Region:Middle East

Author(s):Dev

Product Code:KRAA5321

Pages:81

Published On:January 2026

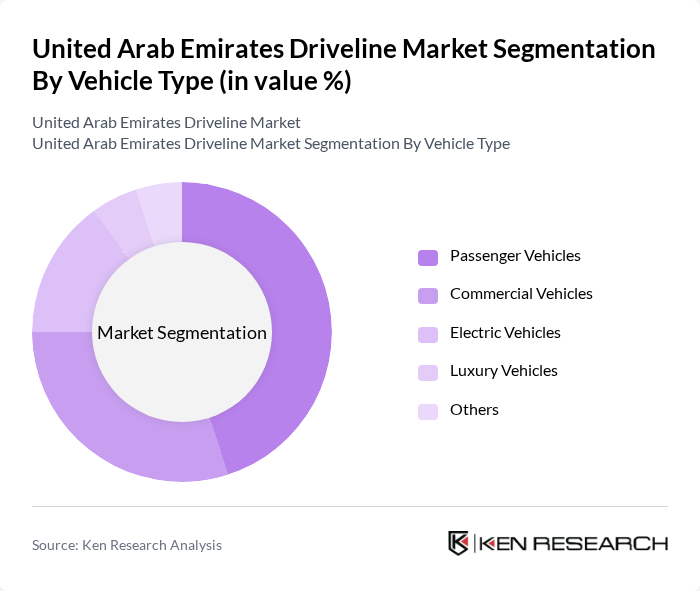

By Vehicle Type:The vehicle type segmentation includes various categories such as passenger vehicles, commercial vehicles, electric vehicles, luxury vehicles, and others. Among these, passenger vehicles are the most dominant segment, driven by the increasing urbanization and rising consumer preferences for personal mobility solutions. The commercial vehicles segment is emerging as the fastest-growing segment in the UAE's electric commercial vehicle market, with a projected growth rate of approximately 35% during 2024-2029, driven by the UAE government's push towards sustainable transportation solutions for businesses and increasing adoption of electric delivery vehicles by e-commerce companies. The demand for electric vehicles is also gaining traction, reflecting a shift towards sustainable transportation options.

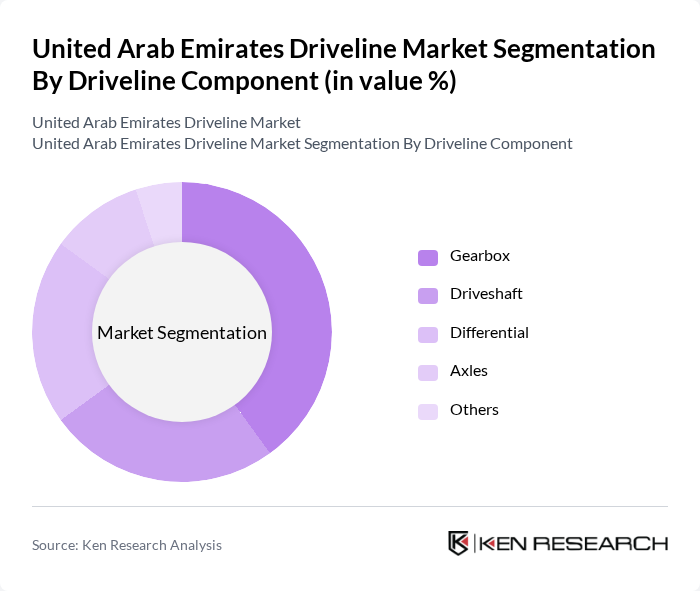

By Driveline Component:The driveline component segmentation encompasses key elements such as gearboxes, driveshafts, differentials, axles, and others. Gearboxes are the leading component in this market, primarily due to their critical role in vehicle performance and efficiency. The increasing complexity of driveline systems in modern vehicles further emphasizes the importance of advanced gearbox technologies. Integrated e-axles are gaining prominence in electric vehicle drivetrains, comprising 33.81% of the electric vehicle drivetrain market share and growing at 8.36% annually, as original equipment manufacturers seek cost reductions and lightweighting through combined motor, inverter, and reducer integration.

The United Arab Emirates Driveline Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Automotive, Al Nabooda Automobiles, Emirates Motor Company, Al Ghandi Auto, Al Tayer Motors, Al Jaziri Motors, Al Mulla Group, Al-Futtaim Engineering, Daimler Commercial Vehicles MENA FZE, Scania Middle East, Volvo Group Middle East, PACCAR Middle East, Nissan Motors Middle East, Mitsubishi Motors Middle East, Isuzu Motors Middle East contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE driveline market appears promising, driven by technological advancements and a growing emphasis on sustainability. As the adoption of electric vehicles continues to rise, manufacturers are likely to invest in innovative driveline solutions that enhance performance and efficiency. Furthermore, the integration of smart technologies and IoT in driveline systems is expected to revolutionize the market, providing opportunities for enhanced vehicle connectivity and user experience, ultimately shaping the future landscape of the automotive industry in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Electric Vehicles Luxury Vehicles Others |

| By Driveline Component | Gearbox Driveshaft Differential Axles Others |

| By Transmission Type | Manual Transmission Automatic Transmission CVT (Continuously Variable Transmission) Dual-Clutch Transmission Others |

| By Fuel Type | Gasoline Diesel Electric Hybrid Others |

| By Distribution Channel | OEM/Authorized Dealers Retailers Distributors Online Sales Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Driveline Components | 120 | Product Managers, Automotive Engineers |

| Commercial Vehicle Driveline Solutions | 100 | Fleet Managers, Procurement Specialists |

| Electric Vehicle Driveline Innovations | 80 | R&D Directors, Sustainability Officers |

| Aftermarket Driveline Services | 70 | Service Managers, Workshop Owners |

| Driveline Technology Trends | 90 | Industry Analysts, Market Researchers |

The United Arab Emirates Driveline Market is valued at approximately USD 3.8 billion, reflecting a significant growth driven by increasing demand for passenger and commercial vehicles, as well as the rapid expansion of infrastructure projects in the region.