Region:Middle East

Author(s):Rebecca

Product Code:KRAA4304

Pages:92

Published On:January 2026

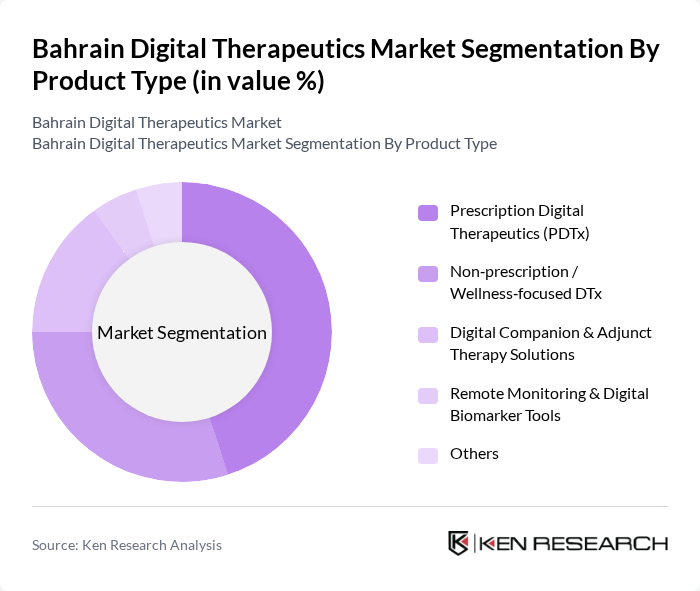

By Product Type:The product type segmentation includes various categories that cater to different therapeutic needs and consumer preferences. The leading sub-segment is Prescription Digital Therapeutics (PDTx), which is gaining traction globally due to clinical validation, evidence?based protocols, and increasing integration into traditional healthcare systems and payer programs for chronic disease and mental health management. Non-prescription wellness-focused DTx is also significant, appealing to consumers seeking preventive care, lifestyle management, and self?management tools for conditions such as obesity, stress, and sleep disorders through mobile apps and wearables. Digital companion and adjunct therapy solutions are increasingly popular as they enhance patient engagement, support treatment adherence, and provide real?time monitoring and feedback alongside pharmacological or procedural interventions, often through remote monitoring platforms and digital biomarker tracking.

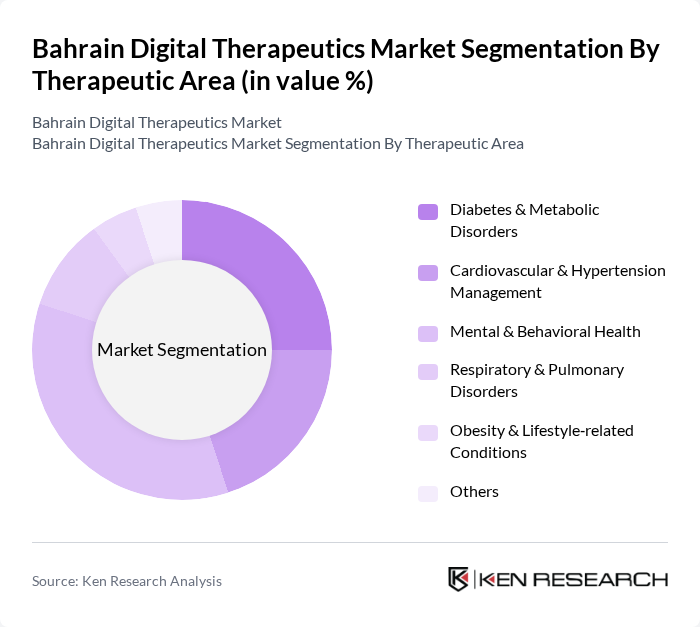

By Therapeutic Area:The therapeutic area segmentation highlights the diverse applications of digital therapeutics in managing various health conditions. The leading sub-segment is Mental & Behavioral Health, driven by increasing awareness of anxiety, depression, and stress?related disorders, limited in?person specialist capacity, and the strong evidence base for cognitive?behavioral and neuroscience?based DTx delivered via mobile apps and digital platforms. Diabetes & Metabolic Disorders also represent a significant portion of the market, reflecting the high prevalence of diabetes and metabolic syndrome across the Gulf region and the use of DTx for glucose monitoring, behavior change, and cardiometabolic risk management. Other areas, such as Cardiovascular & Hypertension Management, are growing as healthcare providers recognize the benefits of remote monitoring, digital coaching, and algorithm?driven risk stratification tools in chronic disease management and secondary prevention.

