Region:Middle East

Author(s):Rebecca

Product Code:KRAE3005

Pages:85

Published On:February 2026

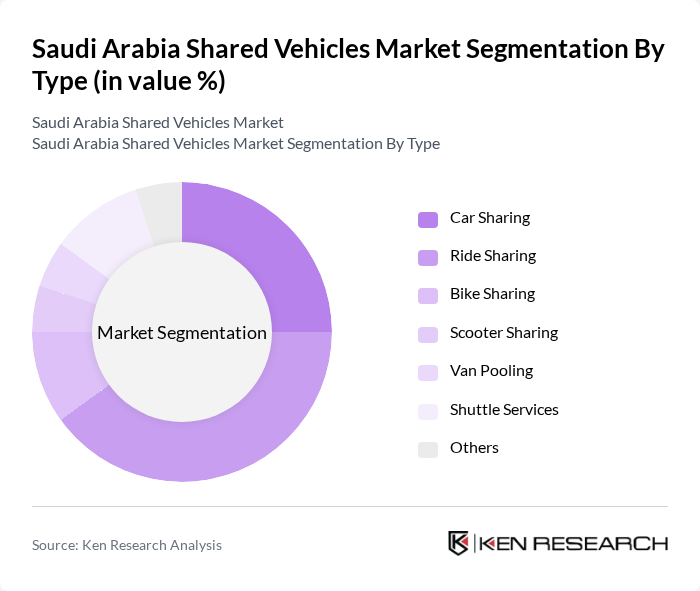

By Type:The segmentation by type includes various modes of shared vehicles, such as car sharing, ride sharing, bike sharing, scooter sharing, van pooling, shuttle services, and others. Each of these sub-segments caters to different consumer needs and preferences, with ride sharing and car sharing being the most popular due to their convenience and flexibility.

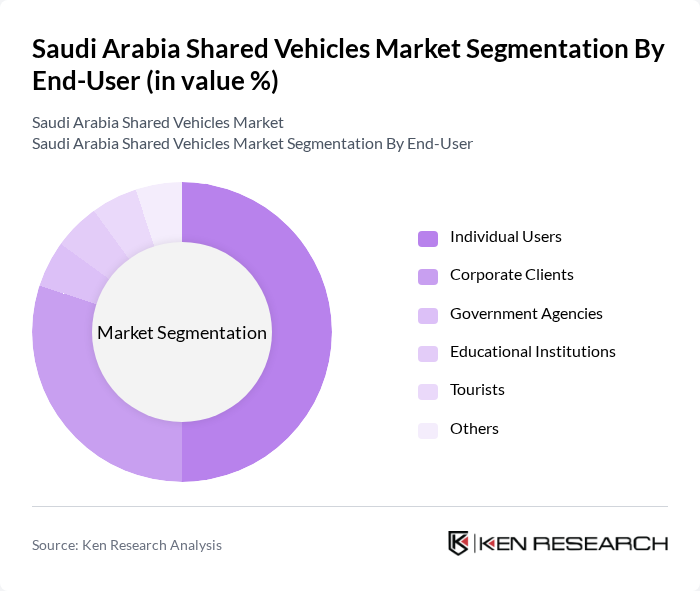

By End-User:The end-user segmentation includes individual users, corporate clients, government agencies, educational institutions, tourists, and others. Individual users and corporate clients are the primary consumers of shared vehicle services, driven by the need for cost-effective and flexible transportation solutions.

The Saudi Arabia Shared Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Careem, Uber, Zain Ride, Udrive, Fennel, Yango, Ofo, Lime, BlaBlaCar, Tashyeed, and Taqseem contribute to innovation, geographic expansion, and service delivery in this space.

The future of the shared vehicles market in Saudi Arabia appears promising, driven by urbanization and government support for sustainable transport. As the population continues to grow, the demand for efficient mobility solutions will increase. Innovations in technology, such as app-based services and smart mobility solutions, will enhance user experience and accessibility. Additionally, partnerships with local businesses and integration with public transport systems will create a more cohesive transportation network, further solidifying the role of shared vehicles in urban mobility.

| Segment | Sub-Segments |

|---|---|

| By Type | Car Sharing Ride Sharing Bike Sharing Scooter Sharing Van Pooling Shuttle Services Others |

| By End-User | Individual Users Corporate Clients Government Agencies Educational Institutions Tourists Others |

| By Vehicle Type | Economy Cars Luxury Cars SUVs Electric Vehicles Vans Others |

| By Service Model | Peer-to-Peer Sharing Business-to-Consumer Sharing Business-to-Business Sharing Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Duration of Use | Short-Term Rentals Long-Term Rentals Subscription Services Others |

| By Payment Model | Pay-Per-Use Subscription-Based Membership Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ride-Hailing Service Users | 150 | Frequent Users, Occasional Users |

| Car-Sharing Service Providers | 100 | Operations Managers, Business Development Executives |

| Urban Mobility Experts | 80 | City Planners, Transportation Policy Makers |

| Government Transportation Officials | 60 | Regulatory Authorities, Policy Advisors |

| Shared Mobility Technology Developers | 70 | Product Managers, Software Engineers |

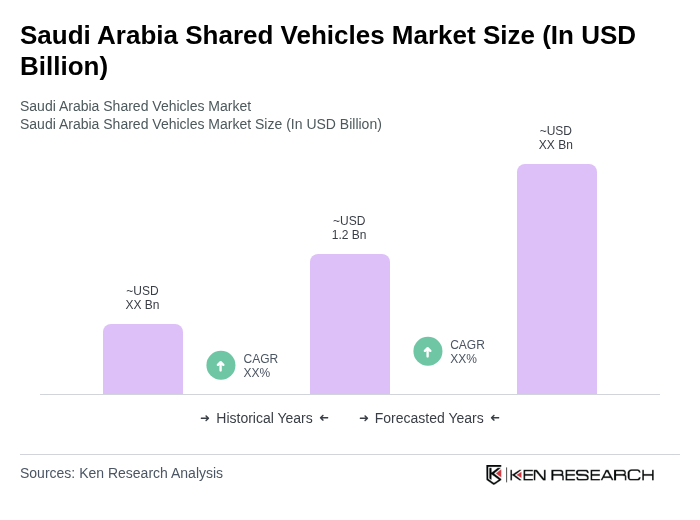

The Saudi Arabia Shared Vehicles Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by urbanization, rising disposable incomes, and a shift towards shared mobility solutions in urban areas.