Region:Africa

Author(s):Dev

Product Code:KRAA3524

Pages:98

Published On:September 2025

By Type:The logistics and last mile delivery market is segmented into Freight Transport (Road, Rail, Air, Sea), Warehousing & Storage (General, Cold Chain), Courier, Express & Parcel (CEP) / Last Mile Delivery, Freight Forwarding, Value-Added Logistics Services, Reverse Logistics & Returns Management, and Others. The Courier, Express & Parcel (CEP) segment currently dominates the market, propelled by the surge in e-commerce activities and growing consumer preference for quick delivery services. The demand for last mile delivery solutions has increased significantly, especially in urban areas, driven by the need for convenience, efficiency, and real-time tracking capabilities .

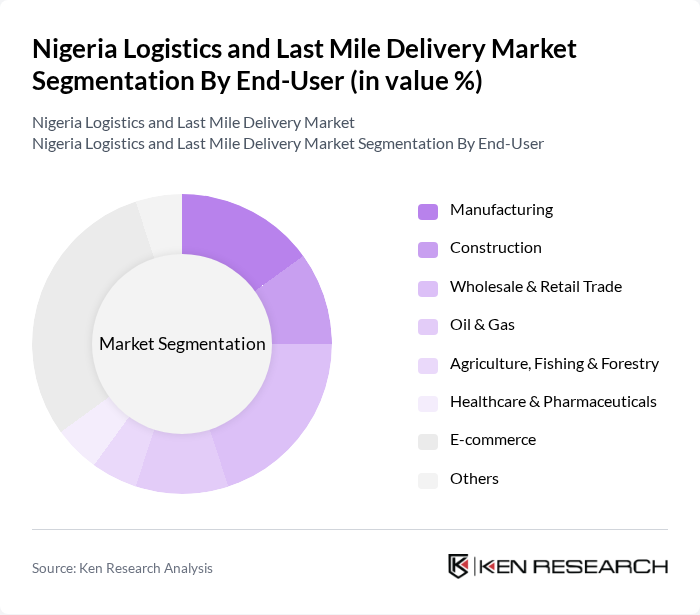

By End-User:The end-user segmentation of the logistics and last mile delivery market includes Manufacturing, Construction, Wholesale & Retail Trade, Oil & Gas, Agriculture, Fishing & Forestry, Healthcare & Pharmaceuticals, E-commerce, and Others. The E-commerce segment leads the market, driven by rapid growth in online shopping and increasing consumer demand for fast and reliable delivery services. This trend has prompted logistics providers to strengthen last mile delivery capabilities, invest in digital platforms, and expand urban delivery networks to meet evolving customer expectations .

The Nigeria Logistics and Last Mile Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Nigeria, GIG Logistics, Jumia Logistics, FedEx Nigeria, UPS Nigeria, Konga Logistics, Transport Services Limited (TSL), Red Star Express, Starlink Global & Ideal Limited, Ziva Logistics, Swift Delivery Limited, APM Terminals Nigeria, Maersk Nigeria, Cargo Services Limited, ABC Transport Plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's logistics and last mile delivery market appears promising, driven by technological advancements and increasing consumer expectations. As e-commerce continues to expand, logistics companies are likely to adopt innovative solutions such as automated delivery systems and data analytics to enhance operational efficiency. Additionally, the government's commitment to improving infrastructure will play a crucial role in addressing existing challenges, ultimately fostering a more competitive and responsive logistics environment in Nigeria.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Transport (Road, Rail, Air, Sea) Warehousing & Storage (General, Cold Chain) Courier, Express & Parcel (CEP) / Last Mile Delivery Freight Forwarding Value-Added Logistics Services Reverse Logistics & Returns Management Others |

| By End-User | Manufacturing Construction Wholesale & Retail Trade Oil & Gas Agriculture, Fishing & Forestry Healthcare & Pharmaceuticals E-commerce Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Multimodal Transport Others |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Forwarding Supply Chain Management Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Customer Segment | B2B B2C C2C Others |

| By Technology Adoption | Traditional Logistics Digital Logistics Platforms Automated Delivery Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Last Mile Delivery | 100 | Logistics Managers, Urban Delivery Coordinators |

| Rural Delivery Challenges | 60 | Supply Chain Analysts, Rural Logistics Operators |

| E-commerce Fulfillment Strategies | 80 | E-commerce Managers, Operations Directors |

| Consumer Delivery Preferences | 50 | End Consumers, Customer Experience Managers |

| Technology Adoption in Logistics | 40 | IT Managers, Logistics Technology Specialists |

The Nigeria Logistics and Last Mile Delivery Market is valued at approximately USD 15 billion, driven by the rapid growth of e-commerce, urbanization, and the demand for efficient supply chain solutions.