Region:Asia

Author(s):Rebecca

Product Code:KRAA4305

Pages:90

Published On:January 2026

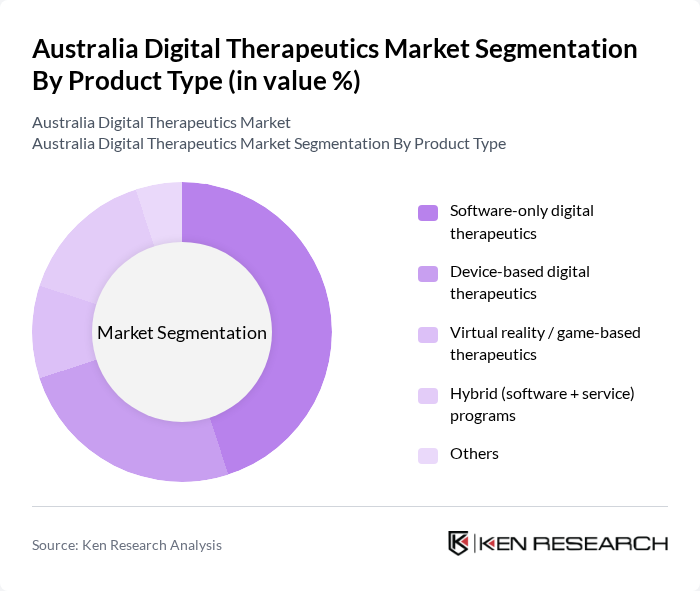

By Product Type:The product type segmentation includes various forms of digital therapeutics, each catering to different user needs and care delivery models. The dominant sub-segment in terms of current revenue is software-only digital therapeutics delivered via mobile apps and web platforms, which are widely adopted due to their ease of use, low marginal cost, and ability to be scaled across large patient populations. Device-based digital therapeutics, including connected sensors and wearables paired with therapeutic software, are also gaining traction, particularly among users seeking integrated solutions for diabetes, sleep apnea, and cardiovascular risk management. Virtual reality and game-based therapeutics are emerging as innovative options, especially in mental health, pain management, and cognitive training, where immersive environments can support behavioral change and symptom reduction. Hybrid programs that combine software and human-led services (such as coaching, telehealth consults, and multidisciplinary care teams) are increasingly popular, offering personalized, continuous support and higher engagement for chronic disease and weight management programs.

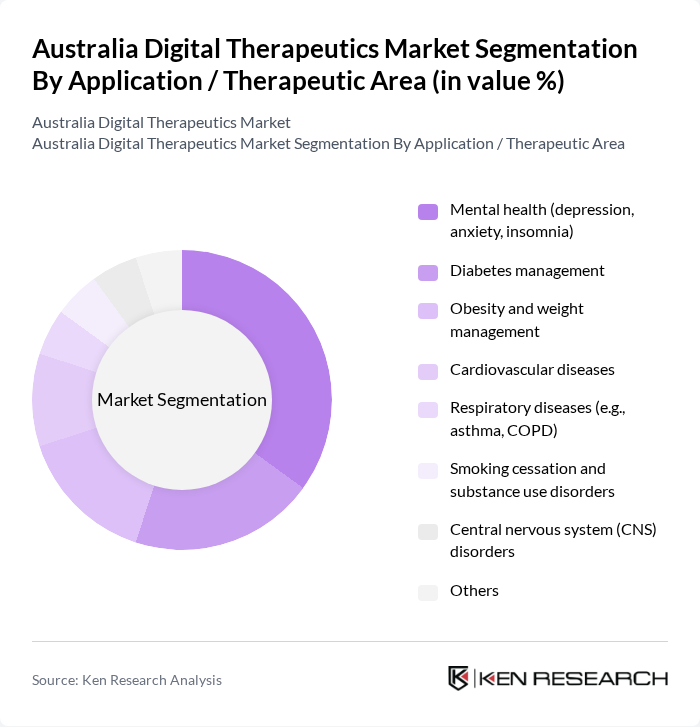

By Application / Therapeutic Area:The application segmentation highlights the various therapeutic areas where digital therapeutics are applied. Mental health is a leading application area globally and in Australia, supported by strong adoption of telepsychiatry, mindfulness and CBT-based apps, and virtual care models addressing depression, anxiety, and insomnia. Diabetes management represents the largest single revenue-generating application segment in the Australia digital therapeutics market, reflecting the high burden of diabetes and the strong evidence base for digital interventions in glycemic control and self-management. Obesity and weight management are also significant areas, driven by lifestyle-related risk factors and the use of app-based coaching, nutrition tracking, and behavior-change programs. Other applications, such as cardiovascular diseases, respiratory diseases (including asthma and COPD), smoking cessation, and central nervous system disorders, are gaining attention as digital solutions become more integrated into standard care pathways and are increasingly used alongside pharmacotherapy and in remote monitoring programs.

The Australia Digital Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as ResMed, Teladoc Health, Welldoc, DarioHealth, Noom, Big Health, Akili Interactive, Omada Health, SilverCloud Health (Amwell), Headspace Health, mySugr (Roche), Mindset Health (Australia), Hello Sunday Morning / Daybreak (Australia), Coviu (Australia), Woebot Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital therapeutics market in Australia appears promising, driven by technological advancements and increasing healthcare demands. As the population ages and chronic disease prevalence rises, the integration of digital solutions into traditional healthcare systems will likely accelerate. Furthermore, ongoing collaborations between tech companies and healthcare providers are expected to enhance the development of innovative therapies, ensuring that digital health solutions become a standard part of patient care, ultimately improving health outcomes across the nation.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Software-only digital therapeutics Device-based digital therapeutics Virtual reality / game-based therapeutics Hybrid (software + service) programs Others |

| By Application / Therapeutic Area | Diabetes management Obesity and weight management Cardiovascular diseases Respiratory diseases (e.g., asthma, COPD) Mental health (depression, anxiety, insomnia) Smoking cessation and substance use disorders Central nervous system (CNS) disorders Others |

| By End-User | Patients / individuals Providers (hospitals, clinics, practitioners) Payers (private health insurers, government schemes) Employers and corporate wellness programs Pharmaceutical and medtech companies Others |

| By Sales / Distribution Channel | Business-to-consumer (B2C) Business-to-business (B2B) Hybrid and partnership-led models Others |

| By Revenue Model | Subscription (SaaS) One-time license / purchase Outcome / value-based contracts Freemium and in-app purchases Others |

| By Technology | Artificial intelligence and machine learning Connected devices and Internet of Things (IoT) Virtual and augmented reality Cloud-based platforms Others |

| By Care Setting | Home and remote care Primary care Specialty clinics Community and rural health settings Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers Using Digital Therapeutics | 120 | Doctors, Nurses, Health IT Specialists |

| Patients Engaged with Digital Therapeutics | 100 | Chronic Disease Patients, Mental Health Patients |

| Payers and Insurers Involved in Digital Health | 80 | Health Insurance Executives, Policy Analysts |

| Digital Therapeutics Developers | 70 | Product Managers, R&D Directors |

| Regulatory Bodies and Health Authorities | 50 | Regulatory Affairs Specialists, Public Health Officials |

The Australia Digital Therapeutics Market is valued at approximately USD 20 million, reflecting a significant growth driven by the rising prevalence of chronic diseases, increasing healthcare costs, and the acceptance of digital health solutions among patients and providers.