Region:Central and South America

Author(s):Rebecca

Product Code:KRAB2981

Pages:89

Published On:October 2025

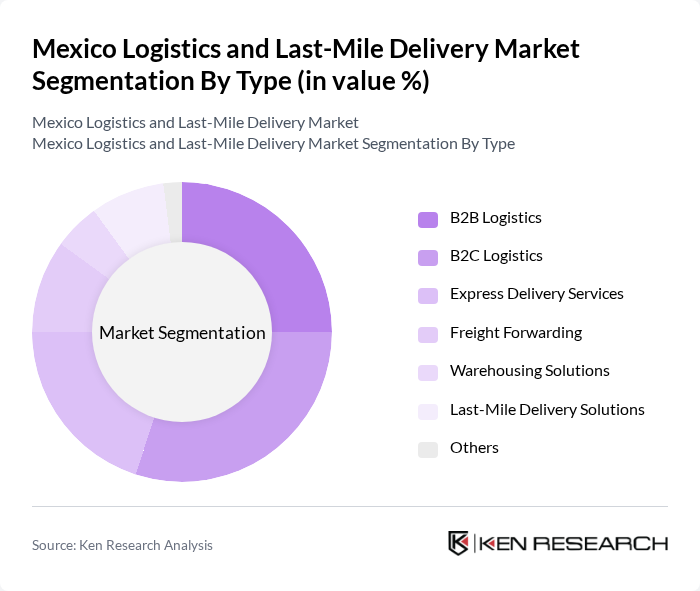

By Type:The logistics and last-mile delivery market can be segmented into various types, including B2B Logistics, B2C Logistics, Express Delivery Services, Freight Forwarding, Warehousing Solutions, Last-Mile Delivery Solutions, and Others. Each of these segments plays a crucial role in the overall logistics ecosystem, catering to different customer needs and operational requirements.

The B2C Logistics segment is currently dominating the market, driven by the exponential growth of e-commerce and changing consumer preferences for online shopping. As more consumers opt for home delivery services, logistics providers are increasingly focusing on enhancing their B2C capabilities. This includes investing in technology for tracking shipments, improving delivery times, and offering flexible delivery options. The rise of mobile commerce and the demand for convenience have further propelled the growth of this segment, making it a key player in the logistics landscape.

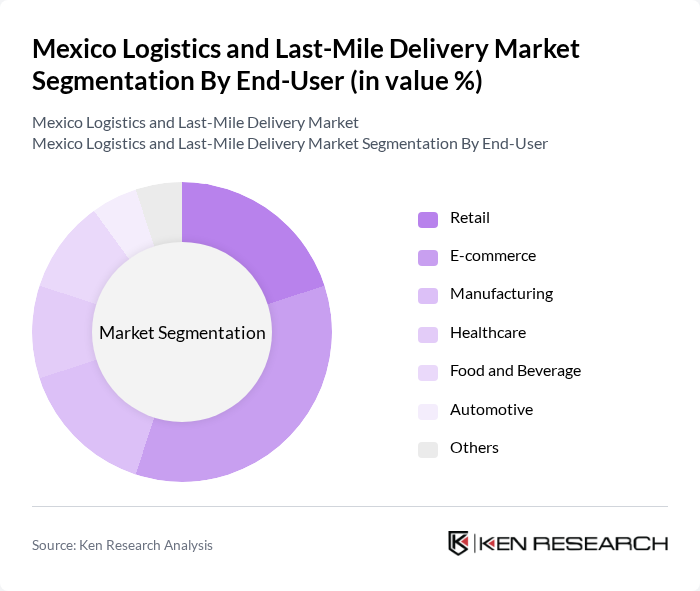

By End-User:The market can also be segmented by end-user industries, including Retail, E-commerce, Manufacturing, Healthcare, Food and Beverage, Automotive, and Others. Each of these sectors has unique logistics requirements, influencing the demand for specific logistics services.

The E-commerce sector is the leading end-user in the logistics market, reflecting the rapid shift towards online shopping. The convenience of home delivery and the increasing number of online retailers have significantly boosted demand for logistics services tailored to e-commerce. This segment's growth is further supported by advancements in technology, enabling faster and more efficient delivery solutions. As consumer expectations for quick and reliable service continue to rise, logistics providers are adapting their strategies to meet these demands, solidifying E-commerce's position as a market leader.

The Mexico Logistics and Last-Mile Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Mexico, Grupo TMM, Estafeta, FedEx Mexico, UPS Mexico, JDA Software Group, Kuehne + Nagel, XPO Logistics, Cargamos, Rappi, Mercado Libre, 99minutos, Logística de México, Cargamos, TCC contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico logistics and last-mile delivery market is poised for significant transformation as technological innovations and consumer expectations evolve. The integration of smart logistics solutions, including AI-driven analytics and automated delivery systems, will enhance operational efficiency. Additionally, the focus on sustainability will drive the adoption of eco-friendly practices. As urbanization continues, logistics providers must adapt to the changing landscape, ensuring they meet the growing demand for faster and more reliable delivery services while navigating regulatory challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | B2B Logistics B2C Logistics Express Delivery Services Freight Forwarding Warehousing Solutions Last-Mile Delivery Solutions Others |

| By End-User | Retail E-commerce Manufacturing Healthcare Food and Beverage Automotive Others |

| By Delivery Model | Standard Delivery Same-Day Delivery Scheduled Delivery Curbside Pickup Contactless Delivery Others |

| By Distribution Channel | Direct Sales Online Platforms Retail Partnerships Third-Party Logistics Providers Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Cross-Border Delivery Others |

| By Service Type | Standard Shipping Expedited Shipping Freight Shipping Returns Management Others |

| By Pricing Model | Flat Rate Variable Rate Subscription-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Last-Mile Delivery | 150 | Logistics Coordinators, E-commerce Operations Managers |

| Retail Supply Chain Logistics | 100 | Supply Chain Managers, Retail Operations Directors |

| Food Delivery Services | 80 | Delivery Fleet Managers, Restaurant Operations Heads |

| Pharmaceutical Distribution | 70 | Pharmacy Managers, Logistics Compliance Officers |

| Urban Courier Services | 90 | Operations Supervisors, Customer Experience Managers |

The Mexico Logistics and Last-Mile Delivery Market is valued at approximately USD 25 billion, driven by the rapid growth of e-commerce, consumer demand for faster delivery, and significant infrastructure investments.