Region:Europe

Author(s):Shubham

Product Code:KRAB1018

Pages:98

Published On:October 2025

By Type:The digital advertising market in Spain is segmented into various types, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Native Advertising, Affiliate Marketing, and Others. Among these, smartphone-based advertising has emerged as the dominant segment, representing the largest revenue-generating component with significant growth driven by mobile device proliferation. Social Media Advertising continues gaining traction as businesses leverage platforms like Facebook, which reached 20.4 million users in Spain, and YouTube, which had 39.7 million users representing 82.9% of Spain's total population. The increasing use of mobile devices has further propelled the demand for video and native advertising formats, with programmatic advertising gaining momentum as brands seek more efficient and data-driven approaches to reach target audiences.

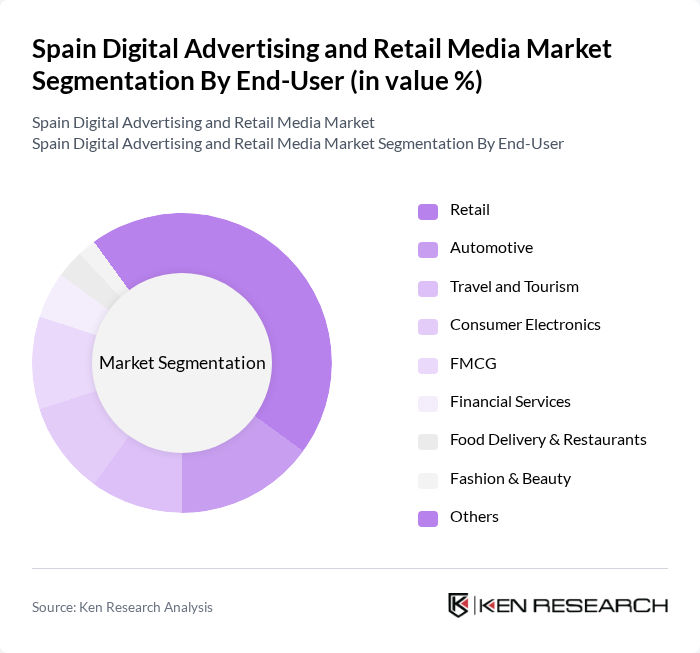

By End-User:The end-user segmentation of the digital advertising market includes Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Technology, and Others. The Retail sector remains the dominant end-user, driven by the rapid growth of e-commerce, particularly in fashion, beauty, and food delivery sectors, which are pushing brands to invest heavily in targeted digital ads to capture online shoppers' attention. The Automotive and Travel sectors are also significant contributors, as they increasingly rely on digital channels to engage consumers and promote their offerings. Spanish brands across sectors are integrating sustainability and corporate responsibility messages into their digital advertising strategies to connect with eco-conscious consumers.

The Spain Digital Advertising and Retail Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Meta Platforms, Inc., Amazon Advertising, Adform A/S, Criteo S.A., The Trade Desk, Inc., Verizon Media, Taboola.com, Outbrain Inc., MediaMath, Inc., AdRoll, Inc., Sizmek Inc., Xandr, Inc., Quantcast Corporation, Rakuten Marketing contribute to innovation, geographic expansion, and service delivery in this space.

The future of Spain's digital advertising and retail media market appears promising, driven by technological advancements and evolving consumer behaviors. As businesses increasingly adopt AI-driven solutions for personalized marketing, the demand for innovative advertising formats will rise. Additionally, the integration of augmented reality in campaigns is expected to enhance user engagement. With a focus on sustainability and ethical advertising practices, companies will likely prioritize transparency and consumer trust, shaping the future landscape of digital marketing in Spain.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Native Advertising Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Technology Others |

| By Sales Channel | Direct Sales Online Marketplaces Affiliate Networks Social Media Platforms Others |

| By Advertising Format | Banner Ads Video Ads Sponsored Content Email Marketing Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting Others |

| By Device Type | Mobile Devices Desktop Computers Tablets Smart TVs Others |

| By Industry Vertical | E-commerce Entertainment Education Real Estate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 100 | Account Managers, Media Planners |

| Retail Brands Utilizing Digital Media | 80 | Marketing Directors, Brand Managers |

| Consumers Engaged with Retail Media | 120 | General Consumers, Online Shoppers |

| Market Analysts and Consultants | 40 | Industry Analysts, Market Researchers |

| Technology Providers for Digital Advertising | 60 | Product Managers, Sales Executives |

The Spain Digital Advertising and Retail Media Market is valued at approximately USD 9.2 billion, driven by increased internet penetration, mobile device usage, and the growth of e-commerce, prompting businesses to invest more in digital advertising strategies.