Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1026

Pages:89

Published On:October 2025

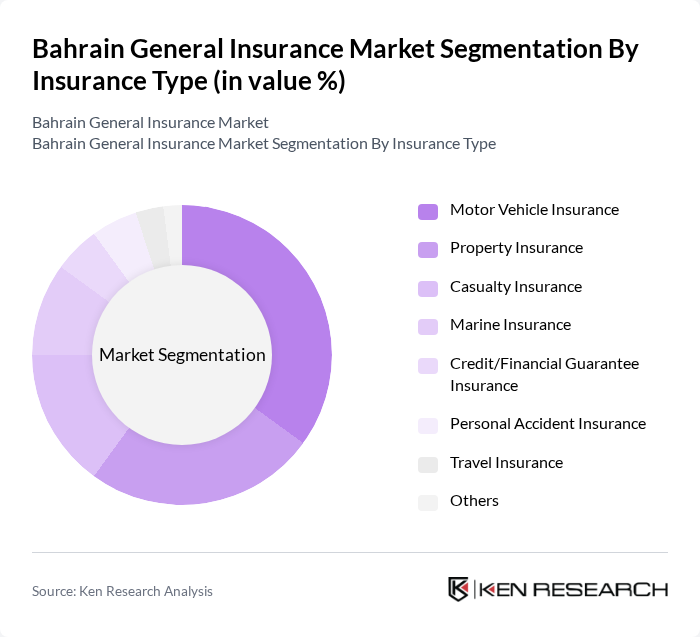

By Insurance Type:The insurance market in Bahrain is segmented into various types, includingMotor Vehicle Insurance, Property Insurance, Casualty Insurance, Marine Insurance, Credit/Financial Guarantee Insurance, Personal Accident Insurance, Travel Insurance, and Others. Among these,Motor Vehicle Insuranceremains the most dominant segment due to the high number of vehicles on the road and the legal requirement for insurance coverage. Health and property insurance are also experiencing robust growth, supported by regulatory initiatives and increased consumer demand for comprehensive protection .

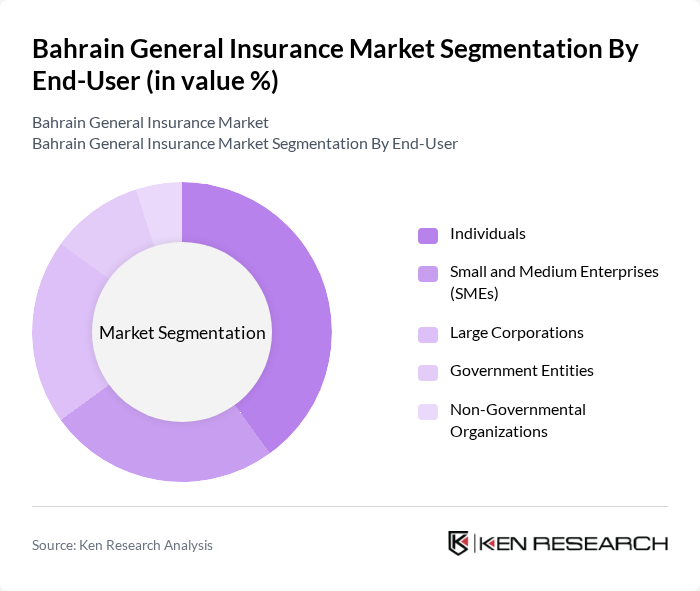

By End-User:The end-user segmentation includesIndividuals, Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, and Non-Governmental Organizations.Individualsrepresent the largest segment, driven by the increasing need for personal insurance products such as health, motor, and property insurance. SMEs and large corporations are also significant contributors, reflecting the growing importance of risk management and employee benefit solutions in Bahrain’s evolving business landscape .

The Bahrain General Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain National Holding Company B.S.C. (BNH), Solidarity Bahrain B.S.C., Takaful International Company B.S.C. (c), Al Ahlia Insurance Company B.S.C., Bahrain Kuwait Insurance Company B.S.C. (c), Arab Insurance Group (ARIG) B.S.C., Trust International Insurance & Reinsurance Company B.S.C. (c), AXA Gulf B.S.C. (c), Zürich Insurance Company, Al Baraka Islamic Bank - Takaful, GIG Gulf (Gulf Insurance Group), United Gulf Bank - Insurance Services, Qatar Insurance Company, Oman Insurance Company, Tokio Marine Middle East contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Bahrain general insurance market appears promising, driven by technological advancements and evolving consumer preferences. The adoption of InsurTech solutions is expected to streamline operations and enhance customer experiences, while the growing demand for health and life insurance products will likely lead to increased policy uptake. Additionally, as the government continues to promote insurance literacy, more individuals are expected to seek coverage, further expanding the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Insurance Type | Motor Vehicle Insurance Property Insurance Casualty Insurance Marine Insurance Credit/Financial Guarantee Insurance Personal Accident Insurance Travel Insurance Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities Non-Governmental Organizations |

| By Distribution Channel | Direct Sales Brokerage Online Platforms Agents Bancassurance |

| By Coverage Type | Comprehensive Coverage Third-Party Coverage |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Customer Segment | Retail Customers Corporate Clients Institutional Clients |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Market Insights | 100 | Insurance Agents, Financial Advisors |

| Health Insurance Consumer Preferences | 80 | Policyholders, Healthcare Providers |

| General Insurance Claims Process | 70 | Claims Adjusters, Risk Managers |

| Insurance Technology Adoption | 60 | IT Managers, Digital Transformation Leads |

| Market Entry Strategies for New Insurers | 40 | Business Development Managers, Market Analysts |

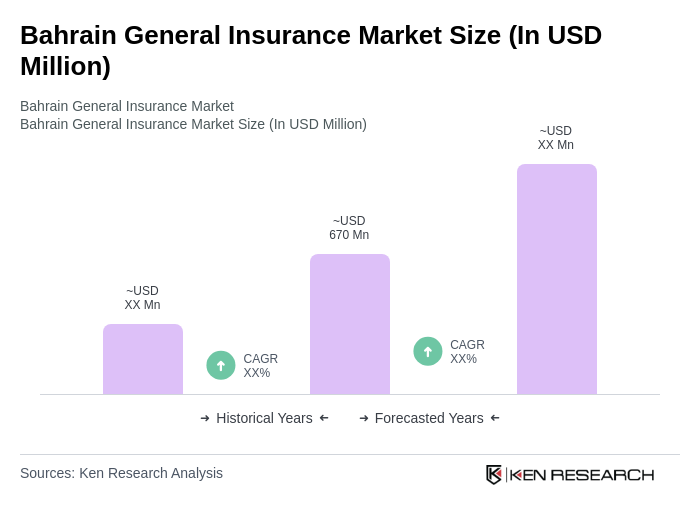

The Bahrain General Insurance Market is valued at approximately USD 670 million, reflecting a robust growth trajectory driven by increased consumer awareness, regulatory support, and a rising demand for comprehensive insurance coverage across various sectors.