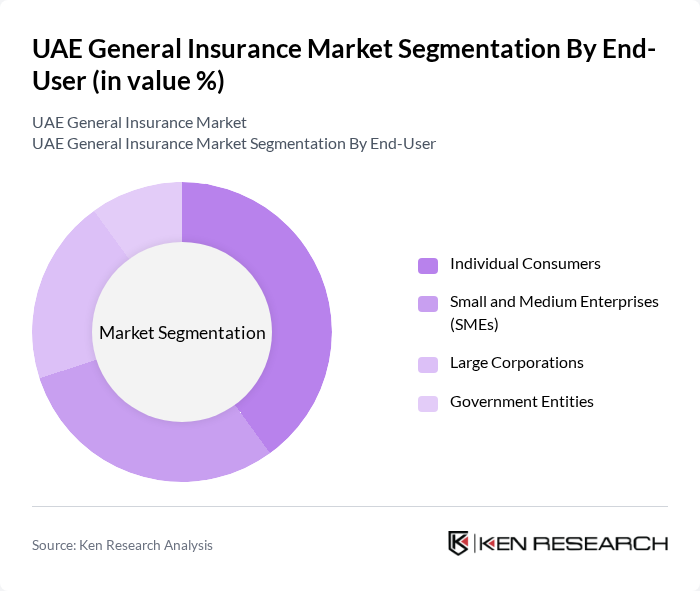

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each segment has distinct insurance needs, with individual consumers typically seeking personal coverage, while SMEs and large corporations focus on comprehensive business insurance solutions.

The UAE General Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi National Insurance Company, Dubai Insurance Company, Oman Insurance Company, Al Ain Ahlia Insurance Company, Emirates Insurance Company, National General Insurance Company, Union Insurance Company, Orient Insurance Company, AXA Gulf Insurance, Qatar Insurance Company, Daman National Health Insurance Company, Noor Takaful, Al Fujairah National Insurance Company, Abu Dhabi Islamic Bank Insurance, Takaful Emarat contribute to innovation, geographic expansion, and service delivery in this space.

The UAE general insurance market is poised for significant evolution, driven by technological advancements and changing consumer preferences. Insurers are increasingly adopting insurtech solutions, enhancing operational efficiency and customer engagement. Additionally, the demand for personalized insurance products is expected to rise, as consumers seek tailored coverage options. As regulatory frameworks evolve, insurers will need to adapt to maintain compliance while leveraging new opportunities for growth in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Property Insurance Liability Insurance Motor Insurance Health Insurance Travel Insurance Marine Insurance Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Coverage Type | Comprehensive Coverage Third-Party Liability Limited Coverage |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Customer Segment | Retail Customers Corporate Clients Institutional Clients |

| By Policy Duration | Short-Term Policies Long-Term Policies Annual Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Policyholders | 150 | Individuals aged 30-55, Middle to High Income |

| Health Insurance Customers | 120 | Families with children, HR Managers from Corporates |

| Property Insurance Buyers | 100 | Homeowners, Real Estate Investors |

| Small Business Owners | 80 | Entrepreneurs, Business Managers |

| Insurance Brokers and Agents | 90 | Insurance Sales Professionals, Agency Owners |

The UAE General Insurance Market is valued at approximately USD 15 billion, reflecting significant growth driven by increased consumer awareness, regulatory reforms, and the expansion of the healthcare sector.