Region:Africa

Author(s):Geetanshi

Product Code:KRAB4024

Pages:84

Published On:October 2025

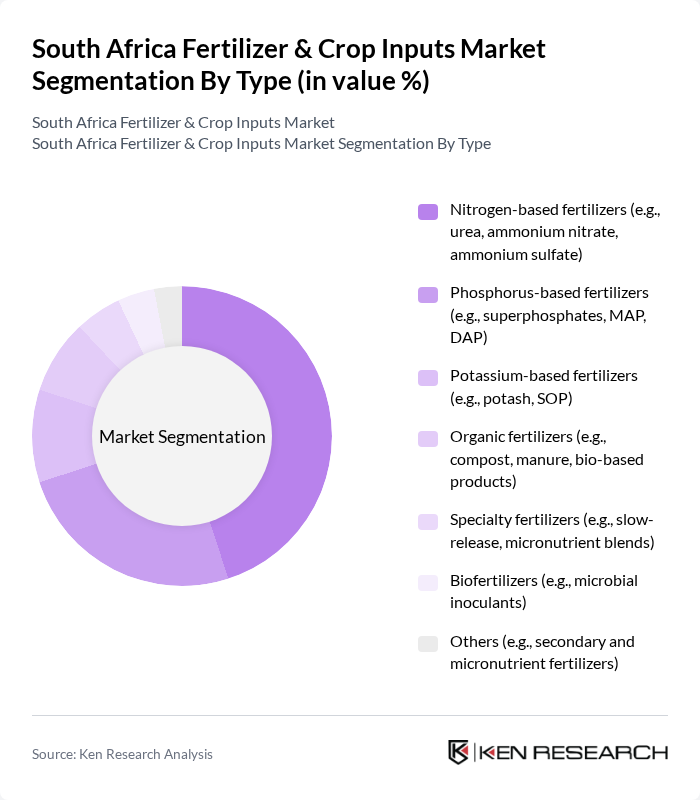

By Type:The market is segmented into nitrogen-based, phosphorus-based, potassium-based, organic, specialty, biofertilizers, and others. Nitrogen-based fertilizers, including urea and ammonium nitrate, hold the largest market share due to their critical role in crop growth and widespread use in staple crop production. The increasing emphasis on yield optimization and soil fertility management continues to drive demand for nitrogen fertilizers among South African farmers .

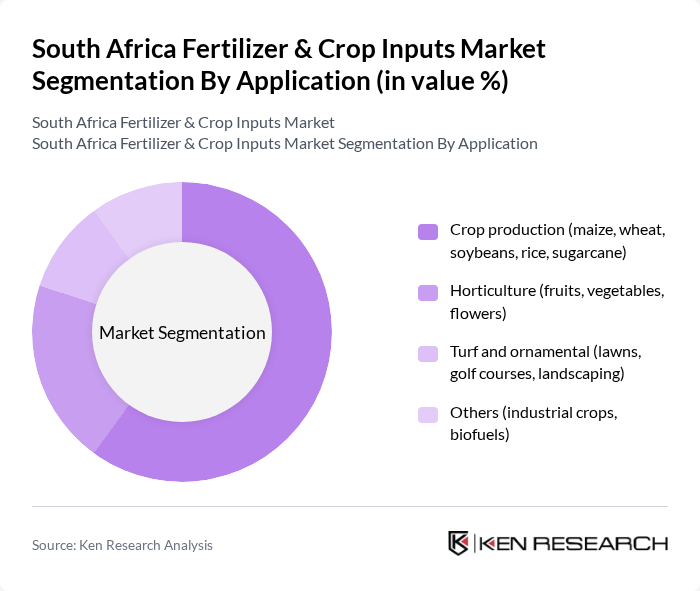

By Application:The application segment includes crop production, horticulture, turf and ornamental, and others. Crop production, especially for staple crops such as maize and wheat, remains the dominant application area, driven by the need for food security and efficient agricultural practices. Population growth and urbanization are further accelerating demand for advanced crop production solutions, making this segment central to the market .

The South Africa Fertilizer & Crop Inputs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omnia Holdings Limited, Kynoch Fertilizers, Yara International ASA, AECI Limited, Sasol Limited, Nutrien Ltd., Agri-Edge, Greenway Farms, Fertilizer South Africa, Interfert, CropLife South Africa, BHBW, UPL Limited, Bayer Crop Science, Syngenta AG contribute to innovation, geographic expansion, and service delivery in this space.

The South African fertilizer and crop inputs market is poised for transformation as sustainability becomes a central focus. With the government promoting eco-friendly practices, the market is likely to see a shift towards organic fertilizers and innovative crop input solutions. Additionally, advancements in digital agriculture tools will enhance efficiency and productivity. As farmers increasingly adopt these technologies, the market will evolve, presenting new opportunities for growth and collaboration within the agricultural sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogen-based fertilizers (e.g., urea, ammonium nitrate, ammonium sulfate) Phosphorus-based fertilizers (e.g., superphosphates, MAP, DAP) Potassium-based fertilizers (e.g., potash, SOP) Organic fertilizers (e.g., compost, manure, bio-based products) Specialty fertilizers (e.g., slow-release, micronutrient blends) Biofertilizers (e.g., microbial inoculants) Others (e.g., secondary and micronutrient fertilizers) |

| By Application | Crop production (maize, wheat, soybeans, rice, sugarcane) Horticulture (fruits, vegetables, flowers) Turf and ornamental (lawns, golf courses, landscaping) Others (industrial crops, biofuels) |

| By End-User | Commercial farmers (large-scale, export-oriented) Smallholder farmers (subsistence, emerging) Agricultural cooperatives Others (government programs, NGOs) |

| By Distribution Channel | Direct sales (manufacturer to farm) Retail outlets (agro-dealers, co-ops) Online platforms (e-commerce, agri-tech apps) Others (bulk terminals, rural depots) |

| By Region | Gauteng KwaZulu-Natal Western Cape Eastern Cape Limpopo Mpumalanga Others (Free State, North West, Northern Cape) |

| By Price Range | Low-cost fertilizers (basic blends, government-subsidized) Mid-range fertilizers (standard NPK, micronutrient blends) Premium fertilizers (specialty, organic, controlled-release) |

| By Packaging Type | Bulk packaging (for large farms, cooperatives) Bagged packaging (retail, smallholders) Others (liquid, custom blends) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Fertilizer Usage | 100 | Farmers, Agronomists |

| Fruit and Vegetable Inputs | 60 | Horticulturists, Crop Consultants |

| Fertilizer Distribution Channels | 50 | Distributors, Retail Managers |

| Government Policy Impact | 40 | Policy Makers, Agricultural Economists |

| Organic vs. Synthetic Fertilizer Preferences | 45 | Farmers, Sustainability Advocates |

The South Africa Fertilizer & Crop Inputs Market is valued at approximately USD 2.6 billion, reflecting a significant growth driven by increasing food security demands, technological advancements, and the adoption of sustainable agricultural practices.