Region:Asia

Author(s):Rebecca

Product Code:KRAA4302

Pages:94

Published On:January 2026

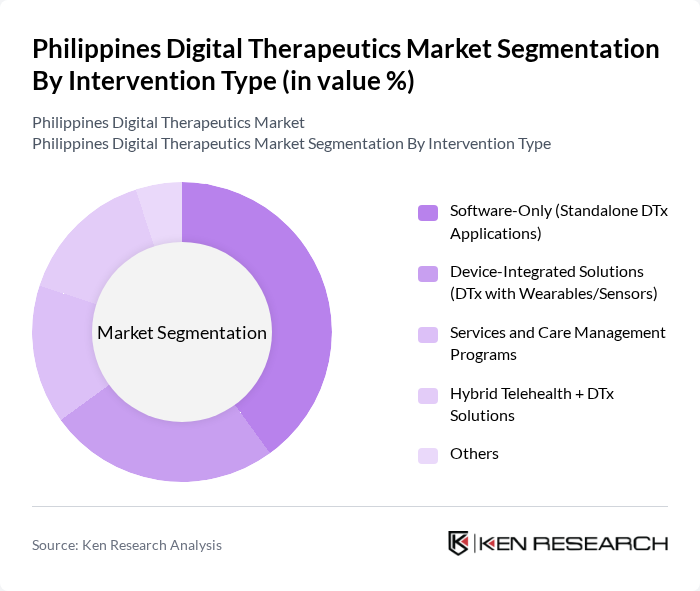

By Intervention Type:The intervention type segmentation includes various approaches to delivering digital therapeutics. The subsegments are Software-Only (Standalone DTx Applications), Device-Integrated Solutions (DTx with Wearables/Sensors), Services and Care Management Programs, Hybrid Telehealth + DTx Solutions, and Others. Among these, Software-Only applications are leading the market due to their ease of deployment via smartphones, relatively lower upfront costs compared with hardware?dependent offerings, and the growing trend of self-management and remote monitoring among patients. The increasing smartphone penetration and user-friendly interfaces, along with app-based mental health, chronic disease management, and lifestyle modification programs, have made these applications highly popular, driving significant consumer engagement in the Philippines.

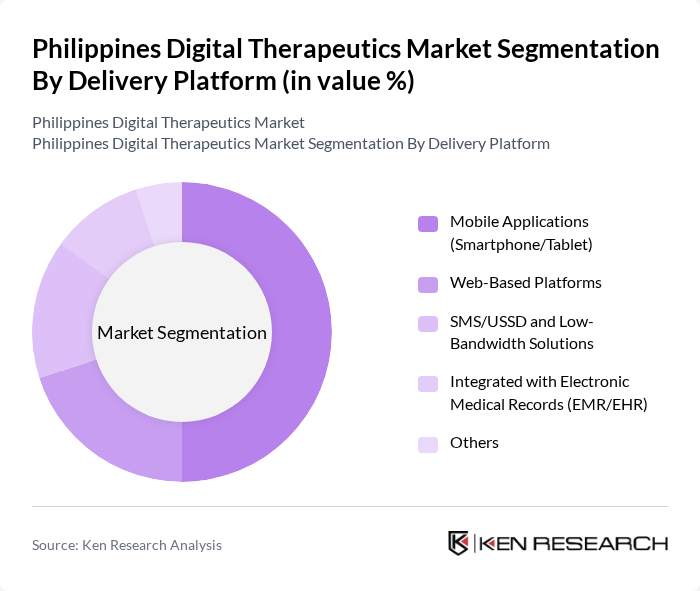

By Delivery Platform:The delivery platform segmentation encompasses various methods through which digital therapeutics are accessed. This includes Mobile Applications (Smartphone/Tablet), Web-Based Platforms, SMS/USSD and Low-Bandwidth Solutions, Integrated with Electronic Medical Records (EMR/EHR), and Others. Mobile applications dominate this segment, driven by the widespread use of smartphones in the Philippines and the convenience they offer for users to manage their health on-the-go. The ability to provide personalized care, interactive coaching, and real-time feedback through mobile platforms, combined with growing usage of teleconsultation and remote monitoring apps, has significantly enhanced user engagement and adherence to treatment in digital therapeutics programs.

