Japan Digital Therapeutics Market Overview

- The Japan Digital Therapeutics Market is valued at USD 320 million, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and respiratory disorders, a growing aging population, and the rising adoption of digital health solutions among healthcare providers and patients. The integration of technology in healthcare, including artificial intelligence, machine learning, and connected devices, has led to enhanced patient engagement, remote monitoring, and improved health outcomes, further propelling market expansion.

- Tokyo and Osaka are the dominant cities in the Japan Digital Therapeutics Market due to their advanced healthcare infrastructure, high concentration of technology companies, and significant investment in health tech innovation. These cities are key parts of the Kanto and Kansai regions, which host major hospitals, academic medical centers, pharmaceutical companies, and digital health startups, serving as hubs for research and development and attracting both domestic and international players looking to capitalize on the growing demand for digital health solutions.

- In 2023, the Japanese government implemented a new regulation aimed at promoting the use of digital therapeutics in clinical settings. This regulation includes guidelines for the approval and reimbursement of digital therapeutic products, ensuring that they meet safety and efficacy standards. Specifically, digital therapeutics that fall under Software as a Medical Device are regulated under the Act on Securing Quality, Efficacy and Safety of Products Including Pharmaceuticals and Medical Devices (Pharmaceuticals and Medical Devices Act) administered by the Ministry of Health, Labour and Welfare, with approval pathways and reimbursement handled through the Pharmaceuticals and Medical Devices Agency and the national health insurance listing process. Recent policy initiatives have expanded the coverage of certain digital therapeutics, such as smoking cessation and hypertension apps, under national health insurance, encouraging innovation in the healthcare sector while providing patients with access to effective digital treatment options.

Japan Digital Therapeutics Market Segmentation

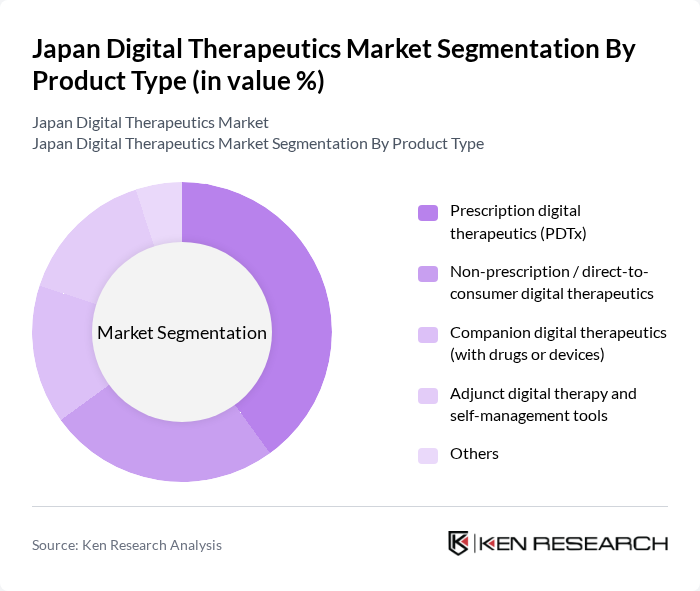

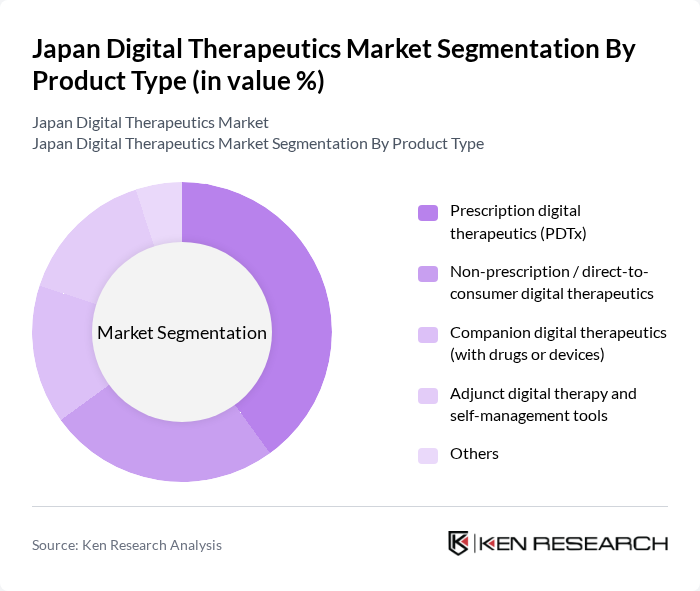

By Product Type:The product type segmentation includes various categories such as Prescription digital therapeutics (PDTx), Non-prescription / direct-to-consumer digital therapeutics, Companion digital therapeutics (with drugs or devices), Adjunct digital therapy and self-management tools, and Others. Each of these subsegments plays a crucial role in addressing specific health needs and preferences among users, with prescription digital therapeutics and regulated Software as a Medical Device products gaining traction through reimbursement, while direct-to-consumer and self-management tools are widely used for lifestyle and chronic disease management.

