Region:Middle East

Author(s):Rebecca

Product Code:KRAA4303

Pages:100

Published On:January 2026

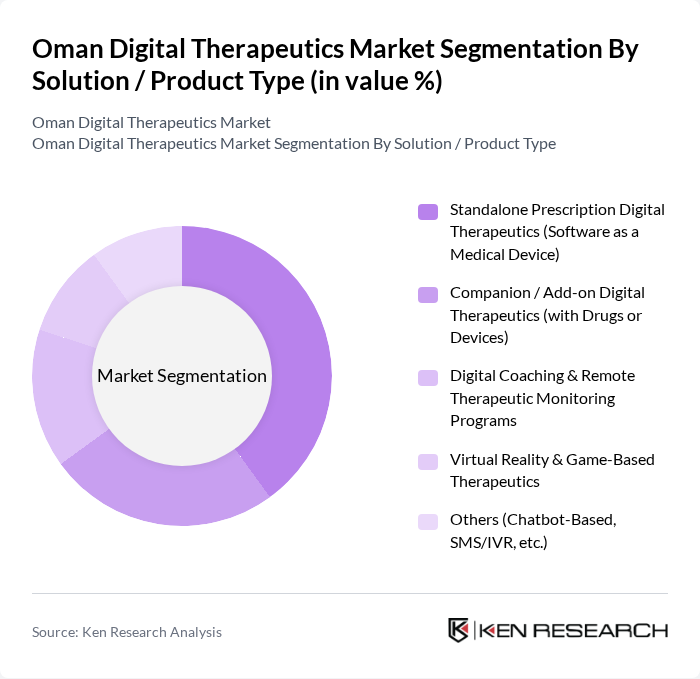

By Solution / Product Type:The market is segmented into various product types, including Standalone Prescription Digital Therapeutics, Companion Digital Therapeutics, Digital Coaching Programs, Virtual Reality Therapeutics, and others. This structure aligns with common global classifications of digital therapeutics solutions, where software as a medical device, add-on DTx with drugs or devices, and remote therapeutic monitoring platforms are key categories. Among these, Standalone Prescription Digital Therapeutics is increasingly prominent due to their evidence-based design, ability to target specific medical conditions (such as diabetes, hypertension, and mental health disorders), and growing acceptance by healthcare providers as adjuncts or alternatives to conventional therapies. The demand for personalized treatment solutions and continuous remote monitoring is driving the growth of this segment, as patients and providers seek tailored, data-driven therapeutic options integrated with routine clinical care.