The Philippines Digital Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as KonsultaMD, HealthNow, mWell, Medifi, AIDE, Lifetrack Medical Systems, Docquity, MedGrocer, SeeYouDoc, SeriousMD, Zuellig Pharma eZConsult, Wellthy Therapeutics, Welldoc, Qure.ai, Other Emerging Local DTx Startups contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital therapeutics market in the Philippines appears promising, driven by technological advancements and increasing healthcare demands. As the government implements supportive policies and funding initiatives, the market is likely to witness accelerated growth. The integration of artificial intelligence and machine learning into digital health solutions will enhance personalization and effectiveness. Furthermore, the rise of telehealth services will facilitate broader access to digital therapeutics, particularly in underserved areas, fostering a more inclusive healthcare environment.

| Segment | Sub-Segments |

|---|---|

| By Intervention Type | Software-Only (Standalone DTx Applications) Device-Integrated Solutions (DTx with Wearables/Sensors) Services and Care Management Programs Hybrid Telehealth + DTx Solutions Others |

| By Delivery Platform | Mobile Applications (Smartphone/Tablet) Web-Based Platforms SMS/USSD and Low-Bandwidth Solutions Integrated with Electronic Medical Records (EMR/EHR) Others |

| By Therapeutic Area | Diabetes and Metabolic Disorders Cardiovascular Diseases and Hypertension Mental and Behavioral Health (Depression, Anxiety, CBT) Respiratory Disorders (Asthma, COPD) Musculoskeletal and Pain Management Lifestyle and Preventive Care (Weight, Sleep, Smoking Cessation) Others |

| By Patient Type | Self-Pay Consumers Employer-Sponsored Patients Payer-Managed / HMO Patients Provider-Managed Care Pathways Others |

| By End-User | Hospitals and Health Systems Clinics and Specialty Centers Health Maintenance Organizations (HMOs) and Insurers Employers and Corporate Wellness Programs Patients/Individuals (Direct-to-Consumer) Others |

| By Business / Payment Model | Subscription (B2B, B2B2C) Direct-to-Consumer (Out-of-Pocket Purchases) Enterprise Licensing (Hospitals, HMOs, Employers) Outcome- or Value-Based Contracts Bundled with Telemedicine or Health Plans Others |

| By Region | Luzon Visayas Mindanao Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals Using Digital Therapeutics | 130 | Doctors, Psychologists, Therapists |

| Patients Engaged with Digital Health Solutions | 140 | Chronic Disease Patients, Mental Health Patients |

| Technology Providers in Digital Health | 90 | Product Managers, Business Development Executives |

| Healthcare Administrators and Decision Makers | 110 | Hospital Administrators, Health Policy Makers |

| Regulatory Bodies and Health Authorities | 60 | Regulatory Officers, Health Program Directors |

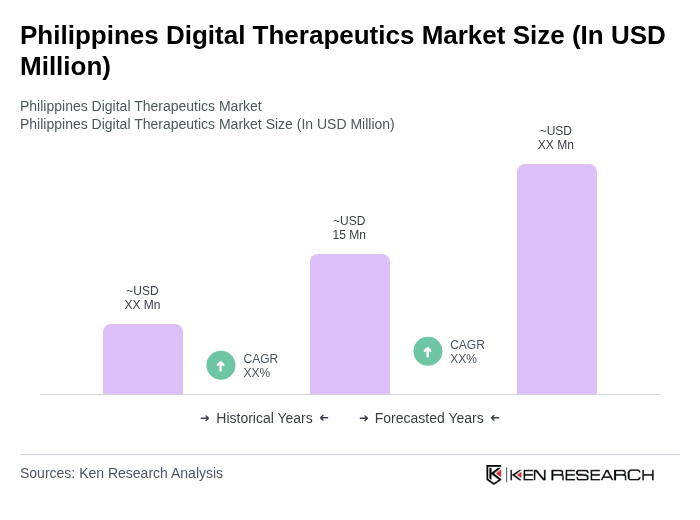

The Philippines Digital Therapeutics Market is valued at approximately USD 15 million, driven by the rising prevalence of chronic diseases, increasing healthcare costs, and the growing acceptance of digital health solutions among consumers and healthcare providers.