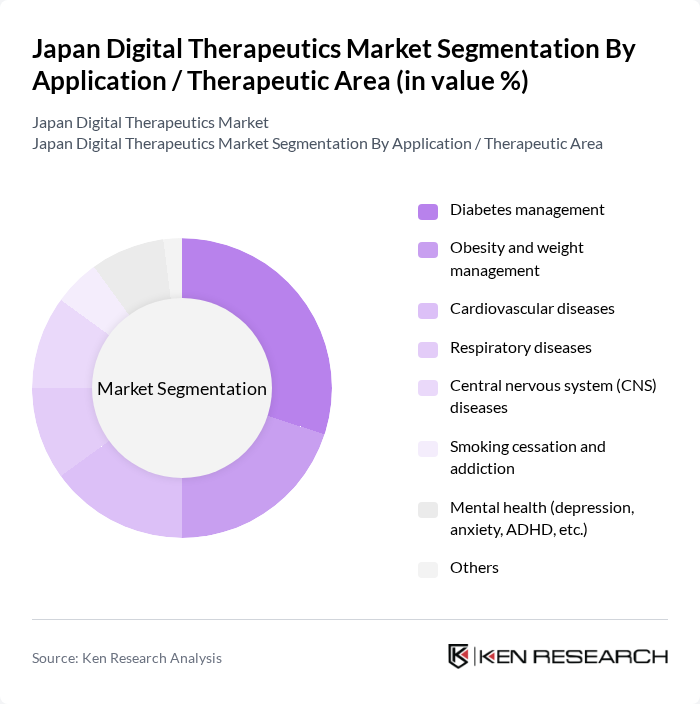

By Application / Therapeutic Area:The application segmentation encompasses various therapeutic areas including Diabetes management, Obesity and weight management, Cardiovascular diseases, Respiratory diseases, Central nervous system (CNS) diseases, Smoking cessation and addiction, Mental health (depression, anxiety, ADHD, etc.), and Others. Each area addresses specific health challenges faced by the population, with diabetes management currently representing the largest application segment in Japan, followed by obesity, cardiovascular, respiratory, CNS diseases, and smoking cessation, and growing interest in mental health and behavioral conditions.

Japan Digital Therapeutics Market Competitive Landscape

The Japan Digital Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Otsuka Pharmaceutical Co., Ltd., CureApp, Inc., Welldoc, Inc., Akili Interactive Labs, Inc., Omada Health, Inc., DarioHealth Corp., Biofourmis, Inc., Jolly Good Inc., Medtronic plc, Koninklijke Philips N.V. (Philips Healthcare), Teladoc Health, Inc., ResMed Inc., FitBit LLC, Mango Health, Inc., and others contribute to innovation, geographic expansion, and service delivery in this space, with particular activity in areas such as diabetes, hypertension, smoking cessation, mental health, and virtual care.

Japan Digital Therapeutics Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:Japan faces a significant rise in chronic diseases, with approximately 11–12 million people suffering from diabetes. The World Health Organization reported that roughly one quarter of the population is affected by hypertension. This growing health burden necessitates innovative treatment solutions, driving the demand for digital therapeutics. The Japanese government aims to reduce healthcare costs by 20% in future, further incentivizing the adoption of digital health solutions to manage chronic conditions effectively.

- Rising Demand for Personalized Medicine:The Japanese healthcare system is increasingly shifting towards personalized medicine, with a market value of ¥1.2 trillion (approximately $11 billion). This trend is fueled by advancements in genomics and biotechnology, allowing for tailored treatment plans. The Ministry of Health, Labour and Welfare has allocated ¥50 billion ($460 million) for research in personalized therapies, indicating strong governmental support for integrating digital therapeutics that cater to individual patient needs, enhancing treatment efficacy and patient satisfaction.

- Technological Advancements in Healthcare:Japan is at the forefront of healthcare technology, with over 80% of hospitals utilizing electronic health records. The integration of AI and machine learning in healthcare is projected to reach ¥500 billion ($4.6 billion) in future. These advancements facilitate the development of sophisticated digital therapeutic solutions that improve patient outcomes. The government’s investment in health tech innovation, estimated at ¥100 billion ($920 million), further supports the growth of digital therapeutics in the market.

Market Challenges

- Regulatory Hurdles and Compliance Issues:The regulatory landscape for digital therapeutics in Japan is complex, with the Pharmaceuticals and Medical Devices Agency (PMDA) overseeing approvals. As of now, only 15 digital therapeutics have received PMDA approval, highlighting the stringent requirements. The lengthy approval process can take up to 18 months, delaying market entry for innovative solutions. This regulatory bottleneck poses a significant challenge for companies aiming to introduce new digital health products in a timely manner.

- Limited Reimbursement Policies:Reimbursement for digital therapeutics remains a significant barrier in Japan, with only 20% of digital health solutions covered by national health insurance. The Ministry of Health has yet to establish comprehensive reimbursement frameworks for these products, leading to financial uncertainty for developers. This lack of reimbursement limits patient access to digital therapeutics, hindering market growth and adoption rates among healthcare providers and patients alike.

Japan Digital Therapeutics Market Future Outlook

The future of the Japan digital therapeutics market appears promising, driven by ongoing technological advancements and a growing acceptance of digital health solutions among patients and providers. As the government continues to invest in healthcare innovation, the integration of AI and telehealth services is expected to enhance treatment efficacy. Additionally, the increasing focus on preventive healthcare will likely lead to a broader adoption of digital therapeutics, positioning Japan as a leader in this evolving sector in future.

Market Opportunities

- Expansion of Telehealth Services:The telehealth market in Japan is projected to reach ¥300 billion ($2.8 billion) in future, driven by increased demand for remote healthcare solutions. This expansion presents a significant opportunity for digital therapeutics to integrate with telehealth platforms, enhancing patient engagement and adherence to treatment plans. The government’s support for telehealth initiatives further solidifies this opportunity, paving the way for innovative digital health solutions.

- Collaborations with Pharmaceutical Companies:Collaborations between digital therapeutic developers and pharmaceutical companies are on the rise, with over 10 partnerships established recently. These collaborations leverage the strengths of both sectors, facilitating the development of comprehensive treatment solutions. The combined market potential of digital therapeutics and pharmaceuticals is estimated at ¥1 trillion ($9.2 billion), creating a lucrative opportunity for innovation and improved patient outcomes in Japan.