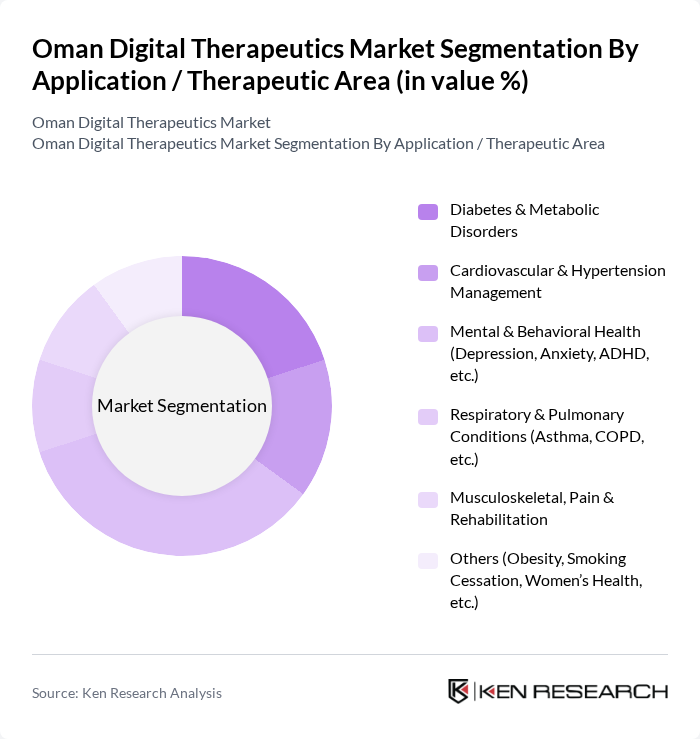

By Application / Therapeutic Area:The market is categorized into various therapeutic areas, including Diabetes & Metabolic Disorders, Cardiovascular Management, Mental & Behavioral Health, Respiratory Conditions, Musculoskeletal Pain, and others, which is consistent with global digital therapeutics application clusters. The Mental & Behavioral Health segment is currently expanding rapidly, supported by rising awareness of mental health issues in the Middle East & Africa region, increased demand for remote psychological support, and proven efficacy of app-based cognitive behavioral therapy, mindfulness, and game-based interventions for conditions like anxiety, depression, and ADHD. Digital therapeutics in this area provide structured, scalable, and confidential interventions that are accessible via smartphones and web platforms, making them highly sought after in both urban centers like Muscat and increasingly in other governorates as connectivity improves.

The Oman Digital Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omada Health, Pear Therapeutics (legacy portfolio), Welldoc, Akili Interactive Labs, DarioHealth, Livongo Health (Teladoc Health Chronic Care), Happify Health (Twill Health), SilverCloud Health (Amwell Digital Care), mySugr (Roche Diabetes Care), Biofourmis, Click Therapeutics, Wellthy Therapeutics, Zillion, Woebot Health, mHealth Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman digital therapeutics market appears promising, driven by technological advancements and increasing healthcare demands. As the government continues to support digital health initiatives, the integration of AI and machine learning into therapeutic solutions will enhance patient outcomes. Furthermore, the growing emphasis on preventive healthcare will likely lead to increased adoption of digital therapeutics, positioning Oman as a leader in the region's digital health landscape.

| Segment | Sub-Segments |

|---|---|

| By Solution / Product Type | Standalone Prescription Digital Therapeutics (Software as a Medical Device) Companion / Add-on Digital Therapeutics (with Drugs or Devices) Digital Coaching & Remote Therapeutic Monitoring Programs Virtual Reality & Game-Based Therapeutics Others (Chatbot-Based, SMS/IVR, etc.) |

| By Application / Therapeutic Area | Diabetes & Metabolic Disorders Cardiovascular & Hypertension Management Mental & Behavioral Health (Depression, Anxiety, ADHD, etc.) Respiratory & Pulmonary Conditions (Asthma, COPD, etc.) Musculoskeletal, Pain & Rehabilitation Others (Obesity, Smoking Cessation, Women’s Health, etc.) |

| By End-User / Customer Type | Public Hospitals & Government Healthcare Facilities Private Hospitals & Specialty Clinics Health Insurance Companies & Payers Employers & Corporate Wellness Programs Patients / Consumers (Direct-to-Consumer) Others (NGOs, Academic & Research Institutions) |

| By Delivery Mode | Mobile Applications (Smartphone & Tablet) Web-Based Platforms / Portals Integrated with Wearables & Connected Devices Hybrid / Omnichannel Delivery |

| By Business / Payment Model | B2B (Payer, Provider, Employer Contracts) B2C (Out-of-Pocket / Direct-to-Consumer) Reimbursement-Based (Insurance-Covered) Bundled / Outcome-Based & Risk-Sharing Models |

| By Age Group | Pediatric & Adolescent Adult (18–59 Years) Geriatric (60+ Years) Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 80 | Doctors, Psychologists, Therapists |

| Patients Using Digital Therapeutics | 120 | Chronic Disease Patients, Mental Health Patients |

| Healthcare Administrators | 60 | Hospital Administrators, Clinic Managers |

| Technology Providers | 50 | Developers, Product Managers in Digital Health |

| Insurance Representatives | 40 | Health Insurance Underwriters, Policy Analysts |

The Oman Digital Therapeutics Market is valued at approximately USD 10 million, reflecting a five-year historical analysis and benchmarking against the broader Middle East and Africa digital therapeutics market. This growth is driven by the rising prevalence of chronic diseases and increasing acceptance of digital health solutions.