Region:Middle East

Author(s):Rebecca

Product Code:KRAB2037

Pages:100

Published On:January 2026

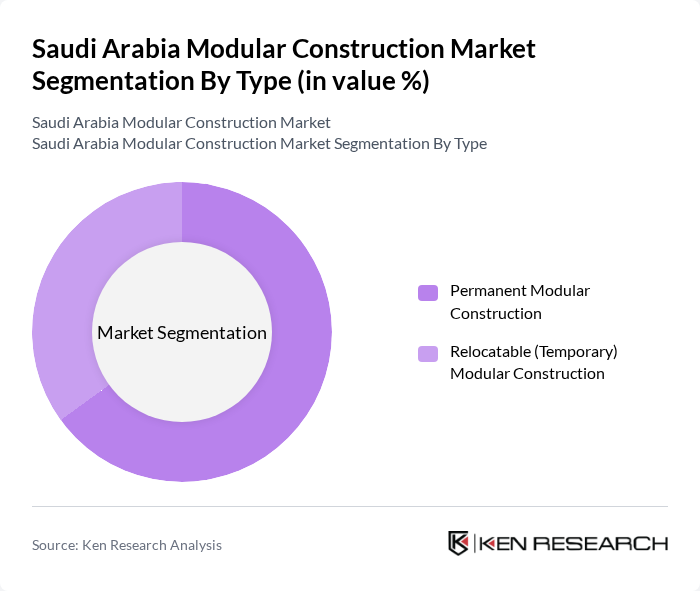

By Type:

The modular construction market in Saudi Arabia is segmented into two primary types: Permanent Modular Construction and Relocatable (Temporary) Modular Construction, in line with leading market studies. Permanent Modular Construction is gaining traction due to its durability, compliance with national building codes, and suitability for long-term projects in residential, commercial, healthcare, and education end uses, especially for large-scale housing and social infrastructure. Relocatable Modular Construction is favored for its flexibility and quick deployment in temporary or semi-permanent settings such as worker accommodation camps, site offices, and remote industrial facilities. The demand for Permanent Modular Construction is particularly strong in residential and commercial sectors, driven by the need for sustainable, industrialized, and efficient building solutions and the push to increase homeownership and reduce project delivery times.

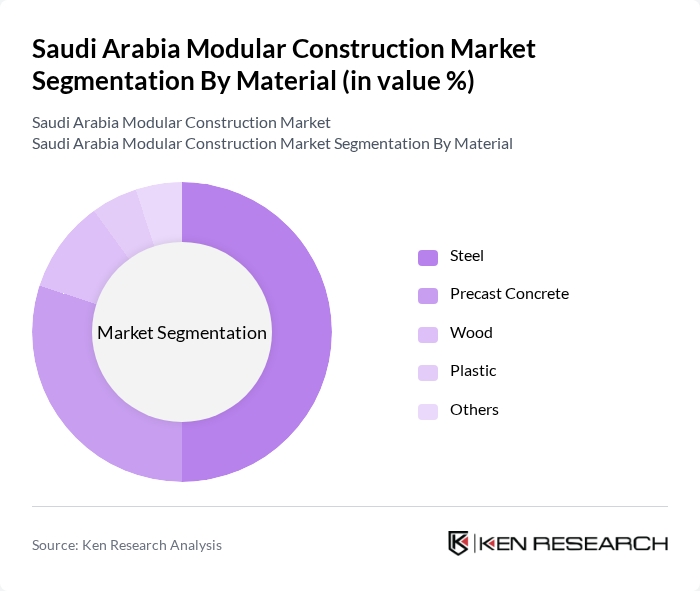

By Material:

The market is also segmented by material, including Steel, Precast Concrete, Wood, Plastic, and Others, consistent with major market analyses. Steel is the dominant material due to its strength, durability, structural efficiency, and recyclability, making it a preferred choice for both permanent and temporary modular structures, particularly in industrial, commercial, and large residential projects. Precast Concrete follows closely, valued for its versatility, fire resistance, and cost-effectiveness in foundations, structural frames, and building envelopes. The use of Wood and Plastic is growing from a smaller base, particularly in residential, interior, and non-structural applications, as developers and consumers seek sustainable, lightweight, and thermally efficient building materials and components.

The Saudi Arabia Modular Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Red Sea International Company, Al Bawani Co. Ltd., Katerra Saudi Arabia, Saudi Building Systems Manufacturing Company (BSM), Zamil Industrial Investment Co. (Zamil Steel), Al Kifah Precast & Modular Construction, NESR Prefab / NESR Camp Solutions, Gulf Modular Factory (GMF), United Modular Industries Co., Redco Modular Construction, El-Seif Engineering Contracting – Modular Division, Speed House Group – Saudi Operations, Alfanar Construction – Modular & Prefab Solutions, Saudi Arabian Baytur Construction Co. – Modular Projects, and other emerging local modular players contribute to innovation, geographic expansion, and service delivery in this space.

The future of the modular construction market in Saudi Arabia appears promising, driven by increasing urbanization and government support for infrastructure development. As the nation continues to invest in sustainable practices, modular construction is likely to gain traction due to its efficiency and environmental benefits. Additionally, advancements in technology and materials will enhance the appeal of modular solutions, making them more accessible to a broader range of developers and contractors, ultimately shaping the market landscape positively.

| Segment | Sub-Segments |

|---|---|

| By Type | Permanent Modular Construction Relocatable (Temporary) Modular Construction |

| By Material | Steel Precast Concrete Wood Plastic Others |

| By Module Type | Four-Sided Modules Open-Sided Modules Partially Open-Sided Modules Mixed Modules and Floor Cassettes Modules Supported by a Primary Structure Others |

| By End Use | Residential Commercial Education Retail Hospitality Healthcare Industrial Others |

| By Region | Northern & Central Region Western Region Eastern Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Modular Construction | 100 | Architects, Home Builders, Project Managers |

| Commercial Modular Solutions | 80 | Construction Managers, Real Estate Developers |

| Industrial Modular Facilities | 70 | Facility Managers, Operations Directors |

| Government Projects in Modular Construction | 60 | Public Sector Officials, Urban Planners |

| Modular Construction Technology Providers | 90 | Product Managers, Technology Developers |

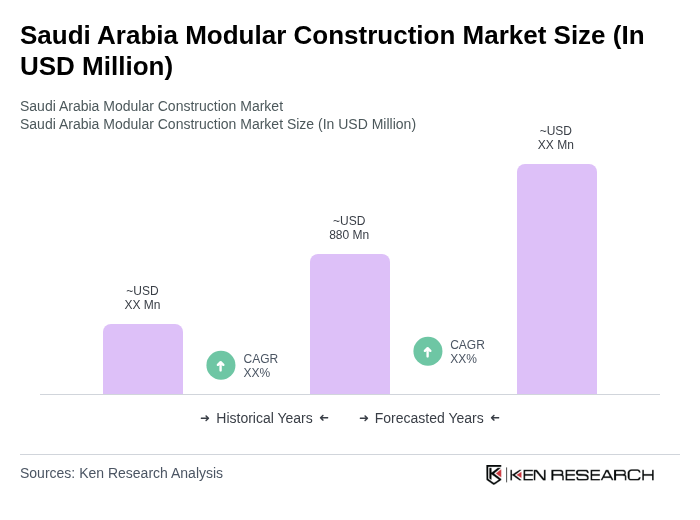

The Saudi Arabia Modular Construction Market is valued at approximately USD 880 million, driven by the demand for rapid construction solutions and government initiatives under Vision 2030 aimed at enhancing infrastructure development.