The Bahrain Digital Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omada Health, Pear Therapeutics, Welldoc, Akili Interactive Labs, DarioHealth, Twill (formerly Happify Health), SilverCloud Health, mySugr, Biofourmis, Click Therapeutics, Big Health, LifeScan, Wellthy, Liva Healthcare, Zocdoc contribute to innovation, geographic expansion, and service delivery in this space, typically entering Bahrain and the wider Gulf region through partnerships with healthcare providers, employers, and payers.

The future of the Bahrain digital therapeutics market appears promising, driven by technological advancements and increasing healthcare investments. In future, the integration of artificial intelligence in therapeutic applications is expected to enhance treatment personalization and efficacy. Additionally, the shift towards preventive healthcare will likely encourage the development of innovative digital solutions aimed at early intervention, ultimately improving patient outcomes and reducing healthcare costs in the long run.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Prescription Digital Therapeutics (PDTx) Non?prescription / Wellness?focused DTx Digital Companion & Adjunct Therapy Solutions Remote Monitoring & Digital Biomarker Tools Others |

| By Therapeutic Area | Diabetes & Metabolic Disorders Cardiovascular & Hypertension Management Mental & Behavioral Health Respiratory & Pulmonary Disorders Obesity & Lifestyle?related Conditions Others |

| By Care Setting | Hospitals & Health Systems Specialty & Primary Care Clinics Home?based & Remote Care Employer & Corporate Wellness Programs Others |

| By Delivery / Access Mode | Mobile / App?based Platforms Web?based Platforms Integrated with Wearables & Connected Devices Hybrid & Omnichannel Models Others |

| By Payment & Revenue Model | Subscription?based One?time Purchase / Licensing Outcome? / Value?based Contracts Insurance?reimbursed / Payer?funded Others |

| By Sales Channel | B2B – Providers (Hospitals & Clinics) B2B – Payers & Insurers B2B – Employers & Corporates B2C – Direct?to?Consumer / Patients Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers Using Digital Therapeutics | 60 | Doctors, Psychologists, Therapists |

| Patients Engaged with Digital Health Solutions | 120 | Chronic Disease Patients, Mental Health Patients |

| Healthcare Administrators and Decision Makers | 50 | Hospital Administrators, Health Policy Makers |

| Technology Providers in Digital Health | 40 | Product Managers, Business Development Executives |

| Regulatory Bodies and Health Authorities | 40 | Regulatory Officers, Health Inspectors |

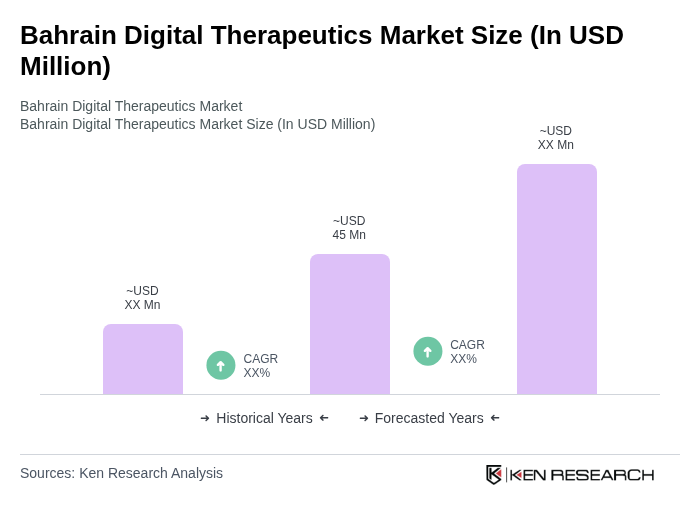

The Bahrain Digital Therapeutics Market is valued at approximately USD 45 million, reflecting a growing integration of digital therapeutic solutions within the broader digital health and e-health revenue base in the region.