Region:Middle East

Author(s):Geetanshi

Product Code:KRAB2749

Pages:86

Published On:October 2025

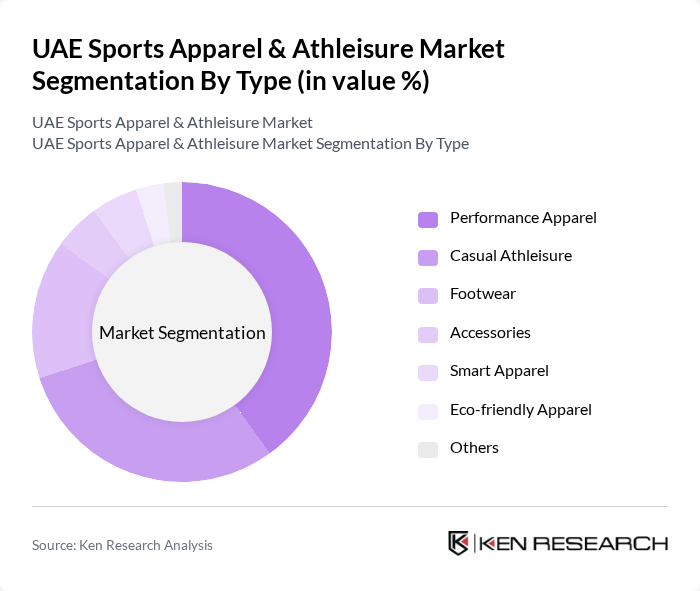

By Type:The market is segmented into various types, including Performance Apparel, Casual Athleisure, Footwear, Accessories, Smart Apparel, Eco-friendly Apparel, and Others. Among these, Performance Apparel is currently dominating the market due to the increasing participation in sports and fitness activities. Consumers are increasingly seeking high-quality, functional clothing that enhances their performance during workouts and sports. Casual Athleisure is also gaining traction as consumers prefer versatile clothing that can be worn both for exercise and casual outings.

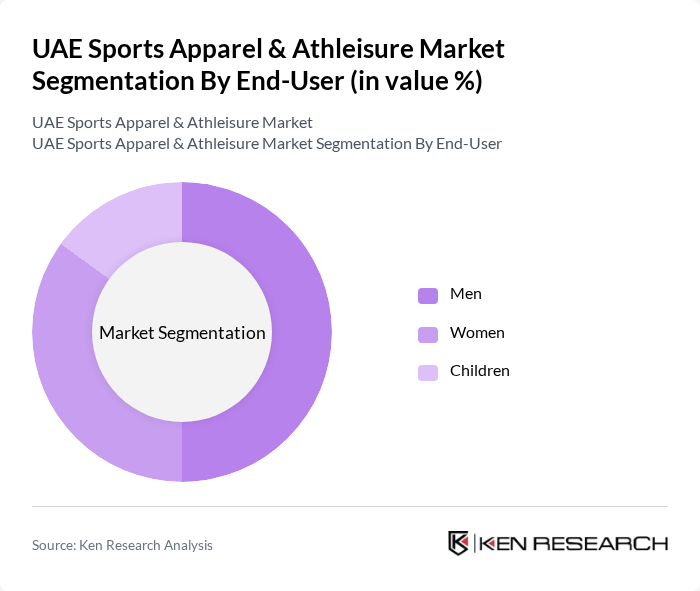

By End-User:The market is segmented by end-user into Men, Women, and Children. The Men's segment is currently leading the market, driven by a growing interest in fitness and sports among men. Women’s participation in sports and fitness activities is also on the rise, leading to increased demand for women-specific sports apparel. The Children’s segment is growing as parents are increasingly investing in sportswear for their children to promote an active lifestyle.

The UAE Sports Apparel & Athleisure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Reebok International Ltd., New Balance Athletics, Inc., ASICS Corporation, Lululemon Athletica Inc., Columbia Sportswear Company, Fila Holdings Corp., Skechers USA, Inc., Gymshark Ltd., Decathlon S.A., H&M Group (Hennes & Mauritz AB), The North Face, Inc., Li Ning Company Limited, Anta Sports Products Limited, Mizuno Corporation, Kappa, Ellesse contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE sports apparel and athleisure market appears promising, driven by increasing health awareness and a growing fitness culture. As e-commerce continues to expand, brands will likely invest in digital marketing strategies to reach a broader audience. Additionally, the integration of technology in apparel, such as smart fabrics, is expected to enhance consumer engagement. Overall, the market is poised for growth, with innovative products and marketing strategies playing a crucial role in shaping its trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | Performance Apparel Casual Athleisure Footwear Accessories Smart Apparel (e.g., biometric sensors, smart fabrics) Eco-friendly Apparel (e.g., recycled polyester, organic cotton) Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail (e-commerce, mobile apps, social commerce) Offline Retail (malls, specialty stores, department stores) Direct Sales (brand stores, pop-ups, D2C) |

| By Price Range | Budget Mid-range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers Trend-driven Customers |

| By Occasion | Sports Events Casual Wear Gym and Fitness |

| By Material | Synthetic Fabrics (polyester, nylon, spandex) Natural Fabrics (cotton, bamboo, hemp) Blended Fabrics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 150 | Store Managers, Brand Representatives |

| Consumer Preferences in Athleisure | 120 | Fitness Enthusiasts, Casual Consumers |

| Trends in Sports Apparel | 100 | Fashion Buyers, Trend Analysts |

| Impact of Social Media on Purchases | 120 | Social Media Influencers, Digital Marketers |

| Market Entry Strategies for New Brands | 80 | Entrepreneurs, Business Development Managers |

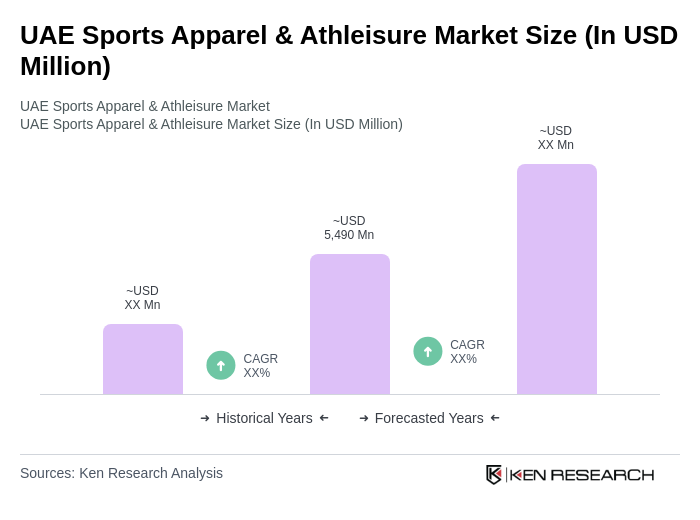

The UAE Sports Apparel & Athleisure Market is valued at approximately USD 5,490 million, reflecting significant growth driven by increasing health consciousness and a rise in fitness activities among consumers.