Region:Asia

Author(s):Rebecca

Product Code:KRAA4301

Pages:94

Published On:January 2026

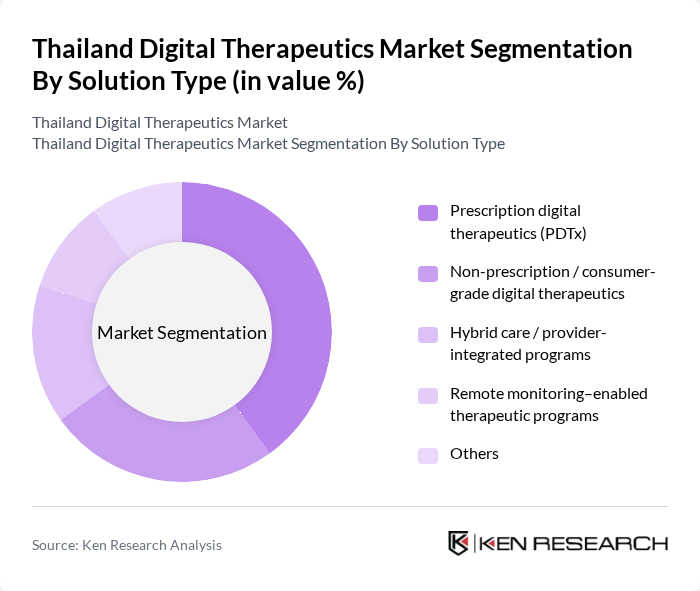

By Solution Type:The solution type segmentation includes various subsegments such as Prescription Digital Therapeutics (PDTx), Non-prescription / consumer-grade digital therapeutics, Hybrid care / provider-integrated programs, Remote monitoring–enabled therapeutic programs, and Others. Among these, Prescription Digital Therapeutics (PDTx) is currently gaining strong traction in clinically supervised settings due to its focus on evidence-based interventions, structured clinical validation, and potential integration into electronic health records and hospital workflows. At the same time, non-prescription and hybrid care models remain highly relevant in Thailand and the wider Asia Pacific region, where vendors often start with consumer or over-the-counter models and then evolve into prescription-linked offerings in collaboration with healthcare providers. The increasing collaboration between technology companies and healthcare providers is driving the adoption of PDTx and hybrid care programs, as they offer clinically supported, scalable solutions for managing chronic conditions such as diabetes, obesity, and mental health disorders while enabling remote monitoring and data-driven personalization.

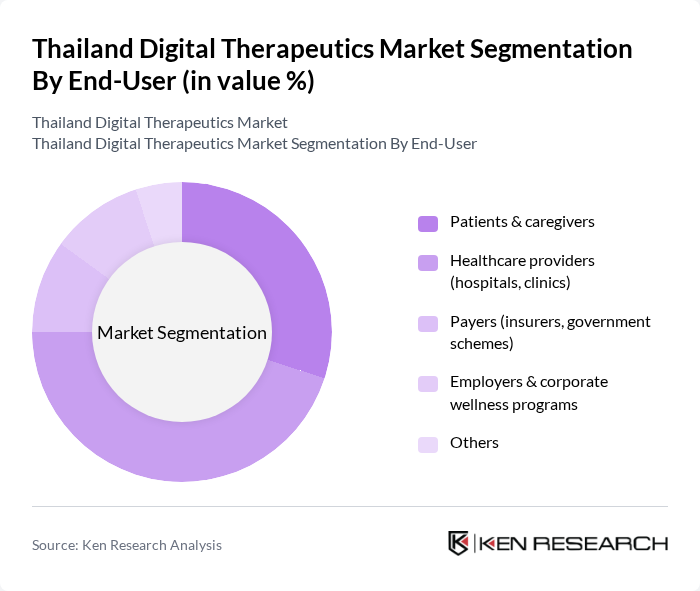

By End-User:The end-user segmentation encompasses Patients & caregivers, Healthcare providers (hospitals, clinics), Payers (insurers, government schemes), Employers & corporate wellness programs, and Others. The segment of Healthcare providers is leading the market, driven by the increasing adoption of digital health solutions in clinical settings across Asia Pacific and Thailand, including hospital-led remote monitoring programs, digital care management platforms, and integration of digital tools into chronic disease pathways. Hospitals and clinics are increasingly integrating digital therapeutics into their treatment protocols to enhance patient engagement, support self-management, and improve health outcomes, with uptake supported by broader digital health policies, pilot reimbursement schemes, and partnerships between providers, payers, and technology vendors.

The Thailand Digital Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omada Health, Pear Therapeutics, Welldoc, Akili Interactive, DarioHealth, Twill (Happify Health), SilverCloud Health, mySugr, Big Health, LifeScan, Noom, Headspace Health, Woebot Health, Liva Healthcare, Biofourmis contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand digital therapeutics market appears promising, driven by technological advancements and increasing healthcare digitization. As the government continues to invest in digital health infrastructure, the integration of AI and machine learning into therapeutic solutions is expected to enhance treatment efficacy. Furthermore, the growing emphasis on preventive healthcare will likely lead to increased adoption of digital therapeutics, fostering a more proactive approach to health management among Thai citizens.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Prescription digital therapeutics (PDTx) Non-prescription / consumer-grade digital therapeutics Hybrid care / provider-integrated programs Remote monitoring–enabled therapeutic programs Others |

| By End-User | Patients & caregivers Healthcare providers (hospitals, clinics) Payers (insurers, government schemes) Employers & corporate wellness programs Others |

| By Business / Revenue Model | Subscription-based One-time purchase / licensing Outcome- / value-based contracts Freemium and in-app monetization Others |

| By Delivery Platform | Smartphone / tablet applications Web-based platforms Integrated with wearables & connected devices Others |

| By Therapeutic Area | Diabetes & metabolic disorders Cardiovascular & hypertension management Mental & behavioral health Respiratory & pulmonary conditions Neurological & musculoskeletal disorders Others |

| By Intervention Type | Cognitive behavioral therapy (CBT)–based programs Coaching & adherence support Lifestyle modification & prevention Rehabilitation & remote physiotherapy Others |

| By Deployment Environment | Standalone digital solutions EHR / HIS-integrated solutions Payer / employer-integrated platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chronic Disease Management | 120 | Healthcare Providers, Digital Health Specialists |

| Mental Health Applications | 90 | Psychiatrists, Psychologists, Mental Health Counselors |

| Diabetes Management Solutions | 80 | End-users, Diabetes Educators |

| Cardiovascular Health Programs | 95 | Cardiologists, Health Coaches |

| Patient Engagement Tools | 85 | IT Managers, Patient Experience Officers |

The Thailand Digital Therapeutics Market is valued at approximately USD 130 million, reflecting a significant growth trend driven by the rising prevalence of chronic diseases and the increasing acceptance of digital health solutions among patients and healthcare providers.