Region:Europe

Author(s):Shubham

Product Code:KRAB6551

Pages:82

Published On:October 2025

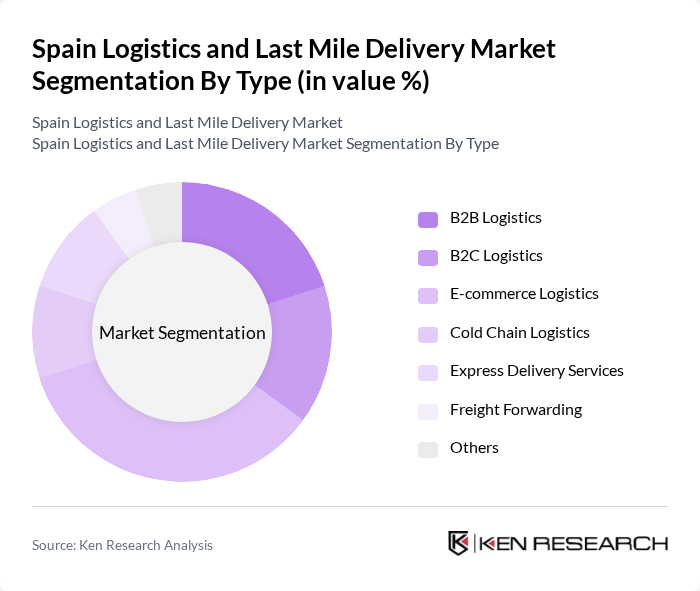

By Type:The logistics and last mile delivery market can be segmented into various types, including B2B Logistics, B2C Logistics, E-commerce Logistics, Cold Chain Logistics, Express Delivery Services, Freight Forwarding, and Others. Among these, E-commerce Logistics is currently the leading sub-segment, driven by the rapid growth of online shopping and consumer expectations for quick delivery. The increasing reliance on digital platforms has led to a surge in demand for efficient logistics solutions tailored to e-commerce needs.

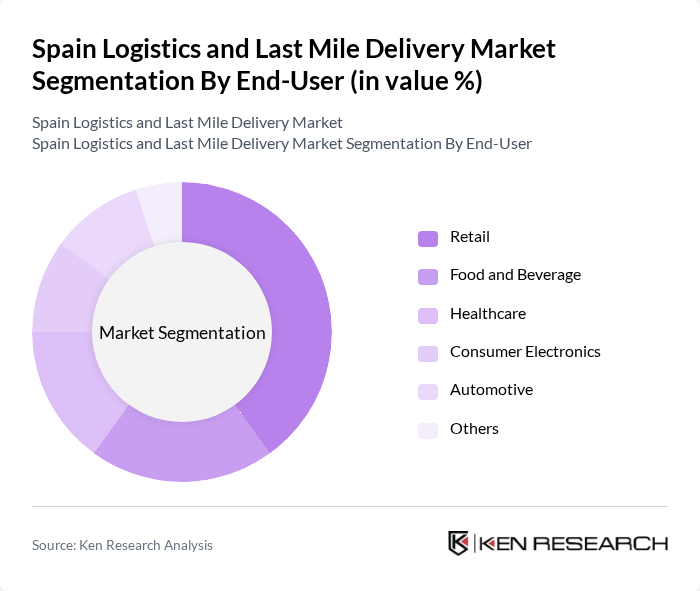

By End-User:The end-user segmentation includes Retail, Food and Beverage, Healthcare, Consumer Electronics, Automotive, and Others. The Retail sector is the dominant end-user, fueled by the increasing demand for efficient supply chain solutions and the rise of omnichannel retailing. Retailers are increasingly investing in logistics capabilities to enhance customer experience and streamline operations, making this segment crucial for market growth.

The Spain Logistics and Last Mile Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as SEUR, Correos, DHL, MRW, UPS, GLS, XPO Logistics, DPD, Amazon Logistics, Zeleris, TSE Express, Redur, Transcoma, Logista, Kuehne + Nagel contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics and last-mile delivery market in Spain appears promising, driven by technological advancements and evolving consumer preferences. As e-commerce continues to grow, logistics providers are likely to invest in automation and smart technologies to enhance efficiency. Additionally, the increasing focus on sustainability will push companies to adopt greener practices, such as electric delivery vehicles and eco-friendly packaging, aligning with consumer demand for environmentally responsible services.

| Segment | Sub-Segments |

|---|---|

| By Type | B2B Logistics B2C Logistics E-commerce Logistics Cold Chain Logistics Express Delivery Services Freight Forwarding Others |

| By End-User | Retail Food and Beverage Healthcare Consumer Electronics Automotive Others |

| By Delivery Method | Standard Delivery Same-Day Delivery Scheduled Delivery Curbside Pickup Drone Delivery Others |

| By Distribution Channel | Direct Sales Online Platforms Retail Partnerships Third-Party Logistics Providers Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Cross-Border Delivery Others |

| By Package Size | Small Packages Medium Packages Large Packages Bulk Deliveries Others |

| By Service Type | Standard Shipping Expedited Shipping Freight Shipping Returns Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Last Mile Delivery | 150 | Logistics Managers, E-commerce Directors |

| Retail Sector Delivery Operations | 100 | Supply Chain Managers, Operations Directors |

| Food Delivery Services | 80 | Delivery Coordinators, Restaurant Managers |

| Urban Logistics Solutions | 70 | City Planners, Logistics Consultants |

| Last Mile Technology Providers | 60 | Product Managers, Technology Officers |

The Spain Logistics and Last Mile Delivery Market is valued at approximately USD 20 billion, driven by the growth of e-commerce, consumer demand for faster delivery, and advancements in logistics technology.